Toncoin (TON) is navigating a challenging market landscape with a current price near $2.79, showing resilience despite recent volatility and whale-driven fluctuations. The coin’s technical indicators reveal a mixed but cautiously optimistic outlook, supported by ongoing developments in the TON ecosystem that promise enhanced scalability and use cases. This article blends a technical chart analysis using the top five indicators with up-to-date news to provide a detailed view of Toncoin’s position, price prediction, and what traders should watch closely.

#1 TON is currently trading near $2.79 after experiencing a slight dip of around 1.8% over the past 24 hours. The coin has sustained a critical support level near $2.62, preventing deeper corrections amid whale-driven market swings.

TON is currently trading near $2.79 after experiencing a slight dip of around 1.8% over the past 24 hours. The coin has sustained a critical support level near $2.62, preventing deeper corrections amid whale-driven market swings.

With a market capitalization of over $7 billion and daily volume near $168 million, Toncoin remains actively traded. Recent price action reflects a consolidation phase as market participants assess incoming developments and external macroeconomic factors.

Market Overview and Current Price Action

TON is currently trading near $2.79 after experiencing a slight dip of around 1.8% over the past 24 hours. The coin has sustained a critical support level near $2.62, preventing deeper corrections amid whale-driven market swings.

TON is currently trading near $2.79 after experiencing a slight dip of around 1.8% over the past 24 hours. The coin has sustained a critical support level near $2.62, preventing deeper corrections amid whale-driven market swings.With a market capitalization of over $7 billion and daily volume near $168 million, Toncoin remains actively traded. Recent price action reflects a consolidation phase as market participants assess incoming developments and external macroeconomic factors.

