Aave (AAVE) is demonstrating strong market momentum in early October 2025, driven by both solid technical indicators and significant ecosystem growth. This article offers a comprehensive look at AAVE’s current price action through five key technical signals, alongside the latest news reinforcing its DeFi leadership. Record deposits, strategic partnerships, and a rising total value locked underline optimism in Aave’s future. Market predictions indicate promising price targets, balancing near-term resistance with sustained bullish potential as AAVE remains a standout asset in decentralized finance.

#1 As of October 6, 2025, Aave trades near $290, reflecting steady recovery supported by a booming DeFi sector.

As of October 6, 2025, Aave trades near $290, reflecting steady recovery supported by a booming DeFi sector.

The platform recently saw total deposits hit $44.8 billion, reinforcing strong fundamentals. Daily trading volumes remain high at around $280 million, confirming active market interest.

Price fluctuations currently hold key support between $284 and $285, with resistance around $293 to $295. Aave’s reputation as a leading DeFi protocol strengthens confidence among investors, laying groundwork for possible continuation of upward momentum.

Aave Current Market Snapshot

As of October 6, 2025, Aave trades near $290, reflecting steady recovery supported by a booming DeFi sector.

As of October 6, 2025, Aave trades near $290, reflecting steady recovery supported by a booming DeFi sector. The platform recently saw total deposits hit $44.8 billion, reinforcing strong fundamentals. Daily trading volumes remain high at around $280 million, confirming active market interest.

Price fluctuations currently hold key support between $284 and $285, with resistance around $293 to $295. Aave’s reputation as a leading DeFi protocol strengthens confidence among investors, laying groundwork for possible continuation of upward momentum.

