Dogecoin (DOGE) is capturing renewed attention in August 2025. Despite recent volatility and market dips, strong whale accumulation, technical rebound signals, and growing adoption are setting the stage for a potential new bull cycle. This article combines a market chart analysis using five top indicators with the latest news on Dogecoin’s growing user base, institutional interest, and price predictions. The balance of technicals and fresh fundamentals suggests a turning point for DOGE investors.

#1 Dogecoin traded near $0.21-$0.22 after bouncing back from a low of $0.21, recovering about 5% on increased volume. DOGE faced selling pressure dropping from roughly $0.23 but is defending key support around $0.21. Heavy institutional purchases totaling over 2 billion DOGE recently have tightened supply. Macro headwinds linked to inflation data have spiked volatility, but whales are stacking coins, indicating strong investor confidence despite short-term dips.

Dogecoin traded near $0.21-$0.22 after bouncing back from a low of $0.21, recovering about 5% on increased volume. DOGE faced selling pressure dropping from roughly $0.23 but is defending key support around $0.21. Heavy institutional purchases totaling over 2 billion DOGE recently have tightened supply. Macro headwinds linked to inflation data have spiked volatility, but whales are stacking coins, indicating strong investor confidence despite short-term dips.

Dogecoin’s Current Market Standing

Dogecoin traded near $0.21-$0.22 after bouncing back from a low of $0.21, recovering about 5% on increased volume. DOGE faced selling pressure dropping from roughly $0.23 but is defending key support around $0.21. Heavy institutional purchases totaling over 2 billion DOGE recently have tightened supply. Macro headwinds linked to inflation data have spiked volatility, but whales are stacking coins, indicating strong investor confidence despite short-term dips.

Dogecoin traded near $0.21-$0.22 after bouncing back from a low of $0.21, recovering about 5% on increased volume. DOGE faced selling pressure dropping from roughly $0.23 but is defending key support around $0.21. Heavy institutional purchases totaling over 2 billion DOGE recently have tightened supply. Macro headwinds linked to inflation data have spiked volatility, but whales are stacking coins, indicating strong investor confidence despite short-term dips.

#2 Examining DOGE’s price chart with technical tools reveals mixed but hopeful signs:

Examining DOGE’s price chart with technical tools reveals mixed but hopeful signs:

