Polygon continues to be a major player in the blockchain space as an Ethereum Layer-2 scaling solution that addresses Ethereum’s high fees and slow transaction speeds. This article combines a technical analysis using five key indicators with recent news and ecosystem updates to provide a balanced outlook on Polygon’s price potential and market position in 2025 and beyond.

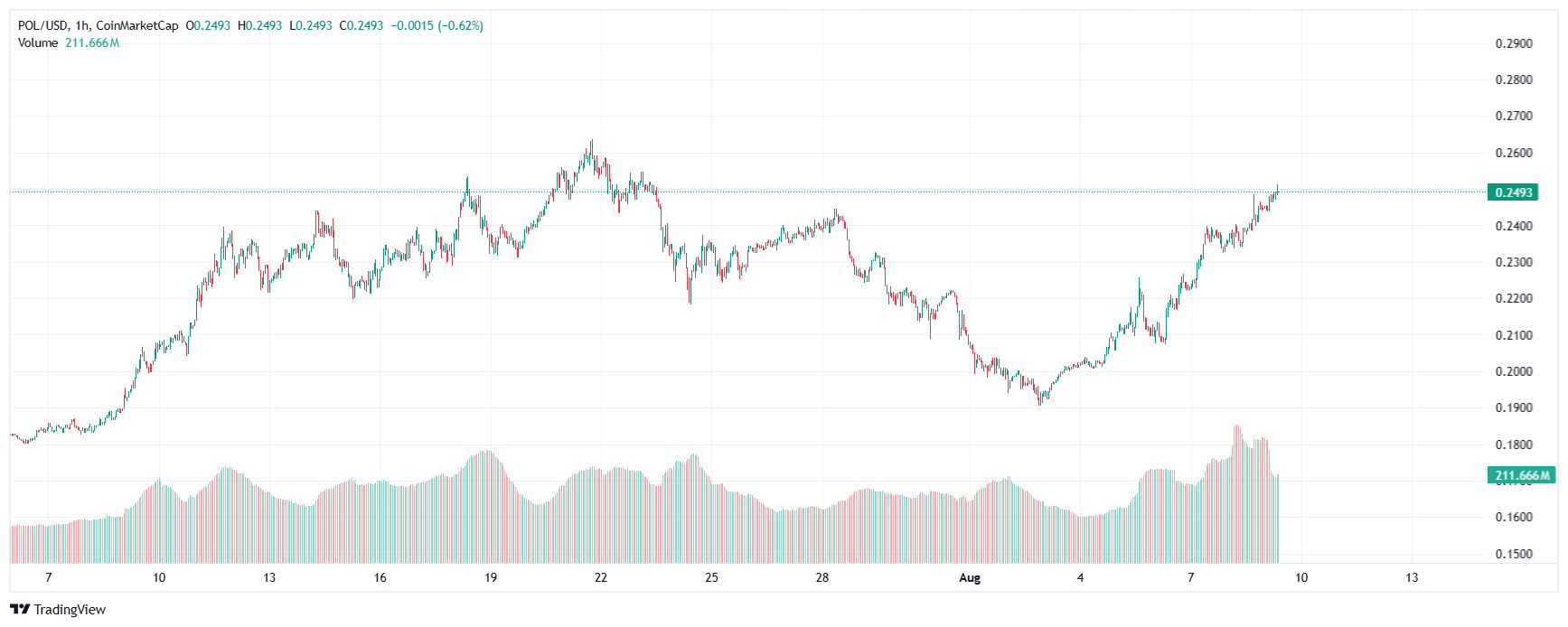

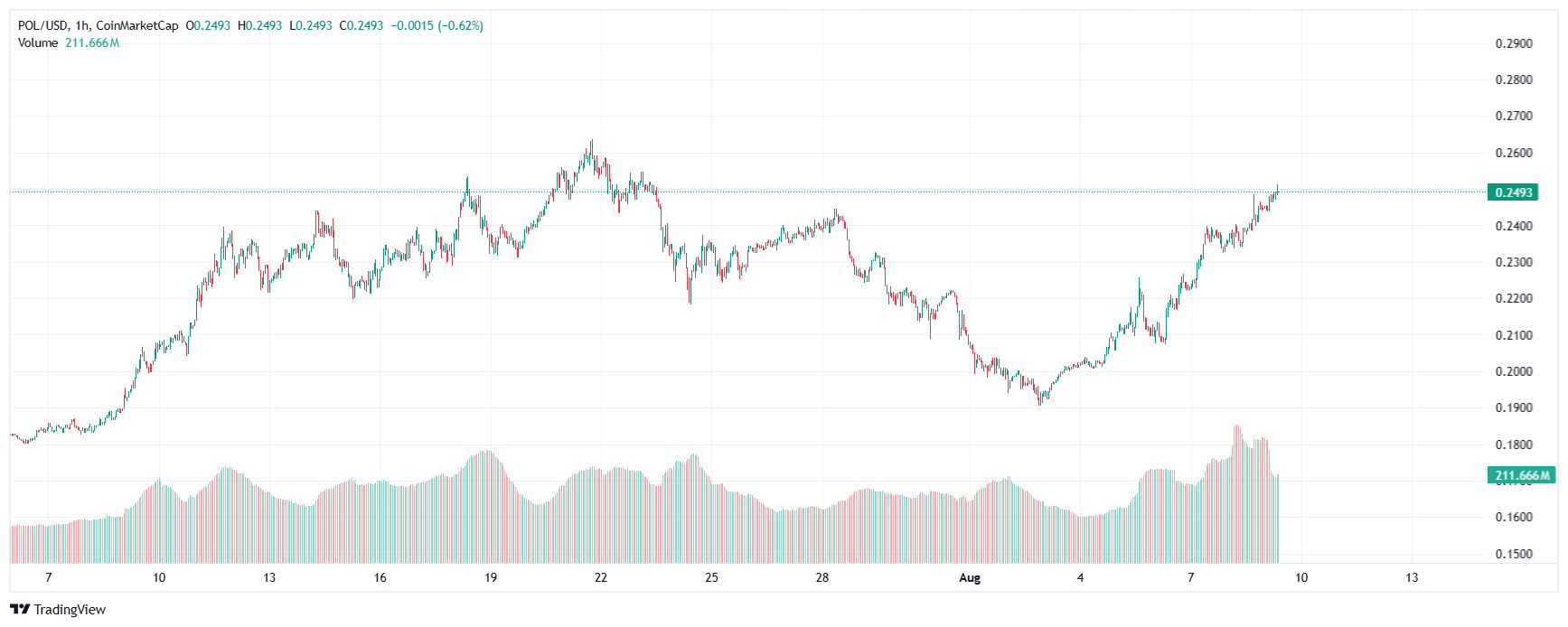

#1 As of early August 2025, Polygon is trading near $0.23 with a market cap around $437 million.

As of early August 2025, Polygon is trading near $0.23 with a market cap around $437 million.

Trading volumes remain moderate as investors digest recent technological upgrades and pending token migration plans.

Despite recent price declines—over 30% in the last month—Polygon holds a crucial position as one of the leading Ethereum scaling solutions, with over 400 decentralized applications powered by its network.

The ecosystem’s health and adoption underpin its medium to long-term growth prospects.

Current Market Overview of Polygon (MATIC)

As of early August 2025, Polygon is trading near $0.23 with a market cap around $437 million.

As of early August 2025, Polygon is trading near $0.23 with a market cap around $437 million. Trading volumes remain moderate as investors digest recent technological upgrades and pending token migration plans.

Despite recent price declines—over 30% in the last month—Polygon holds a crucial position as one of the leading Ethereum scaling solutions, with over 400 decentralized applications powered by its network.

The ecosystem’s health and adoption underpin its medium to long-term growth prospects.

#2 Examining Polygon’s chart using key indicators:

Examining Polygon’s chart using key indicators:

Relative Strength Index (RSI): Currently at 38, signaling oversold conditions that often precede rebounds.

Moving Averages: Price trades below short-term simple moving averages (SMA 7 and SMA 20), indicating short-term bearish momentum, but potential mean reversion exists.

