Hyperliquid’s native token, HYPE, has been a hot topic in the crypto market recently. With strong price movements, platform developments, and on-chain dynamics all playing a role, HYPE shows both promising potential and notable risks. This analysis combines current market data, technical chart indicators, and relevant news to give a comprehensive snapshot of HYPE’s status as of October 3, 2025, along with price predictions and insights into what traders should watch next.

#1 HYPE experienced a powerful price surge early this week, gaining 17% as the Hyperliquid platform generated $3 million in daily fees, signaling strong utility and interest.

HYPE experienced a powerful price surge early this week, gaining 17% as the Hyperliquid platform generated $3 million in daily fees, signaling strong utility and interest.

The price has been consolidating above $45, with key support holding around $46.10, tested multiple times by buyers.

This level acts as a critical floor, supporting further upward movement toward resistance zones at $48–$49. A decisive breakout above this range could open a path for HYPE to climb to $52–$55. However, failure to hold the $42 support level could lead to renewed volatility and downward pressure.

Current Market Momentum and Key Price Movements

HYPE experienced a powerful price surge early this week, gaining 17% as the Hyperliquid platform generated $3 million in daily fees, signaling strong utility and interest.

HYPE experienced a powerful price surge early this week, gaining 17% as the Hyperliquid platform generated $3 million in daily fees, signaling strong utility and interest. The price has been consolidating above $45, with key support holding around $46.10, tested multiple times by buyers.

This level acts as a critical floor, supporting further upward movement toward resistance zones at $48–$49. A decisive breakout above this range could open a path for HYPE to climb to $52–$55. However, failure to hold the $42 support level could lead to renewed volatility and downward pressure.

#2 An analysis of the top five indicators on HYPE's price chart points to a cautiously optimistic outlook.

An analysis of the top five indicators on HYPE's price chart points to a cautiously optimistic outlook.

