Stellar Lumens (XLM) is gaining renewed attention as a leading crypto asset focused on cross-border payments and decentralized finance. This analysis combines the latest market chart insights using five key technical indicators with up-to-date news to provide a well-rounded outlook on XLM’s price potential in 2025 and beyond. With increasing institutional interest and innovative network upgrades, the future looks promising yet volatile for this blockchain project.

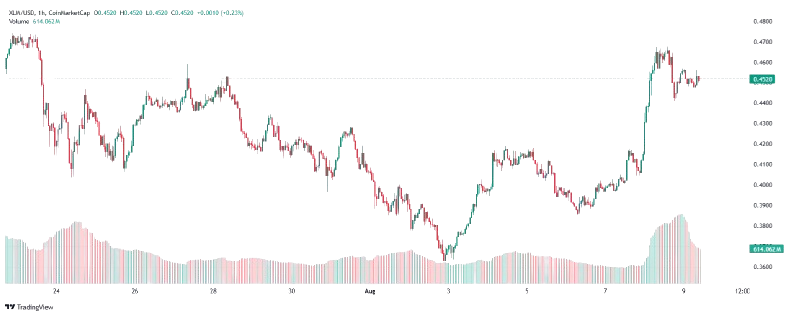

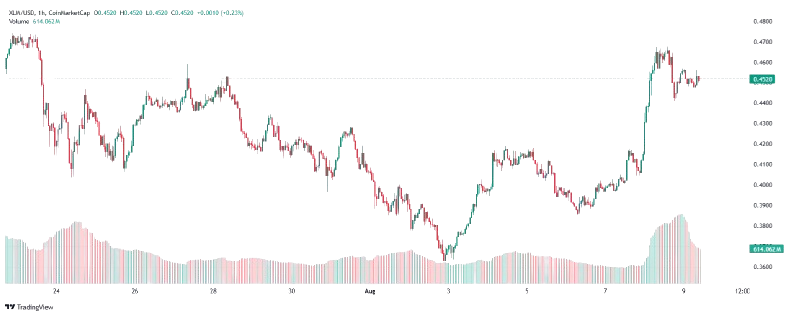

#1 As of August 2025, XLM is trading around $0.41 to $0.46, reflecting a steady rebound after recent pullbacks.

As of August 2025, XLM is trading around $0.41 to $0.46, reflecting a steady rebound after recent pullbacks.

Market sentiment has turned cautiously optimistic, supported by stronger trading volumes which surged 260% following Ripple’s favorable SEC lawsuit resolution—a factor closely watched due to Stellar’s technological ties.

The XLM ecosystem continues expanding with increased adoption in cross-border payments and decentralized applications, reinforcing its medium-term growth prospects despite crypto market turbulence.

Current Market Overview of Stellar Lumens (XLM)

As of August 2025, XLM is trading around $0.41 to $0.46, reflecting a steady rebound after recent pullbacks.

As of August 2025, XLM is trading around $0.41 to $0.46, reflecting a steady rebound after recent pullbacks. Market sentiment has turned cautiously optimistic, supported by stronger trading volumes which surged 260% following Ripple’s favorable SEC lawsuit resolution—a factor closely watched due to Stellar’s technological ties.

The XLM ecosystem continues expanding with increased adoption in cross-border payments and decentralized applications, reinforcing its medium-term growth prospects despite crypto market turbulence.

#2 Relative Strength Index (RSI): Sitting near 67, indicating rising bullish momentum but approaching an overbought level, warranting cautious optimism.

Relative Strength Index (RSI): Sitting near 67, indicating rising bullish momentum but approaching an overbought level, warranting cautious optimism.

Moving Averages (MA): The 50-day MA is above the 200-day MA, confirming a bullish trend and suggesting that XLM might continue upwards if it holds current levels.

MACD (Moving Average Convergence Divergence): Shows positive crossovers signaling strengthening momentum, reinforcing possible upward moves.

Stochastic Oscillator: %K recently crossed above %D, indicating short-term bullish momentum with increasing buying interest.

Bollinger Bands: Price currently near the upper band suggests higher volatility and potential for a short-term pullback before continuation.

Together, these indicators portray a market that is bullish but nearing key resistance points, suggesting the potential for gains balanced with caution against pullbacks.

Top 5 Technical Indicators Analysis for XLM

Relative Strength Index (RSI): Sitting near 67, indicating rising bullish momentum but approaching an overbought level, warranting cautious optimism.

Relative Strength Index (RSI): Sitting near 67, indicating rising bullish momentum but approaching an overbought level, warranting cautious optimism.Moving Averages (MA): The 50-day MA is above the 200-day MA, confirming a bullish trend and suggesting that XLM might continue upwards if it holds current levels.

MACD (Moving Average Convergence Divergence): Shows positive crossovers signaling strengthening momentum, reinforcing possible upward moves.

Stochastic Oscillator: %K recently crossed above %D, indicating short-term bullish momentum with increasing buying interest.

Bollinger Bands: Price currently near the upper band suggests higher volatility and potential for a short-term pullback before continuation.