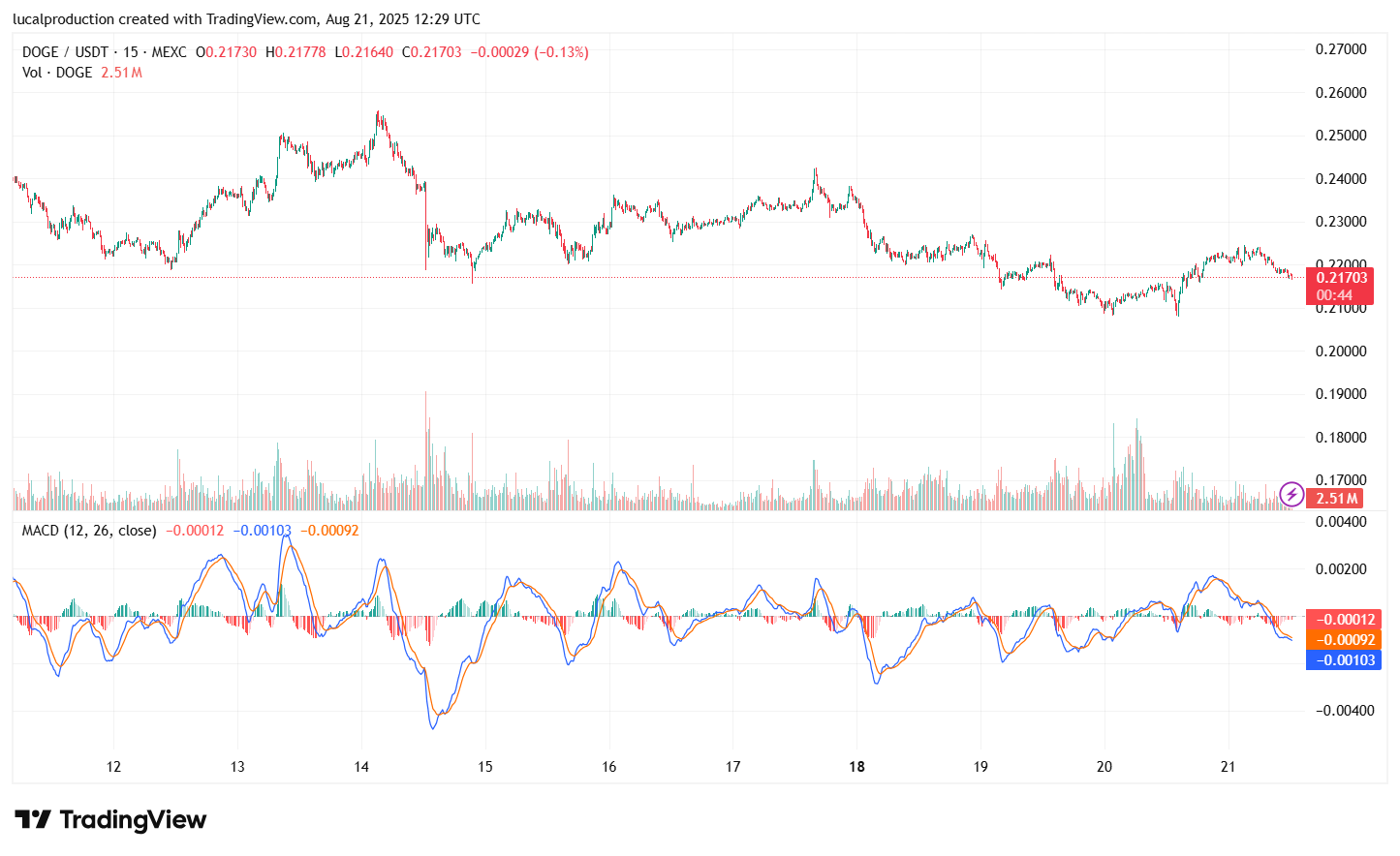

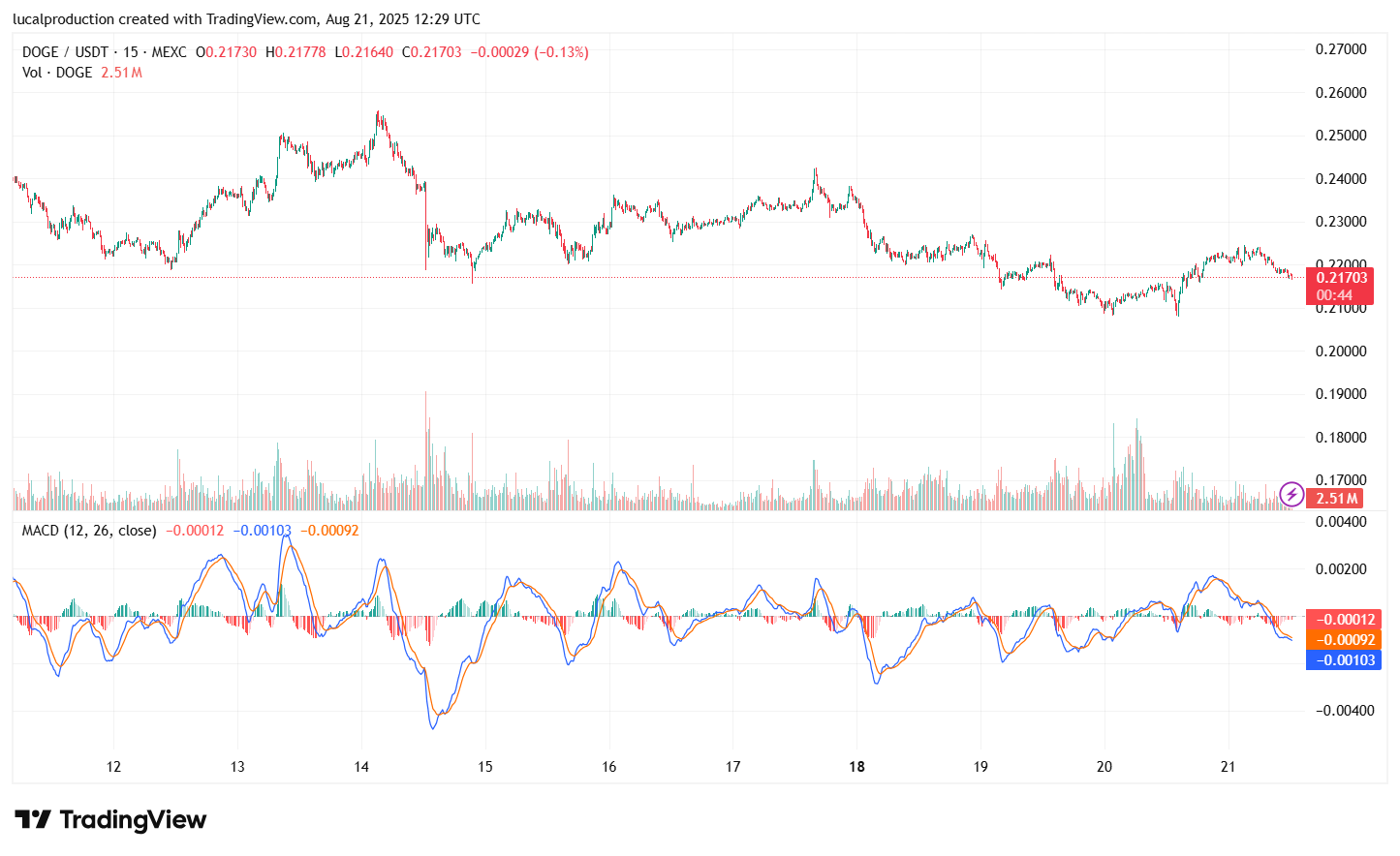

Moving Average Convergence Divergence (MACD): After recent bearish pressure, the MACD shows hints of bullish crossover, signaling momentum may shift upward.

Relative Strength Index (RSI): At a moderate 55, RSI shows neither overbought nor oversold conditions, suggesting room to grow.

