Ethereum Classic (ETC) is at a pivotal point this October, balancing steady technical momentum with important ecosystem shifts poised to impact its trajectory. While price action shows signs of resilience amidst moderate volatility, ETC benefits from evolving on-chain governance and network upgrades that reinforce its identity distinct from Ethereum. This article unpacks the latest technical analysis using five key market indicators alongside fresh news on ETC’s developments, delivering insights on where the token might head next amid broader crypto market trends.

#1 Ethereum Classic continues to strengthen its foothold in Asia with the recently announced ETC Grants DAO targeting Hong Kong expansion, aiming to grow Proof-of-Work adoption through decentralized funding mechanisms.

Ethereum Classic continues to strengthen its foothold in Asia with the recently announced ETC Grants DAO targeting Hong Kong expansion, aiming to grow Proof-of-Work adoption through decentralized funding mechanisms.

The network also advanced its Olympia upgrade, integrating EIP-1559 to introduce a deflationary model via base fee burns.

This upgrade includes the launch of the Olympia Treasury and decentralized governance DAO, helping fund ecosystem projects and improving network sustainability. These developments boost confidence in ETC’s long-term viability as a Proof-of-Work chain distinct from Ethereum, appealing to investors focused on decentralization and network security.

ETC’s Ecosystem Expansion and Governance Updates

Ethereum Classic continues to strengthen its foothold in Asia with the recently announced ETC Grants DAO targeting Hong Kong expansion, aiming to grow Proof-of-Work adoption through decentralized funding mechanisms.

Ethereum Classic continues to strengthen its foothold in Asia with the recently announced ETC Grants DAO targeting Hong Kong expansion, aiming to grow Proof-of-Work adoption through decentralized funding mechanisms. The network also advanced its Olympia upgrade, integrating EIP-1559 to introduce a deflationary model via base fee burns.

This upgrade includes the launch of the Olympia Treasury and decentralized governance DAO, helping fund ecosystem projects and improving network sustainability. These developments boost confidence in ETC’s long-term viability as a Proof-of-Work chain distinct from Ethereum, appealing to investors focused on decentralization and network security.

#2 ETC’s chart reveals a mixed but cautiously bullish picture using five main indicators.