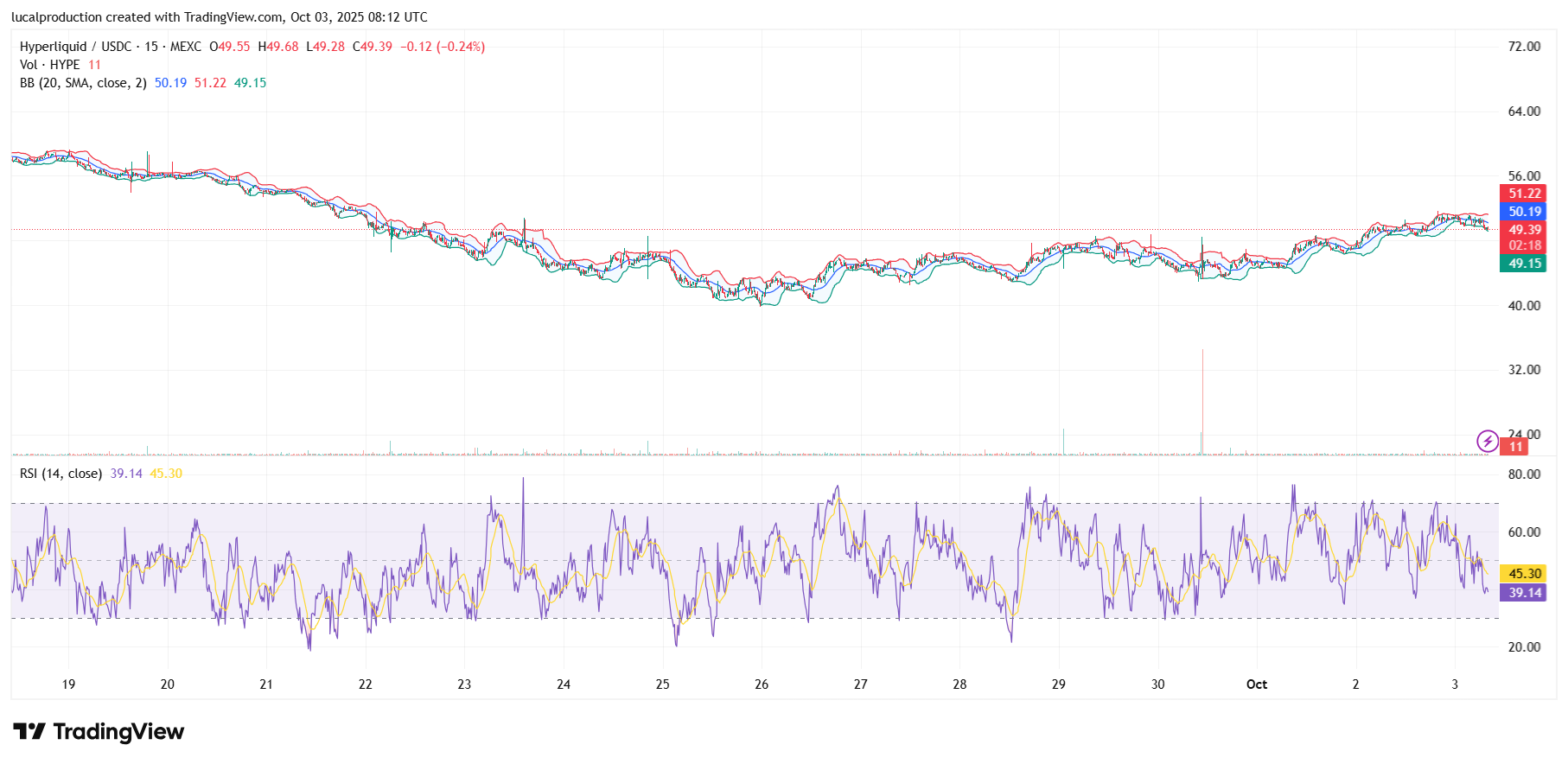

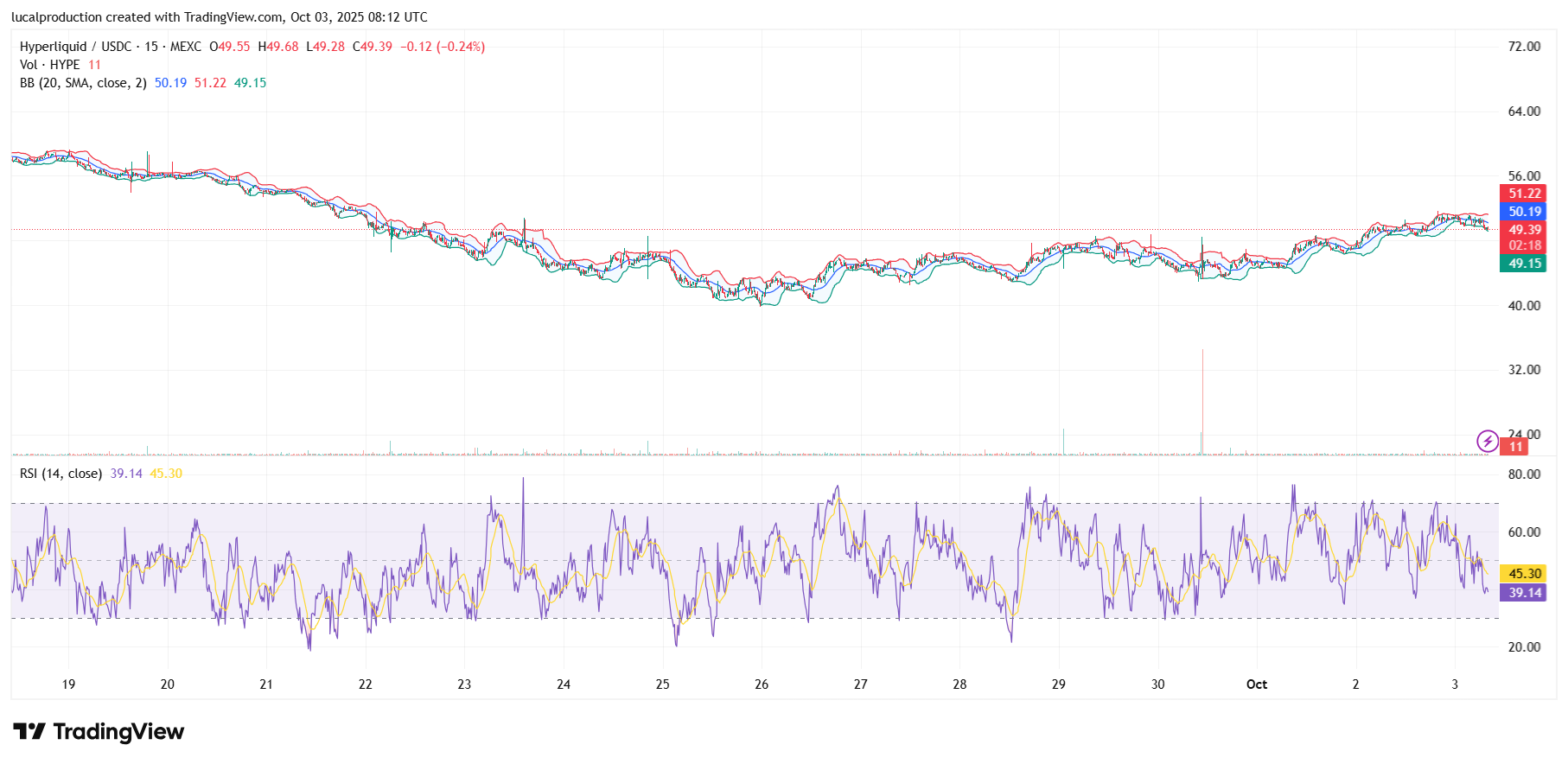

The 20-day Moving Average (MA-20) at around $49.91 and the 50-day Moving Average (MA-50) near $47.93 are currently being tested successfully, showing short-term bullish momentum.

The longer 200-day Moving Average (MA-200) near $34.71 confirms strong historical support.