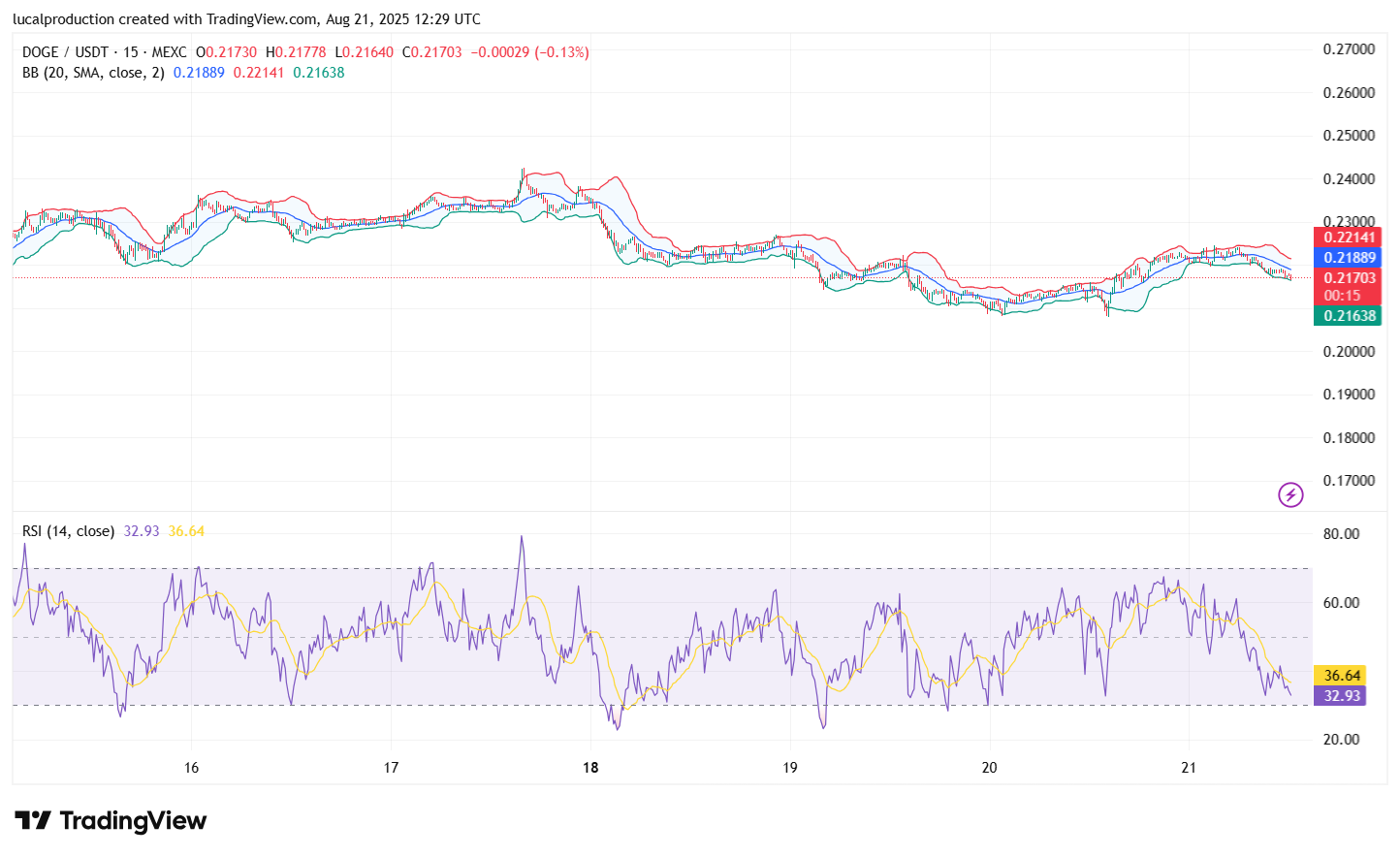

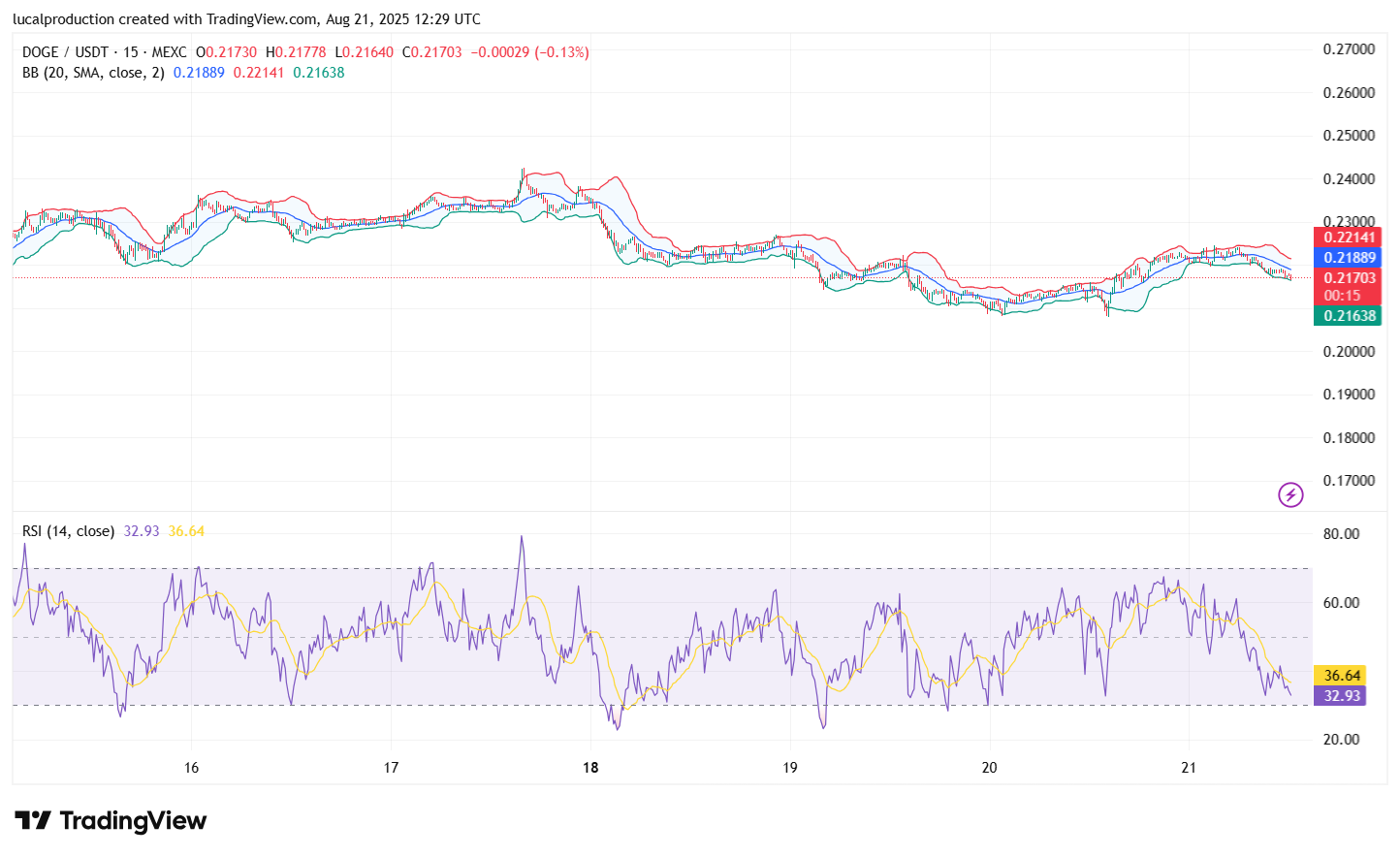

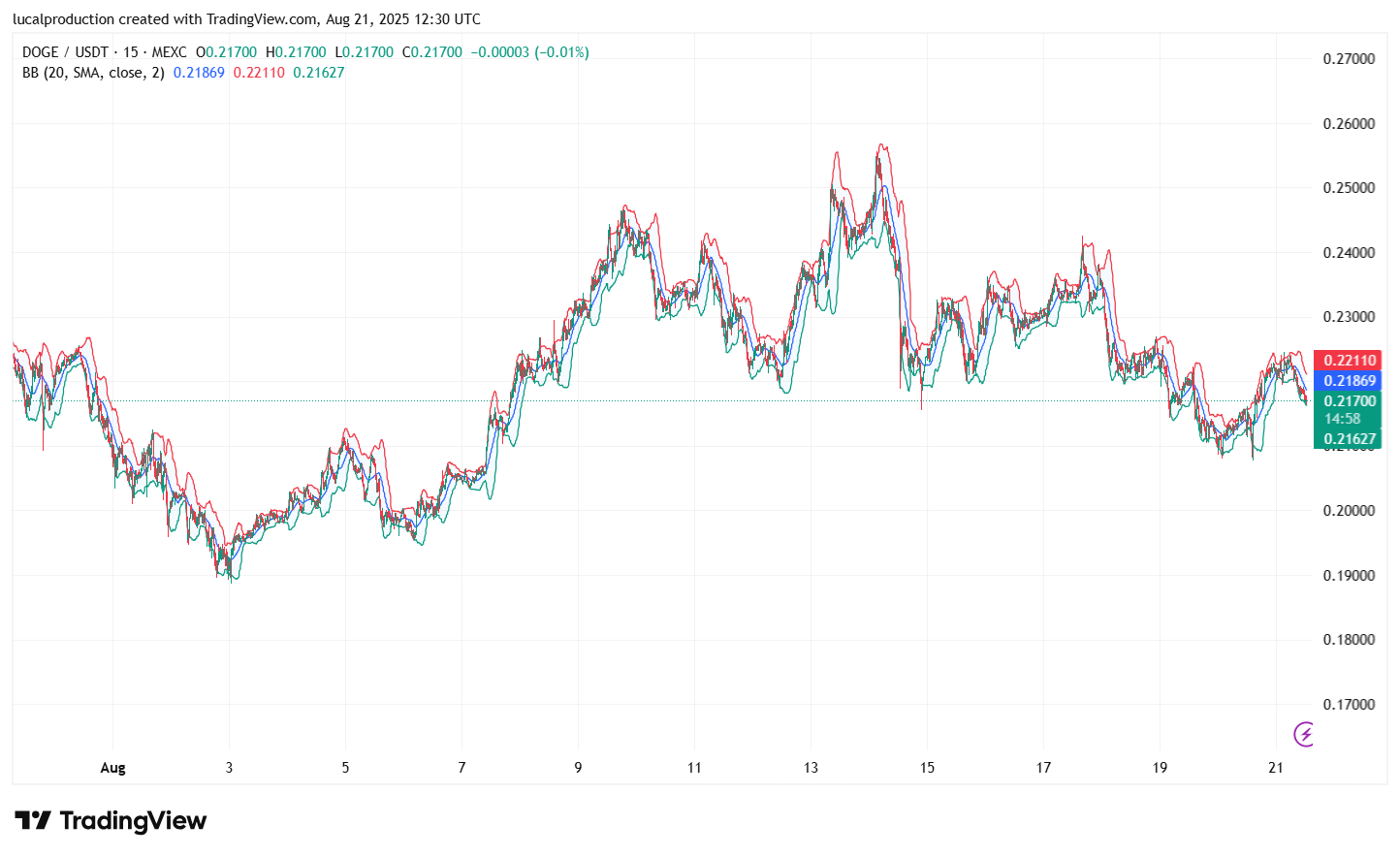

Support and Resistance Levels: Critical support has held near $0.21, while resistance forms between $0.24 and $0.26. Breaching resistance would signal strong upward momentum.

Volume: Volume surges observed during rebounds reflect buyers stepping in, especially large investors accumulating during dips.