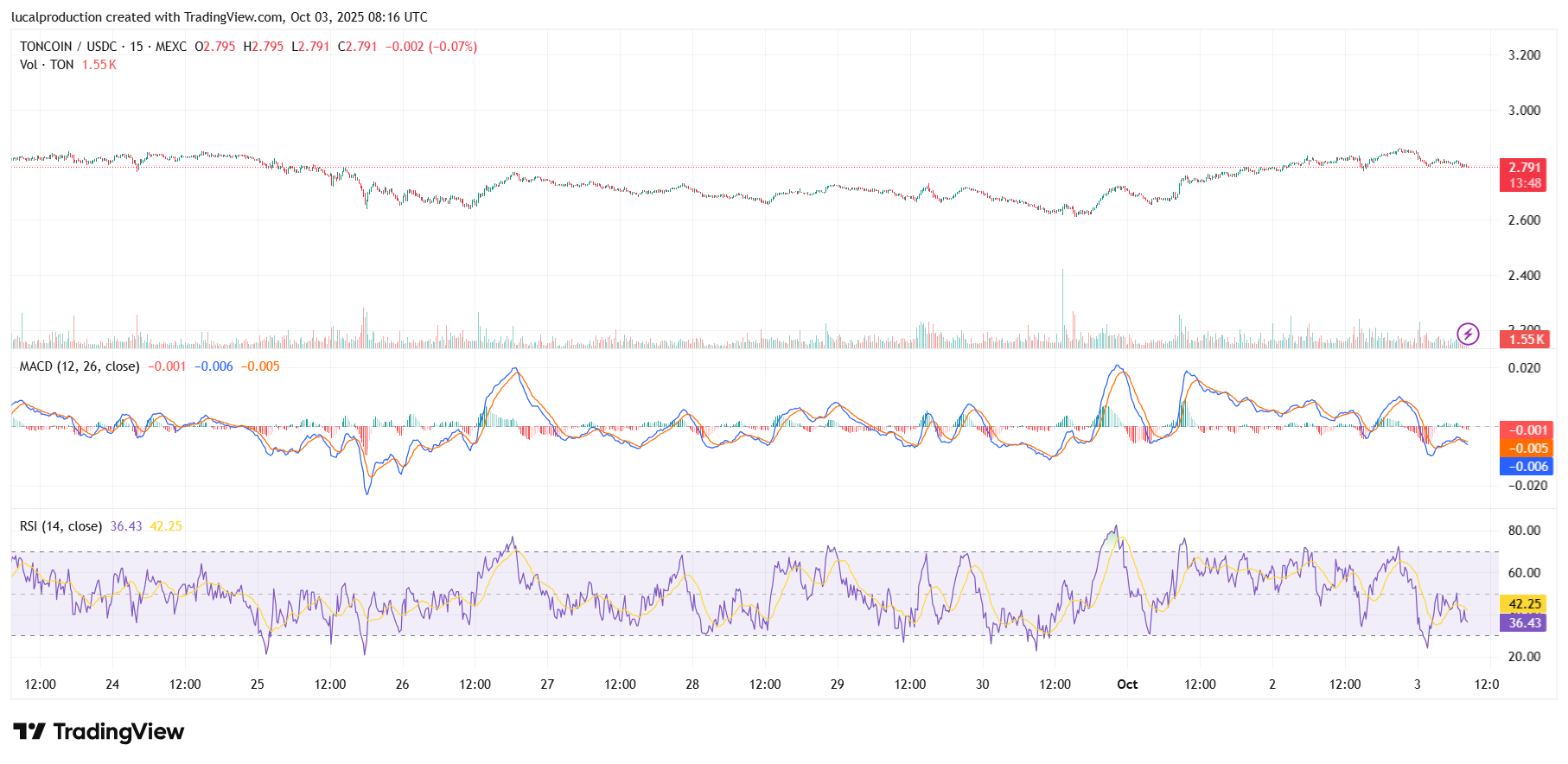

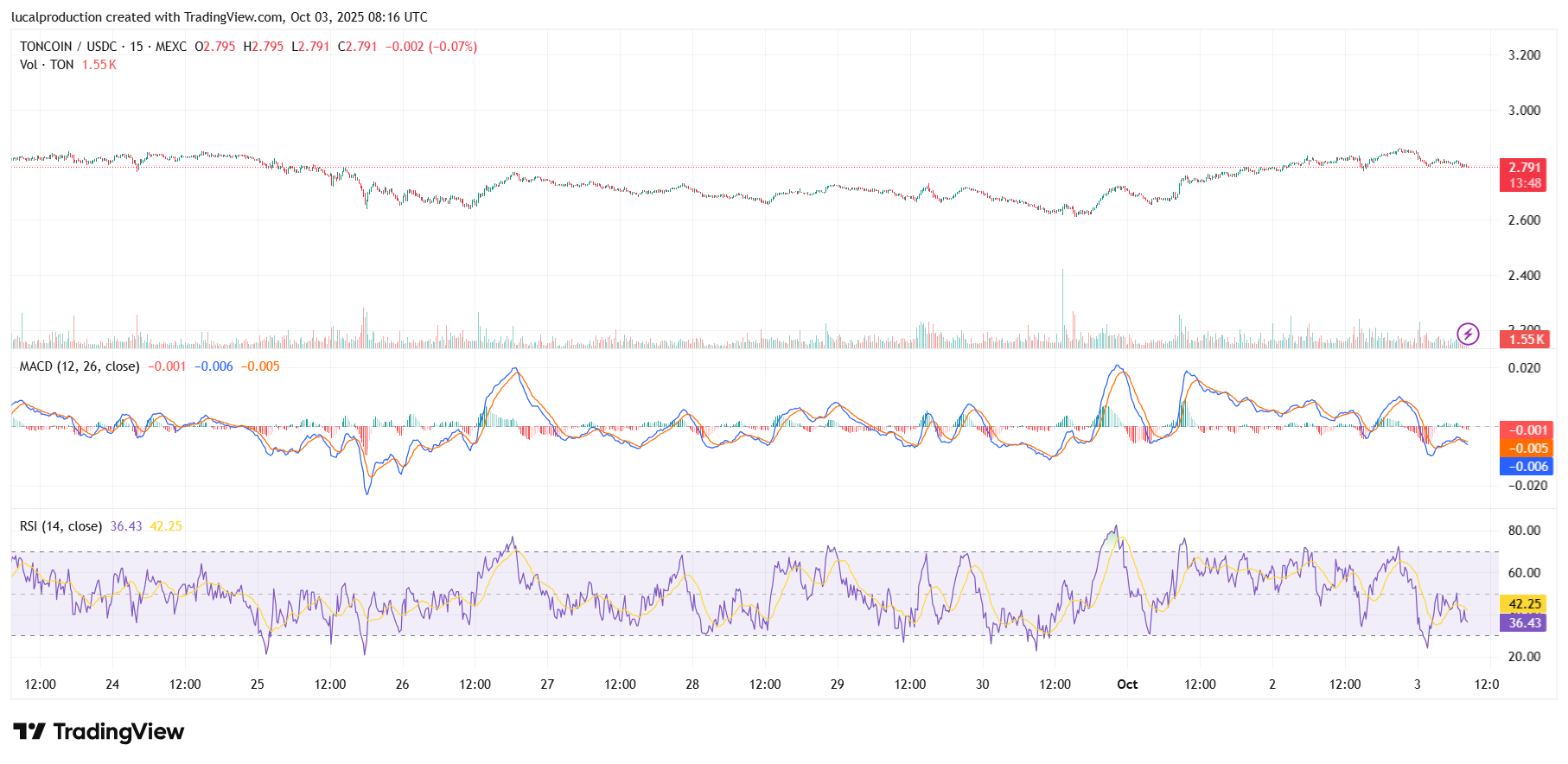

#2 Key chart indicators reveal balanced but cautious momentum for TON. The 20-day Moving Average (MA20) is at $2.79, aligned closely with current price, acting as immediate resistance.

Key chart indicators reveal balanced but cautious momentum for TON. The 20-day Moving Average (MA20) is at $2.79, aligned closely with current price, acting as immediate resistance.

The 50-day Moving Average (MA50) near $2.65 serves as solid support, with the 200-day Moving Average (MA200) at $3.17 signaling longer-term bullish backing.

The RSI holds near 53, suggesting neither overbought nor oversold conditions. MACD shows a recent bullish crossover, highlighting potential bullish momentum ahead.

On-Balance Volume (OBV) trends sideways, indicating steady trading volumes but no major buying or selling surges. The Fear and Greed Index indicates moderate sentiment near 45, pointing to cautious trader psychology.

Technical Indicators Analysis

Key chart indicators reveal balanced but cautious momentum for TON. The 20-day Moving Average (MA20) is at $2.79, aligned closely with current price, acting as immediate resistance.

