This article provides a detailed analysis of Fantom (FTM), a fast-growing crypto blockchain platform. It covers recent market data, key technical indicators, price predictions for 2025 and beyond, and significant news about Fantom’s upgrades and ecosystem. The analysis blends 50% market insights with 50% news to give a rounded picture for investors and enthusiasts.

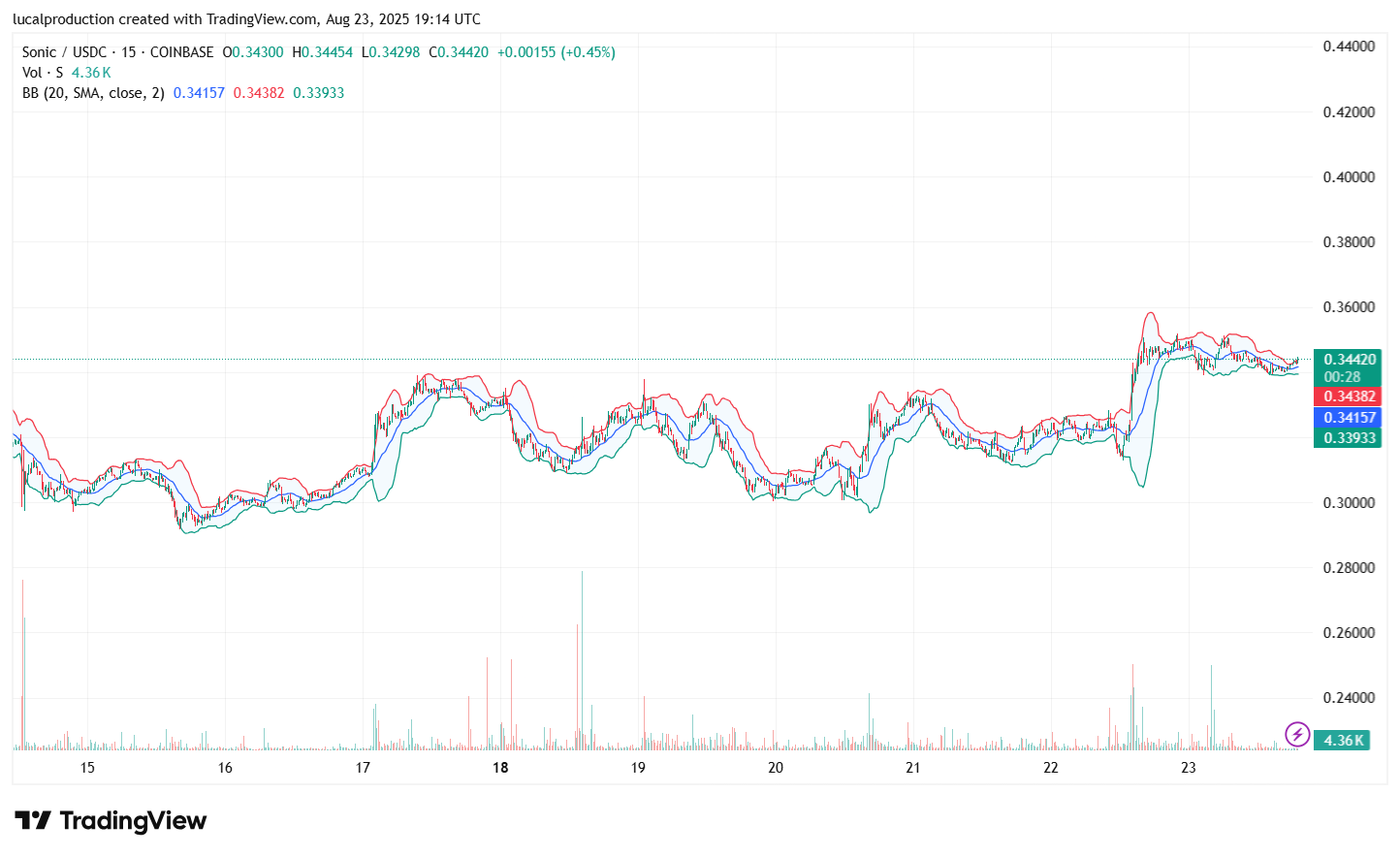

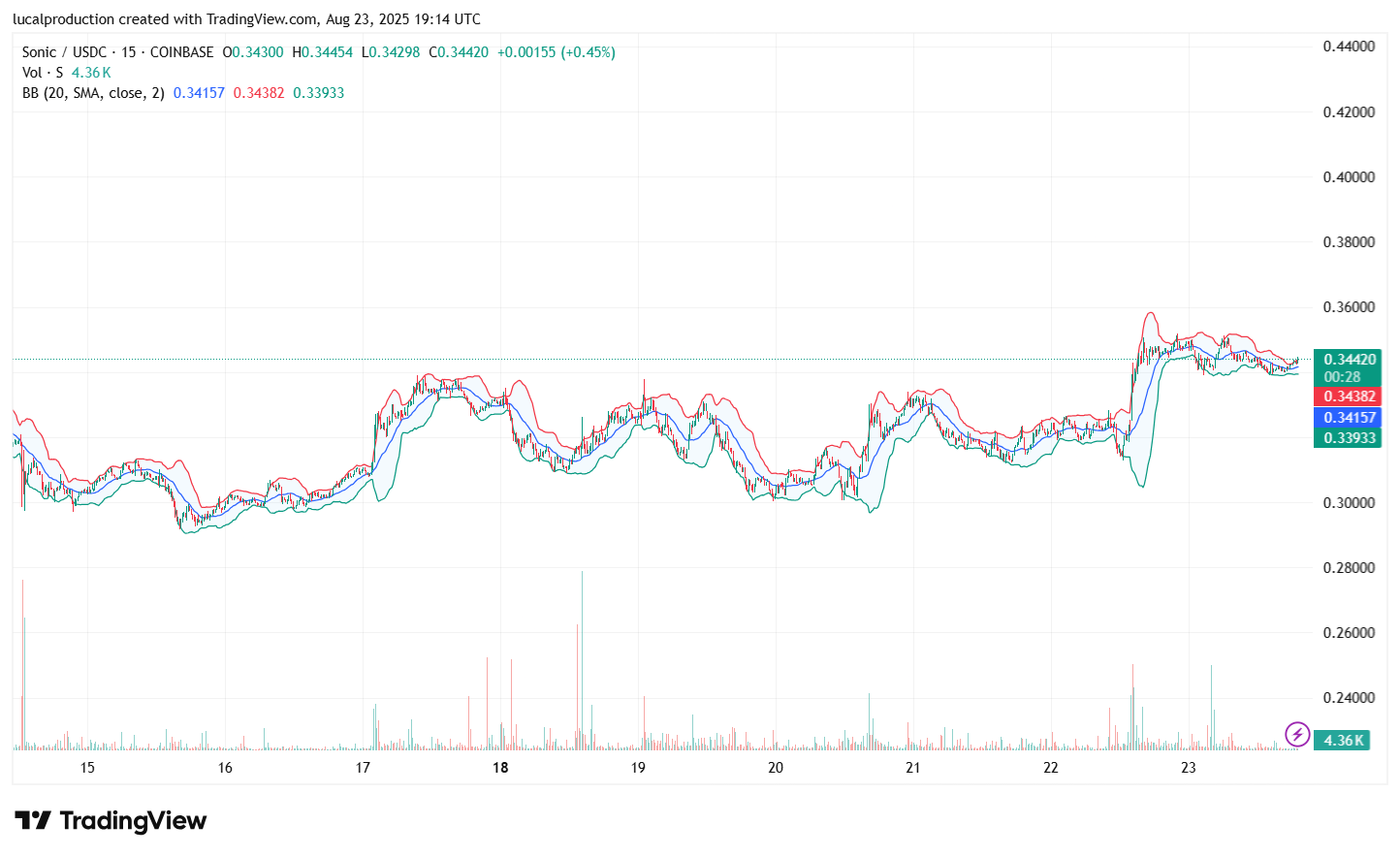

#1 As of late August 2025, Fantom (FTM) trades around $0.33, showing some recovery with a 3% increase in the last 24 hours but down roughly 11% compared to a week ago. Market cap stands near $959 million with a circulating supply close to 2.88 billion FTM tokens.

As of late August 2025, Fantom (FTM) trades around $0.33, showing some recovery with a 3% increase in the last 24 hours but down roughly 11% compared to a week ago. Market cap stands near $959 million with a circulating supply close to 2.88 billion FTM tokens.

Trading volumes show typical crypto volatility, with daily volumes around $94 million.

Fantom holds a low market dominance, reflecting a competitive DeFi landscape.

Current Market Overview

As of late August 2025, Fantom (FTM) trades around $0.33, showing some recovery with a 3% increase in the last 24 hours but down roughly 11% compared to a week ago. Market cap stands near $959 million with a circulating supply close to 2.88 billion FTM tokens.

As of late August 2025, Fantom (FTM) trades around $0.33, showing some recovery with a 3% increase in the last 24 hours but down roughly 11% compared to a week ago. Market cap stands near $959 million with a circulating supply close to 2.88 billion FTM tokens. Trading volumes show typical crypto volatility, with daily volumes around $94 million.

Fantom holds a low market dominance, reflecting a competitive DeFi landscape.

#2 Fantom is riding positive waves thanks to its "Sonic" upgrade, targeting higher scalability and transaction speeds. This update strengthens Fantom’s position among DeFi platforms by improving efficiency and attracting more developers.

Fantom is riding positive waves thanks to its "Sonic" upgrade, targeting higher scalability and transaction speeds. This update strengthens Fantom’s position among DeFi platforms by improving efficiency and attracting more developers.

Additionally, Fantom recently launched a bridge to Ethereum, boosting its total value locked (TVL) in DeFi by 18%. These technological enhancements have helped Fantom remain relevant amid fierce competition.

However, macroeconomic uncertainties and regulatory changes still loom as potential hurdles.

