Uniswap (UNI) is demonstrating notable strength in August 2025, with a blend of solid technical indicators and positive news driving market enthusiasm. This article delivers a detailed analysis using five key technical tools to understand UNI’s price movements and volatility. Coupled with a review of recent developments supporting Uniswap’s ecosystem growth, we provide both market insights and news to forecast UNI’s trajectory. The combination of technology and market events signals promising opportunities amidst some caution due to volatility.

#1 Uniswap has been climbing steadily, with prices recently reaching around $11.14 after breaking past significant resistance levels.

Uniswap has been climbing steadily, with prices recently reaching around $11.14 after breaking past significant resistance levels.

The past month saw UNI gain approximately 6.5%, showing a strong buying momentum.

This rise comes after the coin reclaimed important support near $9.00 and pushed through previous resistance around $9.84 to $11.00. Whale accumulation and growing participation in UNI-driven decentralized finance (DeFi) projects add to investor confidence.

Key price zones are support at roughly $9.00-$9.50 and resistance near $11.00-$11.40. Despite bullish interest, the market remains sensitive to short-term volatility indicated by mixed signals from momentum and volatility metrics.

Uniswap’s Current Market Dynamics

Uniswap has been climbing steadily, with prices recently reaching around $11.14 after breaking past significant resistance levels.

Uniswap has been climbing steadily, with prices recently reaching around $11.14 after breaking past significant resistance levels. The past month saw UNI gain approximately 6.5%, showing a strong buying momentum.

This rise comes after the coin reclaimed important support near $9.00 and pushed through previous resistance around $9.84 to $11.00. Whale accumulation and growing participation in UNI-driven decentralized finance (DeFi) projects add to investor confidence.

Key price zones are support at roughly $9.00-$9.50 and resistance near $11.00-$11.40. Despite bullish interest, the market remains sensitive to short-term volatility indicated by mixed signals from momentum and volatility metrics.

#2 Analyzing Uniswap’s chart with five key market indicators reveals a mostly bullish setup with some caution:

Analyzing Uniswap’s chart with five key market indicators reveals a mostly bullish setup with some caution:

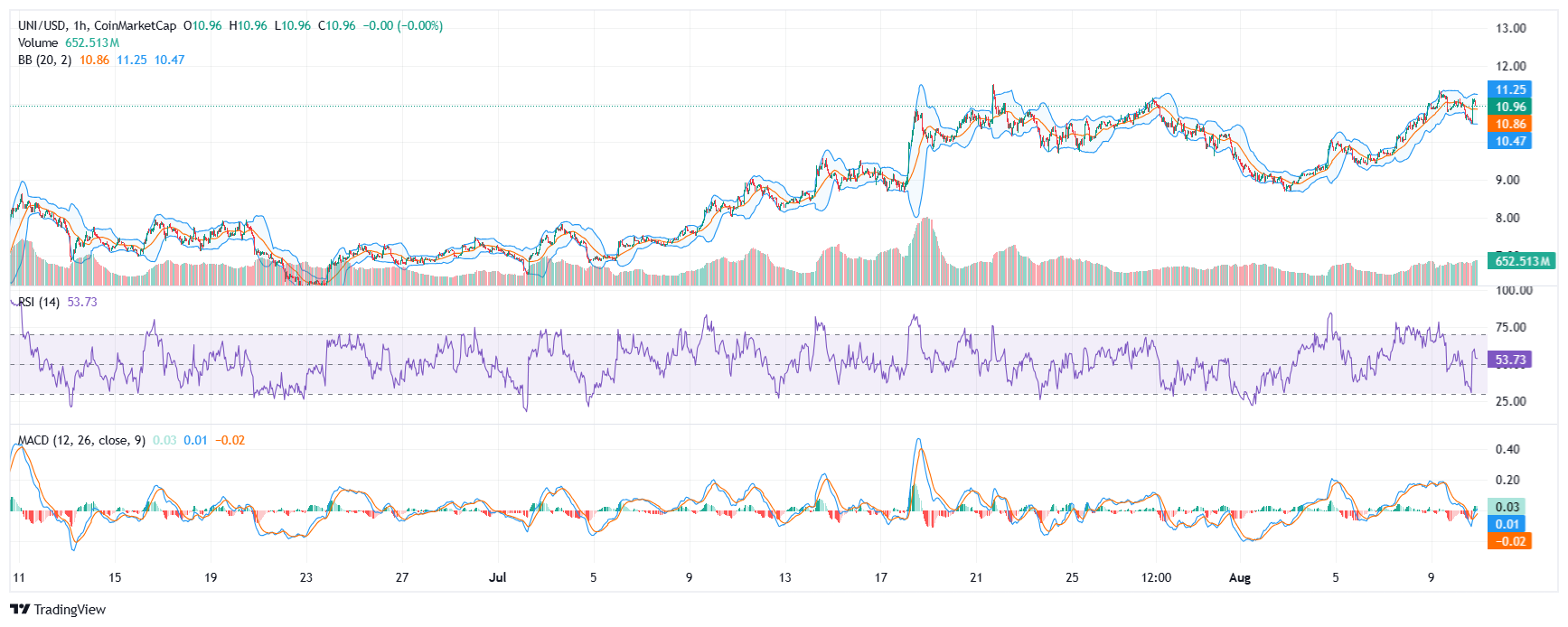

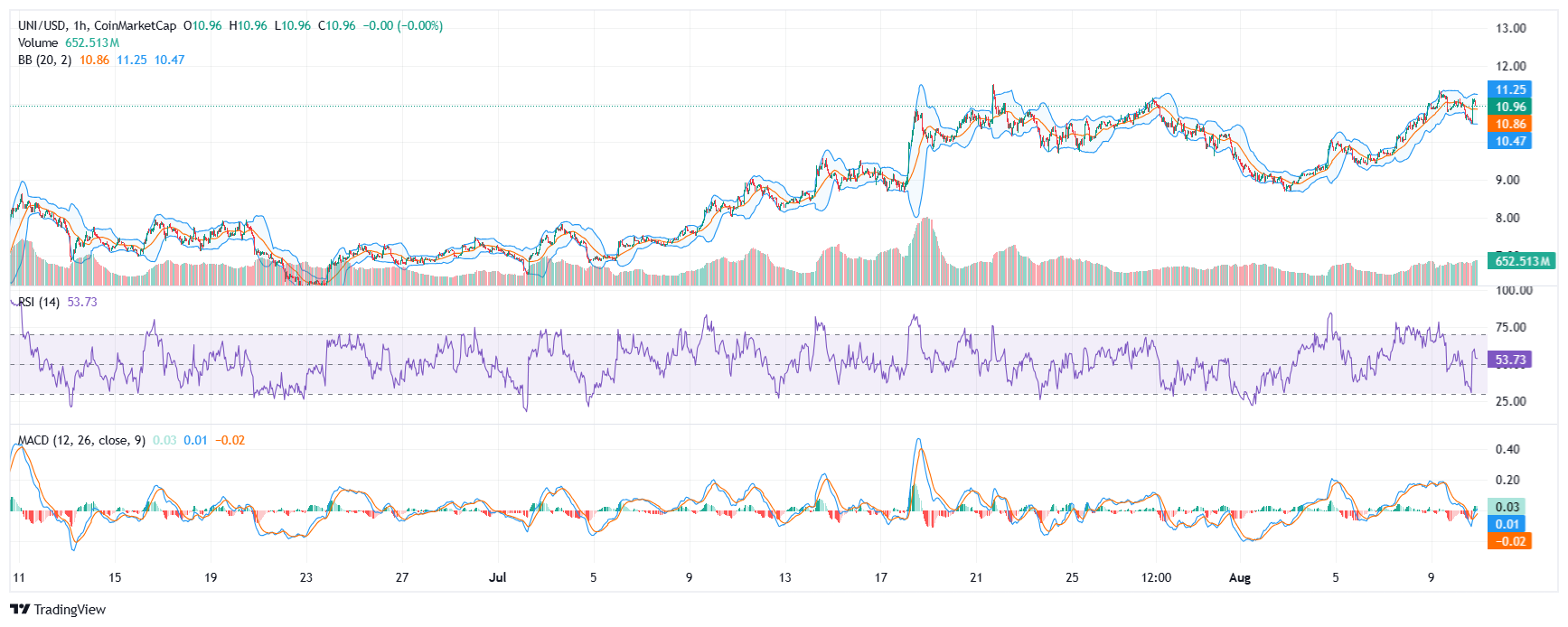

Relative Strength Index (RSI): Currently near 64.5, the RSI signals growing buying pressure without yet reaching overbought status, leaving room for further upside before a correction might happen.