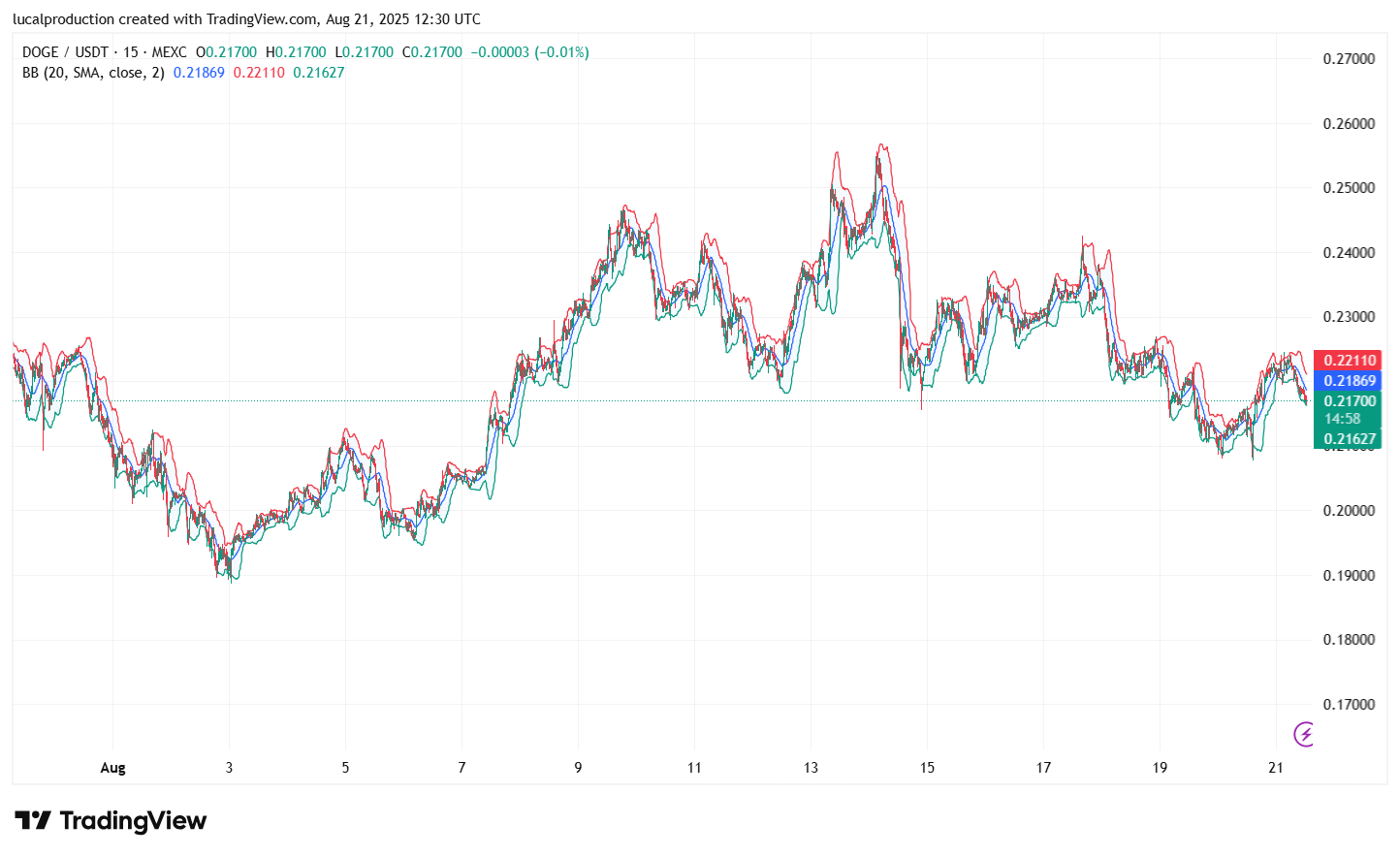

Bollinger Bands: Price bounce off lower bands to midpoint supports suggests a potential stabilization phase, but bands remain wide showing volatility.

These indicators emphasize a likely short-term consolidation with potential for breakout if volume and momentum increase.

Five Key Indicators Decoding Dogecoin’s Trend

Examining DOGE’s price chart with technical tools reveals mixed but hopeful signs:

Examining DOGE’s price chart with technical tools reveals mixed but hopeful signs:Moving Average Convergence Divergence (MACD): After recent bearish pressure, the MACD shows hints of bullish crossover, signaling momentum may shift upward.

Relative Strength Index (RSI): At a moderate 55, RSI shows neither overbought nor oversold conditions, suggesting room to grow.

Support and Resistance Levels: Critical support has held near $0.21, while resistance forms between $0.24 and $0.26. Breaching resistance would signal strong upward momentum.

Volume: Volume surges observed during rebounds reflect buyers stepping in, especially large investors accumulating during dips.

Bollinger Bands: Price bounce off lower bands to midpoint supports suggests a potential stabilization phase, but bands remain wide showing volatility.