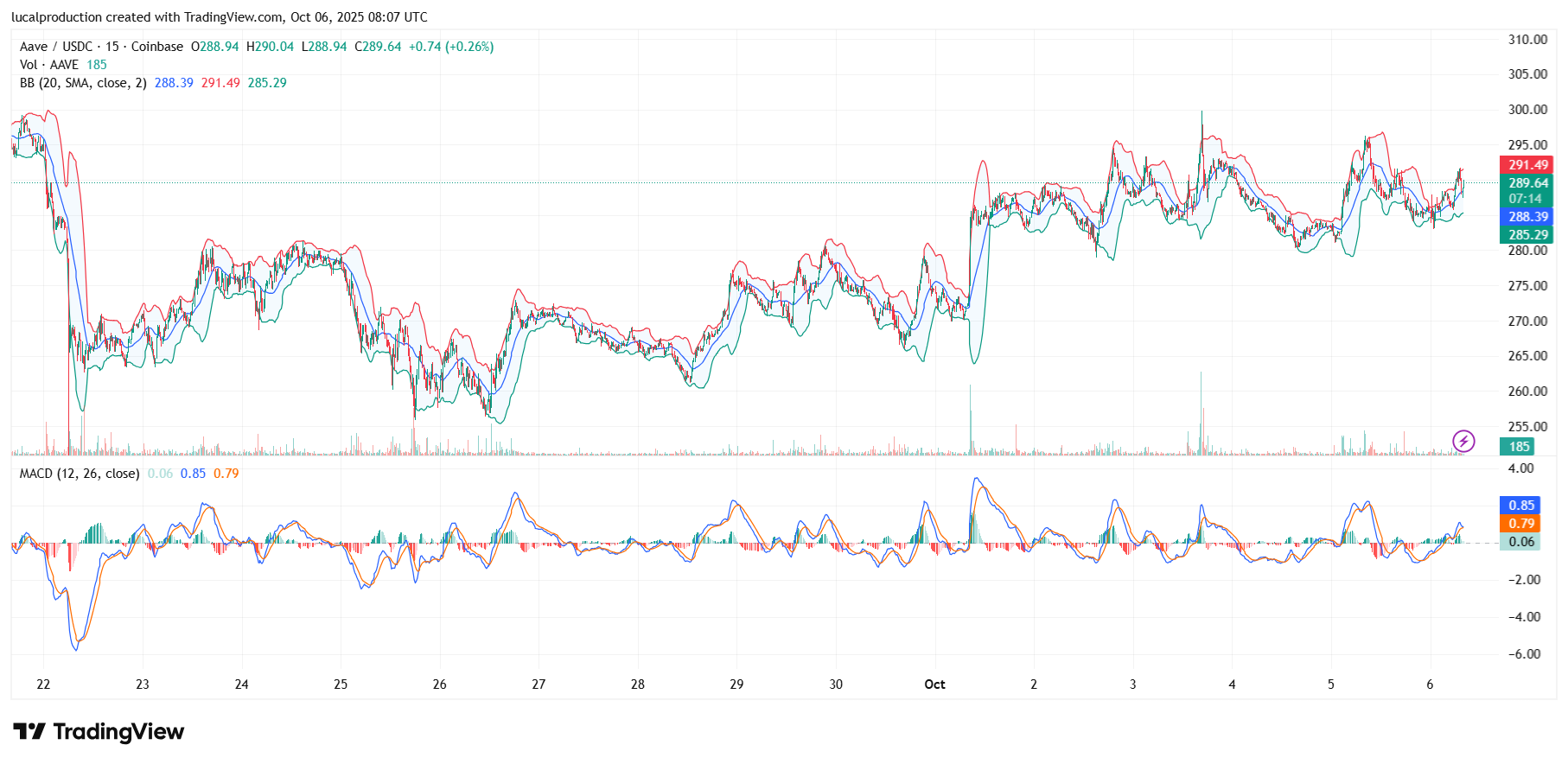

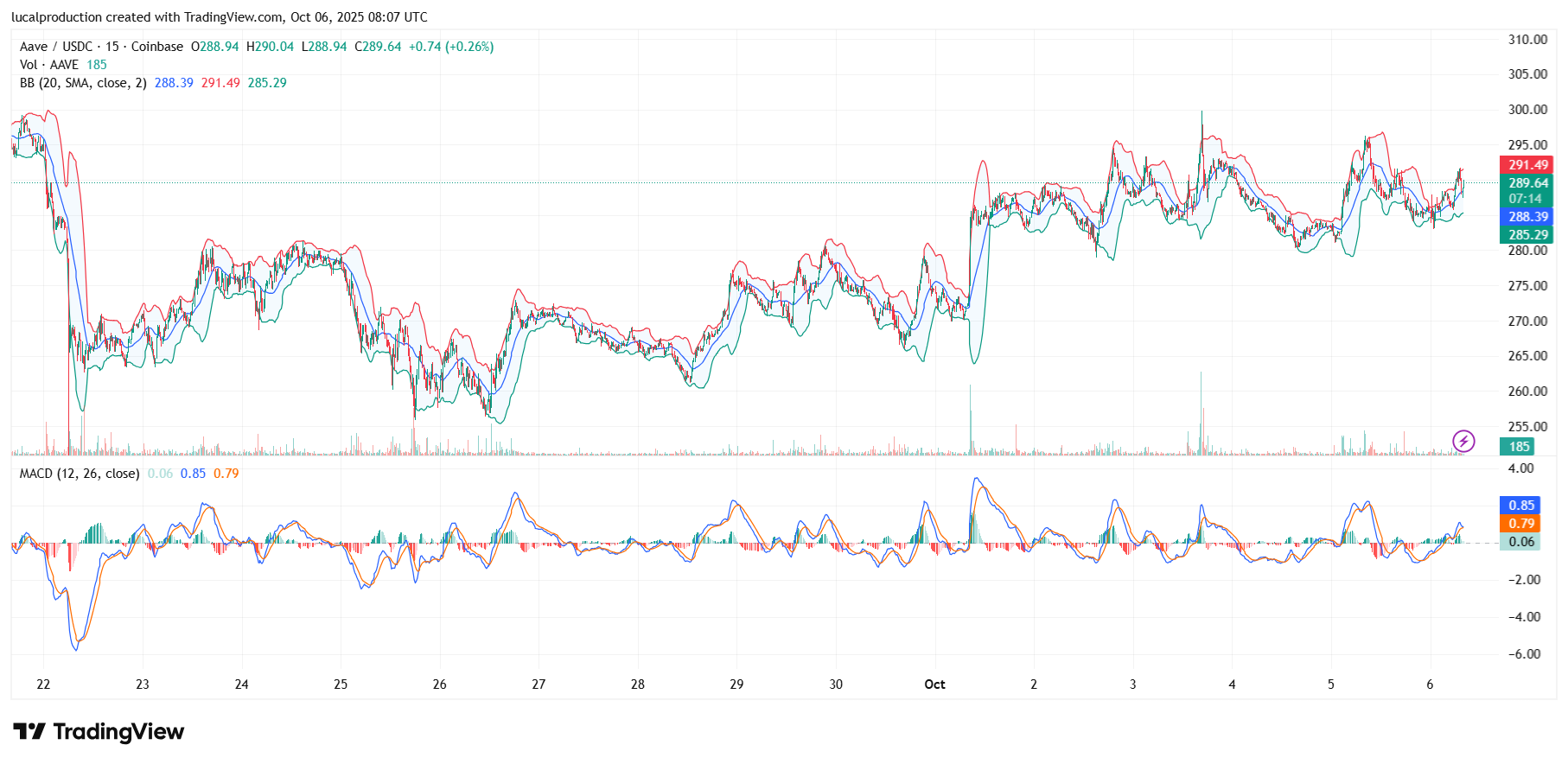

#2 Analysis of AAVE’s price utilizes the 50-day and 200-day moving averages, RSI, MACD, Bollinger Bands, and trading volume:

Analysis of AAVE’s price utilizes the 50-day and 200-day moving averages, RSI, MACD, Bollinger Bands, and trading volume:

- The 50-day moving average is above the 200-day, a classic sign of a bullish trend.

- RSI at 66 suggests strong buying pressure, though nearing overbought levels, so traders should watch for potential pullbacks.

- MACD’s positive crossover affirms strengthening momentum.

- Bollinger Bands show increased volatility with prices near the upper band, hinting at possible near-term profit taking or continuation of breakout.

- Volume is elevated, supporting the price increase and signaling robust participation.

This combination suggests AAVE is positioned well technically, with bullish momentum balanced by caution at resistance.

Technical Chart Analysis Using Five Key Indicators

Analysis of AAVE’s price utilizes the 50-day and 200-day moving averages, RSI, MACD, Bollinger Bands, and trading volume:

Analysis of AAVE’s price utilizes the 50-day and 200-day moving averages, RSI, MACD, Bollinger Bands, and trading volume: - The 50-day moving average is above the 200-day, a classic sign of a bullish trend.

- RSI at 66 suggests strong buying pressure, though nearing overbought levels, so traders should watch for potential pullbacks.

- MACD’s positive crossover affirms strengthening momentum.

- Bollinger Bands show increased volatility with prices near the upper band, hinting at possible near-term profit taking or continuation of breakout.

- Volume is elevated, supporting the price increase and signaling robust participation.

This combination suggests AAVE is positioned well technically, with bullish momentum balanced by caution at resistance.

#3 Aave benefits from remarkable developments in the DeFi space, with the overall market hitting $219 billion in assets—Aave’s portion being substantial.

Aave benefits from remarkable developments in the DeFi space, with the overall market hitting $219 billion in assets—Aave’s portion being substantial.

A recent partnership with Plasma blockchain expands lending markets by over $6 billion in under a week, attracting new users. Enhancements to Aave’s developer toolkit also stimulate adoption in real-world assets and fintech sectors.