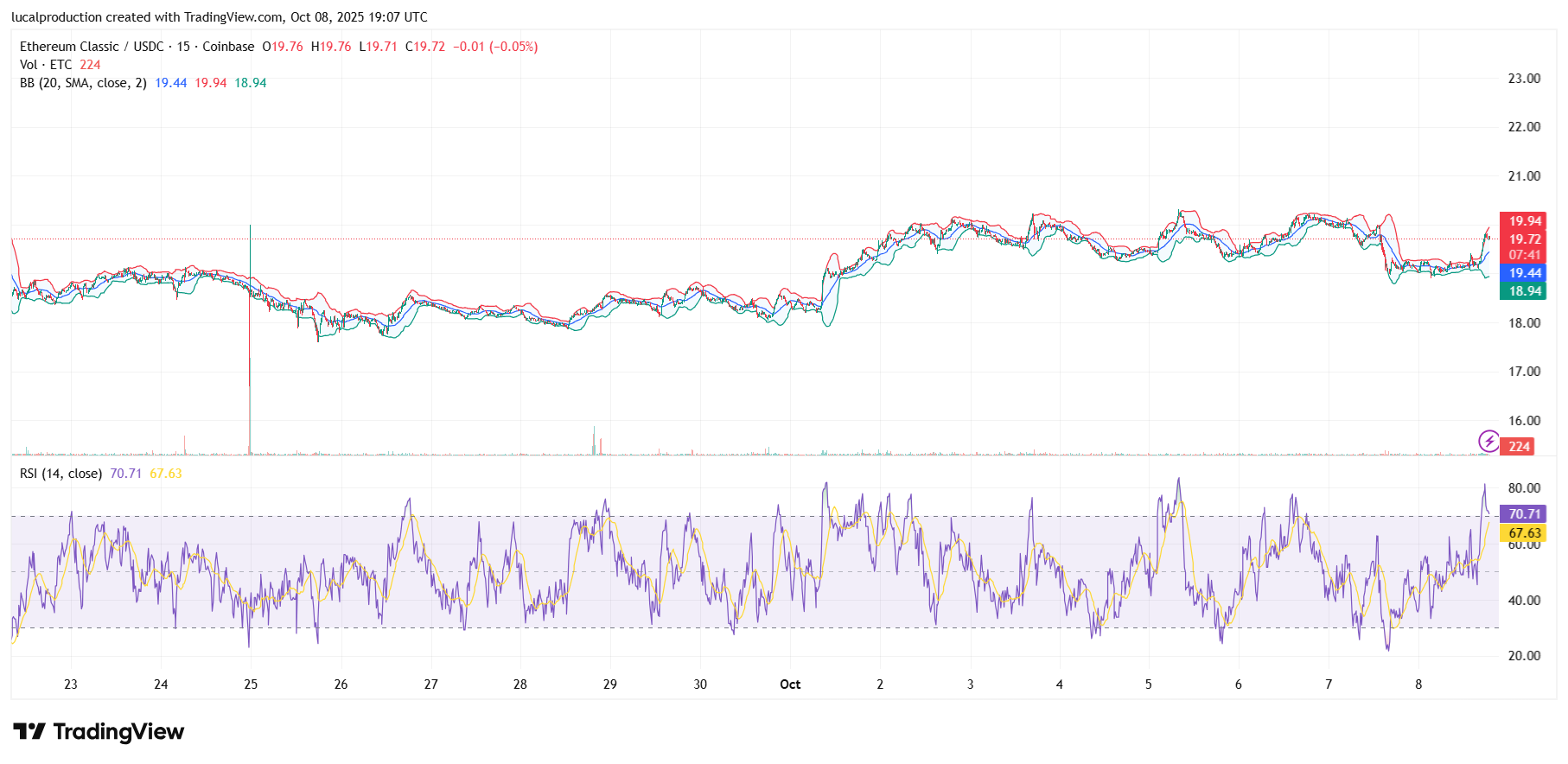

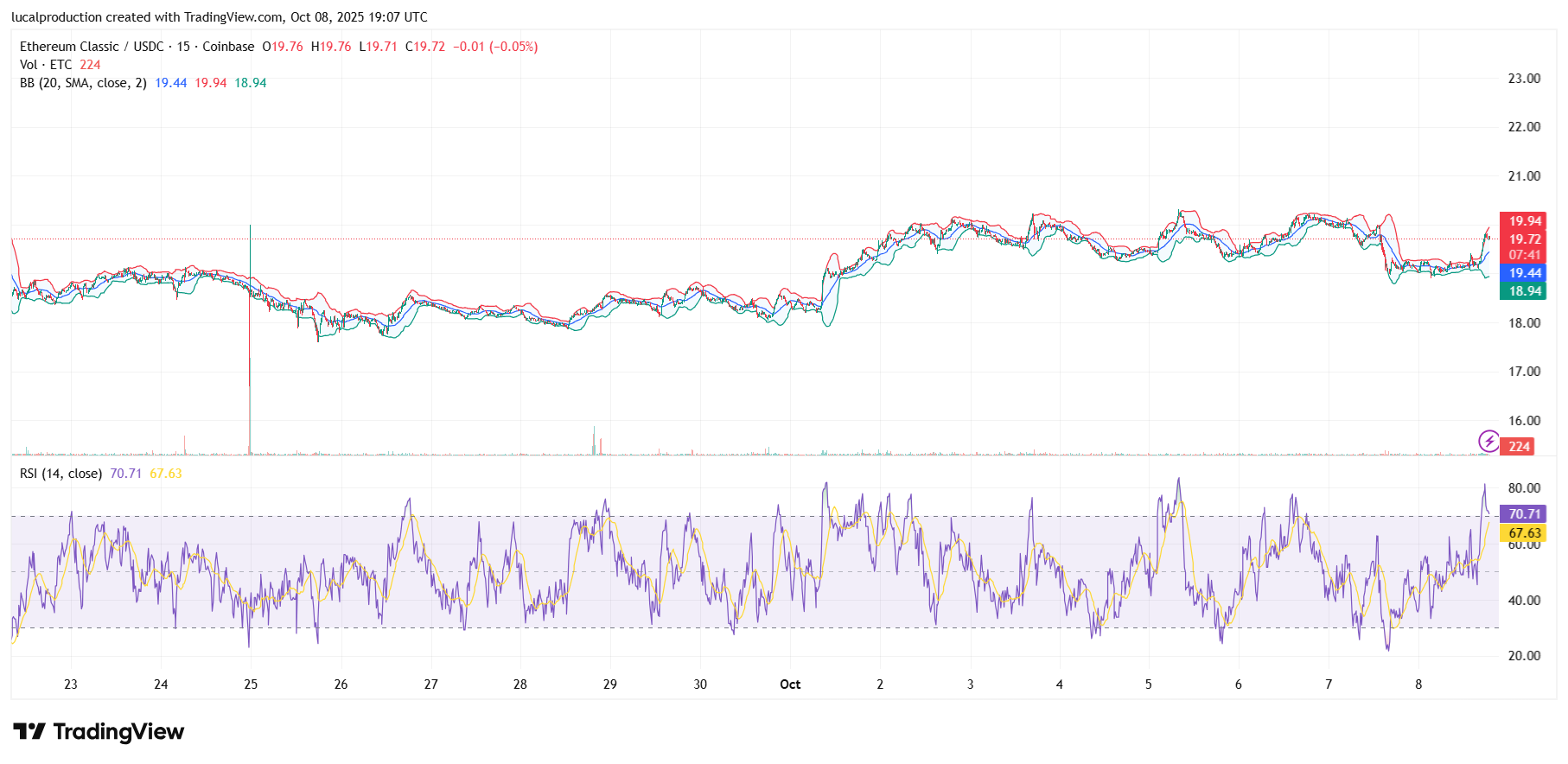

ETC’s chart reveals a mixed but cautiously bullish picture using five main indicators.

The Relative Strength Index (RSI) stands near 65, indicating healthy buying interest without hitting overbought levels, signaling balanced market pressure.

The 50-day moving average is trending upward, supporting a short-term bullish trend, whereas the 200-day moving average hints at longer-term consolidation phases.

The Moving Average Convergence Divergence (MACD) shows a mildly bullish crossover, suggesting momentum tilt toward price gains.

The Average Directional Index (ADX) around 25 indicates a strengthening trend, though not yet strong enough to guarantee an immediate breakout.

Bollinger Bands reflect moderate volatility, with price movements contained comfortably within the bands, suggesting no immediate price shock expected.

Key Technical Indicators Highlight Market Stability

ETC’s chart reveals a mixed but cautiously bullish picture using five main indicators.

ETC’s chart reveals a mixed but cautiously bullish picture using five main indicators. The Relative Strength Index (RSI) stands near 65, indicating healthy buying interest without hitting overbought levels, signaling balanced market pressure.

The 50-day moving average is trending upward, supporting a short-term bullish trend, whereas the 200-day moving average hints at longer-term consolidation phases.

The Moving Average Convergence Divergence (MACD) shows a mildly bullish crossover, suggesting momentum tilt toward price gains.

The Average Directional Index (ADX) around 25 indicates a strengthening trend, though not yet strong enough to guarantee an immediate breakout.

Bollinger Bands reflect moderate volatility, with price movements contained comfortably within the bands, suggesting no immediate price shock expected.