Moving Averages (MA): The 50-day and 200-day simple moving averages (SMA) are both trending upwards, suggesting medium- to long-term bullish support. The 50-day SMA recently crossed above shorter-term averages indicating upward momentu

MACD (Moving Average Convergence Divergence): The MACD line is above the signal line with a positive histogram, reflecting strong bullish momentum and increasing buying interest.

Bollinger Bands: The price is currently near the upper band, indicating strong momentum but also a higher likelihood of short-term volatility or pullbacks. The widening bands signal rising volatility.

Support and Resistance Levels: Key support lies between $9.00 and $9.50, while resistance clusters from $11.00 to $11.40. These levels are critical; breaking resistance convincingly could trigger a new rally phase.

These indicators collectively point to continued upward potential for UNI but suggest that traders monitor for short-term corrections due to volatility patterns.

Five Technical Indicators Driving UNI’s Price Action

Analyzing Uniswap’s chart with five key market indicators reveals a mostly bullish setup with some caution:

Analyzing Uniswap’s chart with five key market indicators reveals a mostly bullish setup with some caution:Relative Strength Index (RSI): Currently near 64.5, the RSI signals growing buying pressure without yet reaching overbought status, leaving room for further upside before a correction might happen.

Moving Averages (MA): The 50-day and 200-day simple moving averages (SMA) are both trending upwards, suggesting medium- to long-term bullish support. The 50-day SMA recently crossed above shorter-term averages indicating upward momentu

MACD (Moving Average Convergence Divergence): The MACD line is above the signal line with a positive histogram, reflecting strong bullish momentum and increasing buying interest.

Bollinger Bands: The price is currently near the upper band, indicating strong momentum but also a higher likelihood of short-term volatility or pullbacks. The widening bands signal rising volatility.

Support and Resistance Levels: Key support lies between $9.00 and $9.50, while resistance clusters from $11.00 to $11.40. These levels are critical; breaking resistance convincingly could trigger a new rally phase.

These indicators collectively point to continued upward potential for UNI but suggest that traders monitor for short-term corrections due to volatility patterns.

#3 Uniswap’s market chart shows robust bullish characteristics.

Uniswap’s market chart shows robust bullish characteristics.

The RSI at 64.5 suggests healthy buying interest without overextension.

The upward movement of both 50-day and 200-day moving averages confirms a strong overall trend and growing investor confidence.

The MACD bullish crossover signals that momentum favors buyers.

Price riding close to the upper Bollinger band signals heightened volatility and potential for a brief pause or pullback.

The presence of clearly defined support and resistance zones around $9-$11 frames the next key price battleground.

Should UNI break above the $11.40 resistance with volume, a push toward $13 or higher could be anticipated.

Market Chart Analysis Using Top Indicators

Uniswap’s market chart shows robust bullish characteristics.

Uniswap’s market chart shows robust bullish characteristics. The RSI at 64.5 suggests healthy buying interest without overextension.

The upward movement of both 50-day and 200-day moving averages confirms a strong overall trend and growing investor confidence.

The MACD bullish crossover signals that momentum favors buyers.

Price riding close to the upper Bollinger band signals heightened volatility and potential for a brief pause or pullback.

The presence of clearly defined support and resistance zones around $9-$11 frames the next key price battleground.

Should UNI break above the $11.40 resistance with volume, a push toward $13 or higher could be anticipated.

#4 Several recent developments have bolstered Uniswap’s market position and positive sentiment:

Several recent developments have bolstered Uniswap’s market position and positive sentiment:

Protocol Upgrades: Uniswap has implemented efficiency improvements in gas fees and introduced new liquidity incentives, which increase user activity and deepen liquidity pools.

Rising DeFi Integration: Uniswap continues to expand as a leading decentralized exchange (DEX) on Ethereum, with growing partnerships and integrations driving more volume and wider adoption.

Institutional Interest: Increased whale accumulation has been seen, and large holders are signaling renewed confidence by adding UNI to their portfolios.

Regulatory Clarity: Recent positive regulations shaping the crypto trading landscape in the U.S. and globally have been favorable, improving investor sentiment toward decentralized platforms like Uniswap.

Community Growth: Developer engagement and user participation on Uniswap’s platform continue to expand, suggesting sustained ecosystem health and innovation potential.

These news factors support the technical momentum and build a solid foundation for UNI’s future growth.

Recent News Energizing Uniswap’s Outlook

Several recent developments have bolstered Uniswap’s market position and positive sentiment:

Several recent developments have bolstered Uniswap’s market position and positive sentiment:Protocol Upgrades: Uniswap has implemented efficiency improvements in gas fees and introduced new liquidity incentives, which increase user activity and deepen liquidity pools.