These indicators emphasize a likely short-term consolidation with potential for breakout if volume and momentum increase.

#3 Dogecoin’s fundamentals strengthen:

Dogecoin’s fundamentals strengthen:

Dogecoin holders topped 8 million in August 2025, a milestone reached in under eight months, faster than last year.

Institutional accumulation remains strong, with whales amassing over 680 million DOGE this month despite market fears over potential network attacks.

The community shows growing confidence despite volatile price swings, fueled by meme coin appeal evolving into broader adoption.

Regulatory clarity and the potential approval of Dogecoin ETFs could further boost institutional demand and liquidity.

New meme coin projects inspired by Dogecoin, like Maxi Doge ($MAXI), offer innovative models with staking and zero-fee trading signaling a maturing meme coin landscape.

Blockchain and Community News Supporting DOGE

Dogecoin’s fundamentals strengthen:

Dogecoin’s fundamentals strengthen:Dogecoin holders topped 8 million in August 2025, a milestone reached in under eight months, faster than last year.

Institutional accumulation remains strong, with whales amassing over 680 million DOGE this month despite market fears over potential network attacks.

The community shows growing confidence despite volatile price swings, fueled by meme coin appeal evolving into broader adoption.

Regulatory clarity and the potential approval of Dogecoin ETFs could further boost institutional demand and liquidity.

New meme coin projects inspired by Dogecoin, like Maxi Doge ($MAXI), offer innovative models with staking and zero-fee trading signaling a maturing meme coin landscape.

#4

Short-term price range expected between $0.21 and $0.25 through September 2025, with possible spikes to $0.28 in strong rallies.

Longer-term predictions see DOGE reaching upwards of $1.00 by the end of 2025 under favorable market and regulatory conditions.

Some caution remains due to token distribution concentration among whales, which may cause price swings on large sell-offs.

Predictions suggest a layered growth outlook, with ROI potentials reaching over 400% in 2025 if momentum holds.

Price Predictions for Dogecoin

Experts forecast varied but overall bullish scenarios:Short-term price range expected between $0.21 and $0.25 through September 2025, with possible spikes to $0.28 in strong rallies.

Longer-term predictions see DOGE reaching upwards of $1.00 by the end of 2025 under favorable market and regulatory conditions.

Some caution remains due to token distribution concentration among whales, which may cause price swings on large sell-offs.

Predictions suggest a layered growth outlook, with ROI potentials reaching over 400% in 2025 if momentum holds.

#5

Price rebounded off $0.21 support multiple times.

Key exponential moving averages (EMAs) on hourly charts are beginning to stack bullishly.

Breaking resistance near $0.24-$0.26 would confirm a new upward trend.

Strong whale interest and rising volume support stable price action.

Watch for volatility spikes due to macroeconomic factors like inflation data but overall the trend is cautiously optimistic.

Technical Analysis Summary and Outlook

Dogecoin shows resilience with short-term bullish technical patterns emerging after a period of correction.Price rebounded off $0.21 support multiple times.

Key exponential moving averages (EMAs) on hourly charts are beginning to stack bullishly.

Breaking resistance near $0.24-$0.26 would confirm a new upward trend.

Strong whale interest and rising volume support stable price action.

Watch for volatility spikes due to macroeconomic factors like inflation data but overall the trend is cautiously optimistic.

#6

Robust whale accumulation and investor confidence.

Technical indicators suggesting potential trend reversal.

Rapidly growing holder count and community engagement.

Possible ETF approvals increasing institutional access.

Analyst forecasts projecting strong medium-term growth.

Key Takeaways

Dogecoin’s future is promising thanks to:Robust whale accumulation and investor confidence.

Technical indicators suggesting potential trend reversal.

Rapidly growing holder count and community engagement.

Possible ETF approvals increasing institutional access.

Analyst forecasts projecting strong medium-term growth.

#7

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human changed and reedited.Reactions

Reactions

1