MACD: Shows bearish momentum but histogram values suggest selling pressure easing.

Stochastic Oscillator: %K at 25.19 and %D at 19.74, supporting oversold status and possible short-term bounce.

Bollinger Bands: Polygon is significantly below the lower band, reinforcing extreme oversold sentiment and technical setup for a potential rally.

This combination suggests Polygon’s price may be poised for a rebound or consolidation ahead of the highly anticipated token migration.

Top 5 Technical Indicators Analysis for Polygon

Examining Polygon’s chart using key indicators:

Examining Polygon’s chart using key indicators:Relative Strength Index (RSI): Currently at 38, signaling oversold conditions that often precede rebounds.

Moving Averages: Price trades below short-term simple moving averages (SMA 7 and SMA 20), indicating short-term bearish momentum, but potential mean reversion exists.

MACD: Shows bearish momentum but histogram values suggest selling pressure easing.

Stochastic Oscillator: %K at 25.19 and %D at 19.74, supporting oversold status and possible short-term bounce.

Bollinger Bands: Polygon is significantly below the lower band, reinforcing extreme oversold sentiment and technical setup for a potential rally.

This combination suggests Polygon’s price may be poised for a rebound or consolidation ahead of the highly anticipated token migration.

#3 Polygon Labs announced a major protocol upgrade in early August 2025 aimed at improving transaction finality times to about 5 seconds, boosting network efficiency for DeFi, NFT, and gaming projects.

Polygon Labs announced a major protocol upgrade in early August 2025 aimed at improving transaction finality times to about 5 seconds, boosting network efficiency for DeFi, NFT, and gaming projects.

Major exchanges like Coinbase and Binance fully support the upcoming MATIC to POL token migration scheduled for late August 2025, reducing uncertainty for holders.

Additionally, the total value locked (TVL) in the Polygon network remains strong at $2.4 billion, ranking it second among Ethereum Layer-2 solutions, behind only Mantle.