Rising DeFi Integration: Uniswap continues to expand as a leading decentralized exchange (DEX) on Ethereum, with growing partnerships and integrations driving more volume and wider adoption.

Institutional Interest: Increased whale accumulation has been seen, and large holders are signaling renewed confidence by adding UNI to their portfolios.

Regulatory Clarity: Recent positive regulations shaping the crypto trading landscape in the U.S. and globally have been favorable, improving investor sentiment toward decentralized platforms like Uniswap.

Community Growth: Developer engagement and user participation on Uniswap’s platform continue to expand, suggesting sustained ecosystem health and innovation potential.

These news factors support the technical momentum and build a solid foundation for UNI’s future growth.

#5

Near term, UNI may test resistance levels around $11.40, and if sustained, could target $13 and beyond.

Support levels near $9.00-$9.50 provide good entry points during pullbacks, which are expected in high volatility markets.

Longer-term forecasts from technical models and analysts show possible price ranges expanding from $15 to above $20 by late 2025, especially if DeFi adoption grows and protocol upgrades continue.

Volatility remains a factor; sudden corrections could arise during profit-taking phases or broader crypto market shifts, so risk management is advised.

Overall, Uniswap’s dual strength in technology and community continues to drive bullish momentum through 2025.

Price Predictions and What to Expect

Based on technical indicators and market developments, Uniswap’s price outlook appears promising but with some risk considerations:Near term, UNI may test resistance levels around $11.40, and if sustained, could target $13 and beyond.

Support levels near $9.00-$9.50 provide good entry points during pullbacks, which are expected in high volatility markets.

Longer-term forecasts from technical models and analysts show possible price ranges expanding from $15 to above $20 by late 2025, especially if DeFi adoption grows and protocol upgrades continue.

Volatility remains a factor; sudden corrections could arise during profit-taking phases or broader crypto market shifts, so risk management is advised.

Overall, Uniswap’s dual strength in technology and community continues to drive bullish momentum through 2025.

#6

Key indicators including RSI (~64.5), moving averages, MACD, and Bollinger Bands highlight a generally positive trend but suggest watching for some short-term volatility.

Important support near $9.00–$9.50 and resistance around $11.00–$11.40 frame near-term price action.

Protocol upgrades, DeFi expansion, and favorable market news create strong growth drivers.

Price forecasts indicate solid upside potential with prudent caution toward short-term pullbacks.

Key takeaways

Uniswap is showing steady bullish momentum supported by significant whale activity and technical strength.Key indicators including RSI (~64.5), moving averages, MACD, and Bollinger Bands highlight a generally positive trend but suggest watching for some short-term volatility.

Important support near $9.00–$9.50 and resistance around $11.00–$11.40 frame near-term price action.

Protocol upgrades, DeFi expansion, and favorable market news create strong growth drivers.

Price forecasts indicate solid upside potential with prudent caution toward short-term pullbacks.

#7

Is Uniswap a good buy now?

Current trends are positive, but volatility means timing is key.

What risks are there?

Market corrections, crypto market volatility, and resistance challenges.

What sets Uniswap apart?

It’s a leading decentralized exchange with broad integrations and improving tech.

What is the long-term outlook?

Bullish, with potential double-digit percentage gains given continued ecosystem growth.

FAQ

What’s influencing Uniswap’s price rally? Whale accumulation, protocol upgrades, and higher DeFi usage.Is Uniswap a good buy now?

Current trends are positive, but volatility means timing is key.

What risks are there?

Market corrections, crypto market volatility, and resistance challenges.

What sets Uniswap apart?

It’s a leading decentralized exchange with broad integrations and improving tech.

What is the long-term outlook?

Bullish, with potential double-digit percentage gains given continued ecosystem growth.

#8

Continuous protocol enhancements and expanding DeFi partnerships support sustained demand for UNI tokens, potentially setting the stage for significant upside.

Looking Ahead: Uniswap’s Growth Trajectory

Uniswap benefits from a rare alignment of strong technical signals and meaningful ecosystem advances. While price corrections remain possible amid market volatility, the overall momentum points to a promising year ahead in 2025.Continuous protocol enhancements and expanding DeFi partnerships support sustained demand for UNI tokens, potentially setting the stage for significant upside.

#9

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human changed and reedited.Reactions

Reactions

2