Key chart indicators reveal balanced but cautious momentum for TON. The 20-day Moving Average (MA20) is at $2.79, aligned closely with current price, acting as immediate resistance. The 50-day Moving Average (MA50) near $2.65 serves as solid support, with the 200-day Moving Average (MA200) at $3.17 signaling longer-term bullish backing.

The RSI holds near 53, suggesting neither overbought nor oversold conditions. MACD shows a recent bullish crossover, highlighting potential bullish momentum ahead.

On-Balance Volume (OBV) trends sideways, indicating steady trading volumes but no major buying or selling surges. The Fear and Greed Index indicates moderate sentiment near 45, pointing to cautious trader psychology.

#3 Toncoin’s underlying blockchain, The Open Network (TON), continues to advance with upgrades aimed at scalability and integrating new decentralized applications. Partnerships with key DeFi platforms and NFT projects have expanded TON’s use cases and adoption.

Toncoin’s underlying blockchain, The Open Network (TON), continues to advance with upgrades aimed at scalability and integrating new decentralized applications. Partnerships with key DeFi platforms and NFT projects have expanded TON’s use cases and adoption.

Developers are focusing on improving transaction speeds and reducing fees, boosting TON’s competitiveness among Layer-1 blockchains.

Though major price-moving announcements have been scarce recently, steady ecosystem development signals growing utility and a maturing blockchain platform.