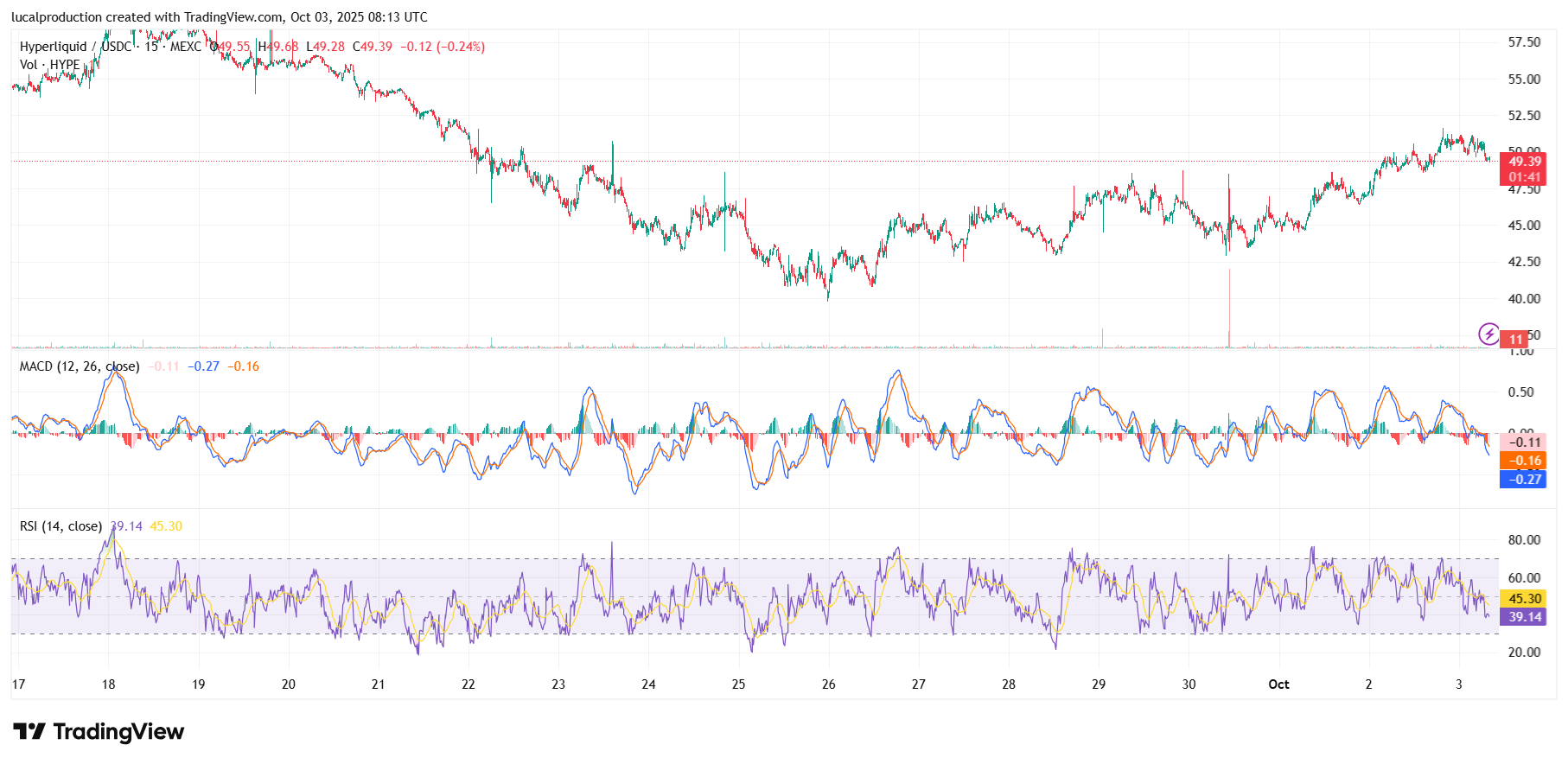

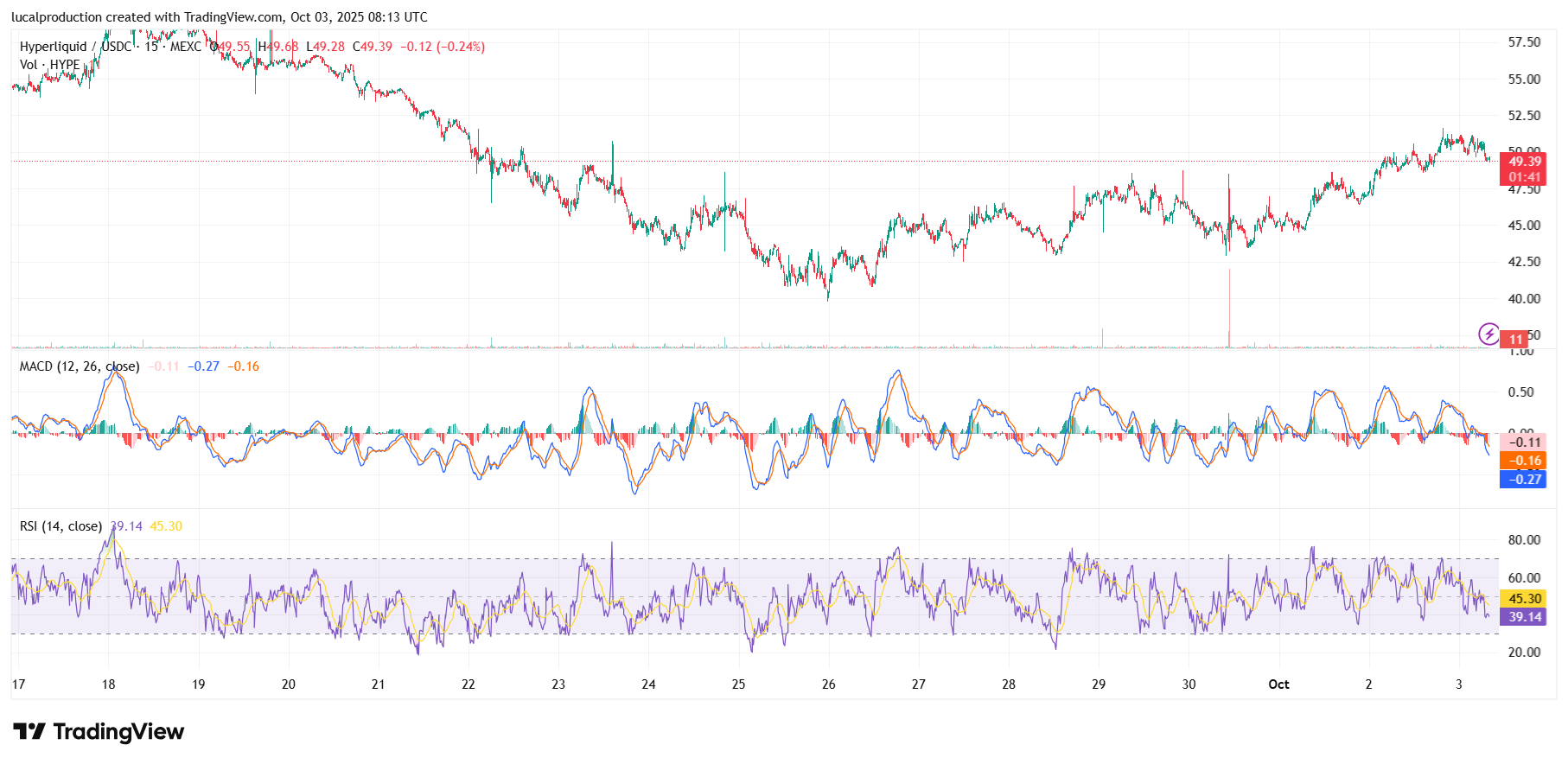

The Relative Strength Index (RSI) remains below overbought territory, indicating room for upside, while the MACD (Moving Average Convergence Divergence) signals a positive crossover confirming bullish momentum.

Meanwhile, On-Balance Volume (OBV) shows increasing buying pressure, though the fear and greed index stands at a moderate level around 37 (fear), signaling cautious sentiment among traders.

Technical Indicators Signal Mixed but Bullish Potential

An analysis of the top five indicators on HYPE's price chart points to a cautiously optimistic outlook.

An analysis of the top five indicators on HYPE's price chart points to a cautiously optimistic outlook. The 20-day Moving Average (MA-20) at around $49.91 and the 50-day Moving Average (MA-50) near $47.93 are currently being tested successfully, showing short-term bullish momentum.

The longer 200-day Moving Average (MA-200) near $34.71 confirms strong historical support.

The Relative Strength Index (RSI) remains below overbought territory, indicating room for upside, while the MACD (Moving Average Convergence Divergence) signals a positive crossover confirming bullish momentum.

Meanwhile, On-Balance Volume (OBV) shows increasing buying pressure, though the fear and greed index stands at a moderate level around 37 (fear), signaling cautious sentiment among traders.

#3 On-chain data reveals over 660,000 HYPE tokens are staked, valued near $30 million, reducing circulating supply and supporting price resilience. Staking and systematic buybacks form a feedback loop strengthening fundamentals.