#3 Current ETC price hovers around $19.50, with projections indicating a potential rise to about $22.75 within the next week, reflecting an anticipated gain of roughly 15%.

Current ETC price hovers around $19.50, with projections indicating a potential rise to about $22.75 within the next week, reflecting an anticipated gain of roughly 15%.

Analysts forecast a cautious yet optimistic October for ETC, driven by upgraded network fundamentals and growing developer activity. The next key resistance levels lie near $20.75 and $21.50, and breaking above these could unlock further momentum toward $24 by December.

Market sentiment remains neutral to slightly bullish, tempered by ongoing macroeconomic uncertainties and sector-wide crypto volatility. Investors are advised to watch volume trends and confirm breakout signals before committing heavily.

Price Prediction and Market Sentiment for October 2025

Current ETC price hovers around $19.50, with projections indicating a potential rise to about $22.75 within the next week, reflecting an anticipated gain of roughly 15%.

Current ETC price hovers around $19.50, with projections indicating a potential rise to about $22.75 within the next week, reflecting an anticipated gain of roughly 15%. Analysts forecast a cautious yet optimistic October for ETC, driven by upgraded network fundamentals and growing developer activity. The next key resistance levels lie near $20.75 and $21.50, and breaking above these could unlock further momentum toward $24 by December.

Market sentiment remains neutral to slightly bullish, tempered by ongoing macroeconomic uncertainties and sector-wide crypto volatility. Investors are advised to watch volume trends and confirm breakout signals before committing heavily.

#4

As institutional interest in decentralized, secure chains grows, ETC gains relevance alongside leading tokens. Trading volumes have seen moderate increases, signaling renewed attention after a quiet summer.

Additionally, decentralized finance (DeFi) integrations and cross-chain bridge enhancements for ETC are in discussion, aiming to boost interoperability and liquidity. These ecosystem improvements could help ETC edge closer to its price targets by expanding real-world usability and developer engagement.

Broader Market Context and Exchange Trends

ETC’s price performance correlates with overall altcoin movement, especially those retaining Proof-of-Work consensus like Bitcoin.As institutional interest in decentralized, secure chains grows, ETC gains relevance alongside leading tokens. Trading volumes have seen moderate increases, signaling renewed attention after a quiet summer.

Additionally, decentralized finance (DeFi) integrations and cross-chain bridge enhancements for ETC are in discussion, aiming to boost interoperability and liquidity. These ecosystem improvements could help ETC edge closer to its price targets by expanding real-world usability and developer engagement.

#5

Additional News and Recent Developments

Beyond technicals, ETC saw active developer conferences focusing on network security and scalability. Interest in Proof-of-Work chains surged amid staking regulatory debates, positioning ETC as a hedge alternative. The ETC community also launched new grant programs to incentivize application-building, which could spark fresh use cases. That said, challenges persist, including competing smart contract platforms and periodic network attacks which ETC continues to guard against with upgraded defense protocols. Overall, steady progress in governance and funding initiatives maintains a cautiously positive outlook.

#6

Price targets near $22.75 are feasible if ETC clears resistance levels around $21. Market sentiment is cautiously optimistic, bolstered by key upgrades like EIP-1559 and community-driven governance.

Among Proof-of-Work coins, ETC stands firm with steady volume and ecosystem expansion, but investors should watch broader sector volatility and key chart breakouts.

Key Takeaways

Ethereum Classic is navigating a balanced October with healthy technical signals supported by a rising 50-day moving average and momentum crossovers.Price targets near $22.75 are feasible if ETC clears resistance levels around $21. Market sentiment is cautiously optimistic, bolstered by key upgrades like EIP-1559 and community-driven governance.

Among Proof-of-Work coins, ETC stands firm with steady volume and ecosystem expansion, but investors should watch broader sector volatility and key chart breakouts.

#7