Together, these indicators portray a market that is bullish but nearing key resistance points, suggesting the potential for gains balanced with caution against pullbacks.

#3 Stellar’s growing prominence in cross-border payments continues to attract institutional investors.

Stellar’s growing prominence in cross-border payments continues to attract institutional investors.

The recent resolution of the Ripple SEC case positively impacted market perception toward XLM, especially given the shared foundational codebases.

Stellar Labs is pushing network upgrades to improve transaction speed and scalability, enhancing DeFi and NFT usability. Partnerships with payment processors and Fortune 500 companies are expanding, deepening real-world adoption. These developments combined are key drivers behind the trading volume surge and rising price.

Recent News and Developments Driving Stellar Lumens

Stellar’s growing prominence in cross-border payments continues to attract institutional investors.

Stellar’s growing prominence in cross-border payments continues to attract institutional investors. The recent resolution of the Ripple SEC case positively impacted market perception toward XLM, especially given the shared foundational codebases.

Stellar Labs is pushing network upgrades to improve transaction speed and scalability, enhancing DeFi and NFT usability. Partnerships with payment processors and Fortune 500 companies are expanding, deepening real-world adoption. These developments combined are key drivers behind the trading volume surge and rising price.

#4 XLM’s price currently consolidates between support near $0.40 and resistance around $0.47. Technical patterns suggest a bullish cup-and-handle formation is in play, which historically signals upward breakout potential. Key Fibonacci support holds around $0.375, vital for sustaining momentum.

XLM’s price currently consolidates between support near $0.40 and resistance around $0.47. Technical patterns suggest a bullish cup-and-handle formation is in play, which historically signals upward breakout potential. Key Fibonacci support holds around $0.375, vital for sustaining momentum.

Predictions for 2025 place XLM’s price within a range of $0.22 to $0.87, with upside targets toward $1.29 if bullish sentiment sustains. Longer-term forecasts envision XLM possibly reaching $2.5 by 2030, driven by continued network adoption and expanding use cases in decentralized financial ecosystems.

Market Chart Analysis & Price Predictions

XLM’s price currently consolidates between support near $0.40 and resistance around $0.47. Technical patterns suggest a bullish cup-and-handle formation is in play, which historically signals upward breakout potential. Key Fibonacci support holds around $0.375, vital for sustaining momentum.

XLM’s price currently consolidates between support near $0.40 and resistance around $0.47. Technical patterns suggest a bullish cup-and-handle formation is in play, which historically signals upward breakout potential. Key Fibonacci support holds around $0.375, vital for sustaining momentum. Predictions for 2025 place XLM’s price within a range of $0.22 to $0.87, with upside targets toward $1.29 if bullish sentiment sustains. Longer-term forecasts envision XLM possibly reaching $2.5 by 2030, driven by continued network adoption and expanding use cases in decentralized financial ecosystems.

#5

Risks and Market Sentiment

Despite favorable technicals and news, XLM remains subject to crypto market volatility including macroeconomic risks and regulatory uncertainties outside of Ripple-related factors. A breakdown below $0.40 would undermine bullish momentum and potentially lead to deeper consolidation. Competition from emerging blockchain solutions and evolving payment technologies pose long-term challenges. Thus, investors should maintain vigilance and apply risk management when trading XLM.

#6

Strong volume increases backed by Ripple legal clarity boost market confidence.

Network upgrades and institutional partnerships underpin fundamental growth.

Price consolidates between $0.40 and $0.47 with breakout potential toward $1.29 in 2025.

Risks include market pullbacks, regulatory shifts, and competitive blockchain advancements.

Long-term outlook is positive, with projections toward $2.5 by 2030 reflecting expanding real-world adoption.

Key takeaways

Stellar Lumens shows bullish technical signals with RSI near 67 and positive moving average crossovers.Strong volume increases backed by Ripple legal clarity boost market confidence.

Network upgrades and institutional partnerships underpin fundamental growth.

Price consolidates between $0.40 and $0.47 with breakout potential toward $1.29 in 2025.

Risks include market pullbacks, regulatory shifts, and competitive blockchain advancements.

Long-term outlook is positive, with projections toward $2.5 by 2030 reflecting expanding real-world adoption.

#7

What are key support and resistance levels? Support near $0.40; resistance around $0.47.

Can XLM reach $1 in 2025? It’s possible with sustained bullish momentum and adoption.

Is XLM affected by Ripple’s SEC case? Yes, Ripple’s legal clarity positively impacts investor confidence in XLM.

Is XLM a good investment now? It offers potential for gains but carries typical crypto risks, so risk tolerance is important.

Frequently Asked Questions (FAQ)

What is the current price of XLM? Around $0.41 to $0.46 as of August 2025.What are key support and resistance levels? Support near $0.40; resistance around $0.47.

Can XLM reach $1 in 2025? It’s possible with sustained bullish momentum and adoption.

Is XLM affected by Ripple’s SEC case? Yes, Ripple’s legal clarity positively impacts investor confidence in XLM.

Is XLM a good investment now? It offers potential for gains but carries typical crypto risks, so risk tolerance is important.

Reactions

Reactions

1