Recent Developments and Ecosystem Growth

Toncoin’s underlying blockchain, The Open Network (TON), continues to advance with upgrades aimed at scalability and integrating new decentralized applications. Partnerships with key DeFi platforms and NFT projects have expanded TON’s use cases and adoption.

Toncoin’s underlying blockchain, The Open Network (TON), continues to advance with upgrades aimed at scalability and integrating new decentralized applications. Partnerships with key DeFi platforms and NFT projects have expanded TON’s use cases and adoption. Developers are focusing on improving transaction speeds and reducing fees, boosting TON’s competitiveness among Layer-1 blockchains.

Though major price-moving announcements have been scarce recently, steady ecosystem development signals growing utility and a maturing blockchain platform.

#4

Maintaining the $2.62 support level is critical to avoid more significant corrections. Broader crypto market uncertainty and regulatory pressures continue to influence investor risk appetite.

Traders should be wary of sudden volume spikes or price swings frequently associated with large holders moving positions.

Market Risks and Whale Activity

TON faces near-term risks from potential market sell-offs triggered by large whale transactions, which have caused recent price volatility.Maintaining the $2.62 support level is critical to avoid more significant corrections. Broader crypto market uncertainty and regulatory pressures continue to influence investor risk appetite.

Traders should be wary of sudden volume spikes or price swings frequently associated with large holders moving positions.

#5

A sustained break above $2.85 could trigger a bullish rally toward $3.10 or higher, while failure to hold above $2.62 support may prompt dips toward $2.50 or below.

Investors are advised to watch key technical levels and trading volumes to time entries or exits. The medium-term outlook remains positive as TON’s blockchain continues its development trajectory and improved network utility.

Price Forecast and Outlook

Short-term price forecasts suggest TON may fluctuate between $2.65 and $3.10 over the coming weeks, dependent on market sentiment and volume trends.A sustained break above $2.85 could trigger a bullish rally toward $3.10 or higher, while failure to hold above $2.62 support may prompt dips toward $2.50 or below.

Investors are advised to watch key technical levels and trading volumes to time entries or exits. The medium-term outlook remains positive as TON’s blockchain continues its development trajectory and improved network utility.

#6

Key takeaways

Toncoin stands firm at crucial support near $2.62 amid moderate trading volumes and balanced technical indicators. Ecosystem developments enhance long-term prospects, but short-term volatility driven by whale activity requires caution. Traders should monitor moving averages and momentum indicators for signs of breakout or breakdown. Overall, TON holds potential for growth if it sustains support and capitalizes on blockchain advancements.

#7

[1](https://changelly.com/blog/toncoin-ton-price-prediction/)

[2](https://finance.yahoo.com/quote/TON11419-USD/history/)

[3](https://finance.yahoo.com/quote/TON-USD/history/)

[4](https://coinmarketcap.com/currencies/toncoin/historical-data/)

[5](https://coincodex.com/crypto/toncoin/price-prediction/)

[6](https://www.investing.com/crypto/toncoin/historical-data)

[7](https://coinmarketcap.com/cmc-ai/toncoin/latest-updates/)

[8](https://financefeeds.com/toncoin-technical-analysis-report-2-october-2025/)

[9](https://www.coinlore.com/coin/toncoin/historical-data)

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human changed and reedited.[1](https://changelly.com/blog/toncoin-ton-price-prediction/)

[2](https://finance.yahoo.com/quote/TON11419-USD/history/)

[3](https://finance.yahoo.com/quote/TON-USD/history/)

[4](https://coinmarketcap.com/currencies/toncoin/historical-data/)

[5](https://coincodex.com/crypto/toncoin/price-prediction/)

[6](https://www.investing.com/crypto/toncoin/historical-data)

[7](https://coinmarketcap.com/cmc-ai/toncoin/latest-updates/)

[8](https://financefeeds.com/toncoin-technical-analysis-report-2-october-2025/)

[9](https://www.coinlore.com/coin/toncoin/historical-data)

Reactions

Reactions

1