These initiatives strengthen ecosystem fundamentals and enhance investor optimism, supporting price gains amid broader crypto market rallies.

Recent News Impacting Aave’s Outlook

Aave benefits from remarkable developments in the DeFi space, with the overall market hitting $219 billion in assets—Aave’s portion being substantial.

Aave benefits from remarkable developments in the DeFi space, with the overall market hitting $219 billion in assets—Aave’s portion being substantial. A recent partnership with Plasma blockchain expands lending markets by over $6 billion in under a week, attracting new users. Enhancements to Aave’s developer toolkit also stimulate adoption in real-world assets and fintech sectors.

These initiatives strengthen ecosystem fundamentals and enhance investor optimism, supporting price gains amid broader crypto market rallies.

#4

The Fear & Greed index shows heightened market optimism ("Greed"), yet caution remains warranted at these levels. Long-term forecasts remain bullish, projecting prices up to $360 in 2025 depending on market cycles and regulatory developments.

AAVE’s price trajectory is strongly correlated with the health of the broader DeFi sector and crypto markets.

Price Predictions and Market Sentiment

Analysts forecast AAVE reaching around $339 by October 10, marking over a 17% gain from current prices. Price support ranges near $265, while resistance lies close to $320, defining short-term trade zones.The Fear & Greed index shows heightened market optimism ("Greed"), yet caution remains warranted at these levels. Long-term forecasts remain bullish, projecting prices up to $360 in 2025 depending on market cycles and regulatory developments.

AAVE’s price trajectory is strongly correlated with the health of the broader DeFi sector and crypto markets.

#5

The bullish macro crypto environment in October 2025 benefits altcoins like AAVE, with key players such as Bitcoin and Ethereum rallying in tandem.

Platform upgrades and regulatory compliance increase sector legitimacy, helping to reinforce Aave’s position as a favored DeFi investment option.

Broader Market Context and Aave’s Role

As a top decentralized finance protocol, Aave holds a strategic role amid an expanding DeFi market. Record levels of assets locked underline increasing trust and usage.The bullish macro crypto environment in October 2025 benefits altcoins like AAVE, with key players such as Bitcoin and Ethereum rallying in tandem.

Platform upgrades and regulatory compliance increase sector legitimacy, helping to reinforce Aave’s position as a favored DeFi investment option.

#6

Its ecosystem expansion and record deposit milestones bolster fundamentals.

Price targets suggest potential gains reaching near $339 by mid-October, balanced by key support levels.

Overall, Aave remains a promising DeFi asset combining technical strength with influential news catalysts to sustain growth.

Key Takeaways

Aave’s technical analysis signals a strong bullish trend backed by moving averages, RSI, and MACD.Its ecosystem expansion and record deposit milestones bolster fundamentals.

Price targets suggest potential gains reaching near $339 by mid-October, balanced by key support levels.

Overall, Aave remains a promising DeFi asset combining technical strength with influential news catalysts to sustain growth.

#7

[1](https://ivypanda.com/essays/topic/cryptocurrency-essay-topics/)

[2](https://www.sciencedirect.com/science/article/pii/S2199853122011726)

[3](https://www.sciencedirect.com/science/article/pii/S1059056025001030)

[4](https://gradcoach.com/research-topics-blockchain-crypto/)

[5](https://www.emerald.com/cafr/article/26/1/1/1237641/A-systematic-literature-review-on-the-determinants)

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human changed and reedited.[1](https://ivypanda.com/essays/topic/cryptocurrency-essay-topics/)

[2](https://www.sciencedirect.com/science/article/pii/S2199853122011726)

[3](https://www.sciencedirect.com/science/article/pii/S1059056025001030)

[4](https://gradcoach.com/research-topics-blockchain-crypto/)

[5](https://www.emerald.com/cafr/article/26/1/1/1237641/A-systematic-literature-review-on-the-determinants)