On-chain data reveals over 660,000 HYPE tokens are staked, valued near $30 million, reducing circulating supply and supporting price resilience. Staking and systematic buybacks form a feedback loop strengthening fundamentals.

However, looming token unlocks starting November 29 pose a significant risk, with over 237 million HYPE tokens scheduled to vest over 24 months, potentially flooding the market with $500 million in monthly sell pressure.

Current buybacks cover only a fraction of this, raising concerns of potential oversupply and downward price impact as whales and large holders might liquidate assets.

On-Chain Activity and Supply Dynamics

On-chain data reveals over 660,000 HYPE tokens are staked, valued near $30 million, reducing circulating supply and supporting price resilience. Staking and systematic buybacks form a feedback loop strengthening fundamentals.

On-chain data reveals over 660,000 HYPE tokens are staked, valued near $30 million, reducing circulating supply and supporting price resilience. Staking and systematic buybacks form a feedback loop strengthening fundamentals. However, looming token unlocks starting November 29 pose a significant risk, with over 237 million HYPE tokens scheduled to vest over 24 months, potentially flooding the market with $500 million in monthly sell pressure.

Current buybacks cover only a fraction of this, raising concerns of potential oversupply and downward price impact as whales and large holders might liquidate assets.

#4

While this was a bearish trigger, the Hyperliquid ecosystem itself continues advancing. The recent launch of Hypurr NFTs generated $45 million in volume despite some setbacks like a $400K NFT theft.

Additionally, Hyperliquid maintains leadership in decentralized derivatives with $280 billion monthly trading volume, although new competitors like Aster are intensifying pressure.

Strategic updates such as USDH stablecoin buybacks and HyperBFT upgrades aim to reinforce the platform's standing.

Market News Impacting HYPE

Recent major whale activity has rocked the market, with a single holder dumping 4.99 million tokens for $228 million, taking profits just before the big token unlock events, triggering an 8% price drop.While this was a bearish trigger, the Hyperliquid ecosystem itself continues advancing. The recent launch of Hypurr NFTs generated $45 million in volume despite some setbacks like a $400K NFT theft.

Additionally, Hyperliquid maintains leadership in decentralized derivatives with $280 billion monthly trading volume, although new competitors like Aster are intensifying pressure.

Strategic updates such as USDH stablecoin buybacks and HyperBFT upgrades aim to reinforce the platform's standing.

#5

The short-term price outlook leans slightly bullish if key support holds, with potential rallies targeting the $50-$55 zone.

However, persistent risks from token unlocks and whale liquidations could trigger price corrections. Analysts recommend monitoring the $46.10 support level closely and watching trading volumes to confirm any sustainable breakouts.

Price Prediction and Outlook

According to recent forecasts, HYPE is expected to hover around the $45.47 mark today, with modest 5% annual growth potential projecting a target near $45.65 within the next 30 days.The short-term price outlook leans slightly bullish if key support holds, with potential rallies targeting the $50-$55 zone.

However, persistent risks from token unlocks and whale liquidations could trigger price corrections. Analysts recommend monitoring the $46.10 support level closely and watching trading volumes to confirm any sustainable breakouts.

#6

Whale sell-offs and token vesting schedules pose risks of oversupply and price dips in the coming months. On-chain fundamentals and platform fee growth are positive, but cautious trading sentiment prevails amid competitive pressures and market fluctuations.

Traders should watch the $46-$49 range for breakout or breakdown signals and factor in potential selling pressure from upcoming unlock events.

Key takeaways

HYPE is displaying strong short-term bullish momentum supported by key moving averages and rising staking activity, with critical support around $46 standing firm.Whale sell-offs and token vesting schedules pose risks of oversupply and price dips in the coming months. On-chain fundamentals and platform fee growth are positive, but cautious trading sentiment prevails amid competitive pressures and market fluctuations.

Traders should watch the $46-$49 range for breakout or breakdown signals and factor in potential selling pressure from upcoming unlock events.

#7