These factors contribute to steady interest and growing confidence among investors and developers.

Recent News and Developments Driving Polygon

Polygon Labs announced a major protocol upgrade in early August 2025 aimed at improving transaction finality times to about 5 seconds, boosting network efficiency for DeFi, NFT, and gaming projects.

Polygon Labs announced a major protocol upgrade in early August 2025 aimed at improving transaction finality times to about 5 seconds, boosting network efficiency for DeFi, NFT, and gaming projects.Major exchanges like Coinbase and Binance fully support the upcoming MATIC to POL token migration scheduled for late August 2025, reducing uncertainty for holders.

Additionally, the total value locked (TVL) in the Polygon network remains strong at $2.4 billion, ranking it second among Ethereum Layer-2 solutions, behind only Mantle.

These factors contribute to steady interest and growing confidence among investors and developers.

#4

Short-term resistance is near $0.25, with key support around $0.21. Analysts forecast the price will range between $0.22 and $0.25 over the next few weeks, with a slight bullish bias if technical momentum improves post migration.

Longer-term price predictions vary, with optimistic scenarios suggesting $0.50–$0.78 by the end of 2025, driven by ecosystem expansion and synergy with Ethereum upgrades.

However, competition from other layer-2 solutions and Ethereum 2.0 progress poses risks to Polygon’s dominance.

Market Chart Predictions and Price Outlook

Polygon’s price is currently in a consolidation phase after recent losses.Short-term resistance is near $0.25, with key support around $0.21. Analysts forecast the price will range between $0.22 and $0.25 over the next few weeks, with a slight bullish bias if technical momentum improves post migration.

Longer-term price predictions vary, with optimistic scenarios suggesting $0.50–$0.78 by the end of 2025, driven by ecosystem expansion and synergy with Ethereum upgrades.

However, competition from other layer-2 solutions and Ethereum 2.0 progress poses risks to Polygon’s dominance.

#5

A drop below $0.21 could signal further downside pressure. Uncertainties surrounding Ethereum’s roadmap and competitor platforms like Arbitrum and Optimism could affect demand for Polygon.

Additionally, crypto’s inherent volatility requires investors to monitor technical signals closely and stay informed about ongoing ecosystem developments.

Risks and Market Sentiment

Despite the promising technology and network upgrades, Polygon’s price remains vulnerable to overall market conditions and investor sentiment.A drop below $0.21 could signal further downside pressure. Uncertainties surrounding Ethereum’s roadmap and competitor platforms like Arbitrum and Optimism could affect demand for Polygon.

Additionally, crypto’s inherent volatility requires investors to monitor technical signals closely and stay informed about ongoing ecosystem developments.

#6

Technical indicators show current oversold conditions and potential for a short-term price rebound.

Major exchange support for the MATIC to POL token migration reduces uncertainty and supports confidence.

Recent protocol upgrades enhance network scalability and efficiency.

Price expected to consolidate near $0.22–$0.25, with potential upside if momentum strengthens.

Risks include competitive pressures, Ethereum upgrade impacts, and general market volatility.

Key takeaways

Polygon remains a cornerstone Ethereum scaling platform with significant ecosystem adoption.Technical indicators show current oversold conditions and potential for a short-term price rebound.

Major exchange support for the MATIC to POL token migration reduces uncertainty and supports confidence.

Recent protocol upgrades enhance network scalability and efficiency.

Price expected to consolidate near $0.22–$0.25, with potential upside if momentum strengthens.

Risks include competitive pressures, Ethereum upgrade impacts, and general market volatility.

#7

-What are key support and resistance levels? Support near $0.21; resistance around $0.25.

-When is the MATIC to POL migration? Scheduled for late August 2025.

-Can Polygon’s price reach $1 soon? Unlikely in the short term given market dynamics and competition.

-Is Polygon a good investment? Suitable for investors with moderate risk tolerance looking for exposure to Ethereum scaling technologies.

Frequently Asked Questions (FAQ)

-What is Polygon’s current price? Around $0.23 as of early August 2025.-What are key support and resistance levels? Support near $0.21; resistance around $0.25.

-When is the MATIC to POL migration? Scheduled for late August 2025.

-Can Polygon’s price reach $1 soon? Unlikely in the short term given market dynamics and competition.

-Is Polygon a good investment? Suitable for investors with moderate risk tolerance looking for exposure to Ethereum scaling technologies.

#8

While technical and fundamental factors signal opportunity, investors should remain cautious and watch for confirmation of bullish momentum post-migration.

As Ethereum and its ecosystem evolve, Polygon’s ability to maintain its competitive edge will be key to sustained growth.

Your Next Step with Polygon

Polygon stands at a critical juncture with major network upgrades and token migration underway.While technical and fundamental factors signal opportunity, investors should remain cautious and watch for confirmation of bullish momentum post-migration.

As Ethereum and its ecosystem evolve, Polygon’s ability to maintain its competitive edge will be key to sustained growth.

#9

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human changed and reedited.Reactions

Reactions

3