Key News Impacting Fantom

Fantom is riding positive waves thanks to its "Sonic" upgrade, targeting higher scalability and transaction speeds. This update strengthens Fantom’s position among DeFi platforms by improving efficiency and attracting more developers.

Fantom is riding positive waves thanks to its "Sonic" upgrade, targeting higher scalability and transaction speeds. This update strengthens Fantom’s position among DeFi platforms by improving efficiency and attracting more developers.Additionally, Fantom recently launched a bridge to Ethereum, boosting its total value locked (TVL) in DeFi by 18%. These technological enhancements have helped Fantom remain relevant amid fierce competition.

However, macroeconomic uncertainties and regulatory changes still loom as potential hurdles.

#3 Five primary technical indicators shape Fantom’s current outlook:

Five primary technical indicators shape Fantom’s current outlook:

Relative Strength Index (RSI) at 53.15 signals a neutral market stance, neither oversold nor overbought.

Moving Average Convergence Divergence (MACD) slightly below zero shows mild bearish pressure but close to a buy signal.

Average Directional Index (ADX) at 11.8 indicates a weak to moderate buy trend developing.

Commodity Channel Index (CCI) around 62 suggests neutral momentum.

Rate of Change (ROC) at nearly 7 points to recent positive price momentum.

Together, these indicators suggest a cautious but potentially positive market mood, balancing optimism with uncertainty.

Technical Analysis Using Top 5 Indicators

Five primary technical indicators shape Fantom’s current outlook:

Five primary technical indicators shape Fantom’s current outlook:Relative Strength Index (RSI) at 53.15 signals a neutral market stance, neither oversold nor overbought.

Moving Average Convergence Divergence (MACD) slightly below zero shows mild bearish pressure but close to a buy signal.

Average Directional Index (ADX) at 11.8 indicates a weak to moderate buy trend developing.

Commodity Channel Index (CCI) around 62 suggests neutral momentum.

Rate of Change (ROC) at nearly 7 points to recent positive price momentum.

Together, these indicators suggest a cautious but potentially positive market mood, balancing optimism with uncertainty.

#4

Longer-term forecasts envision Fantom reaching $1.00+ by 2050, though short-term volatility and regulatory risks remain.

Overall, the market is cautiously optimistic but aware of crypto market unpredictability.

Price Predictions and Market Sentiment for 2025

Analysts forecast mixed outcomes for Fantom’s price across 2025. Some models suggest Fantom could hold steady around $0.33 to $0.40 levels through 2025, while more optimistic projections see potential spikes up to $1.40 or beyond—mainly if upgrades and adoption accelerate.Longer-term forecasts envision Fantom reaching $1.00+ by 2050, though short-term volatility and regulatory risks remain.

Overall, the market is cautiously optimistic but aware of crypto market unpredictability.

#5

Its Directed Acyclic Graph (DAG) technology differentiates it from traditional blockchains and boosts its appeal for DeFi dApps needing speed and low fees.

Compatibility with Ethereum’s ecosystem adds to its versatility, making migration easier for developers and expanding its use cases.

Fantom’s Unique Blockchain Edge

Fantom stands out with its Lachesis consensus mechanism, an asynchronous Byzantine fault-tolerant (aBFT) protocol that allows ultra-fast transaction finality.Its Directed Acyclic Graph (DAG) technology differentiates it from traditional blockchains and boosts its appeal for DeFi dApps needing speed and low fees.

Compatibility with Ethereum’s ecosystem adds to its versatility, making migration easier for developers and expanding its use cases.

#6

The Fear & Greed Index leans toward optimism but technical trends suggest a wait-and-see attitude.

External factors like stricter regulations or broader crypto market downturns could dampen growth. Investors must weigh Fantom’s technological promise against these inherent crypto risks.

Challenges and Risks Facing Fantom

Despite strengths, Fantom faces some challenges: market sentiment is volatile with swings between greed and caution.The Fear & Greed Index leans toward optimism but technical trends suggest a wait-and-see attitude.

External factors like stricter regulations or broader crypto market downturns could dampen growth. Investors must weigh Fantom’s technological promise against these inherent crypto risks.

#7

Price sits near $0.33 with neutral to cautiously positive indicators from RSI, MACD, ADX, CCI, and ROC.

Predictions for 2025 range from stable pricing to potential significant gains if market conditions and upgrades align.

Regulatory uncertainty and crypto market volatility remain risks.

Fantom’s Lachesis consensus and DAG tech provide a competitive edge for fast, low-cost transactions.

Key Takeaways

Fantom’s Sonic upgrade and Ethereum bridge boost its DeFi credentials and user adoption.Price sits near $0.33 with neutral to cautiously positive indicators from RSI, MACD, ADX, CCI, and ROC.

Predictions for 2025 range from stable pricing to potential significant gains if market conditions and upgrades align.

Regulatory uncertainty and crypto market volatility remain risks.

Fantom’s Lachesis consensus and DAG tech provide a competitive edge for fast, low-cost transactions.

#8