Stablecoins have become essential pillars in the cryptocurrency ecosystem, bridging the gap between volatile crypto assets and fiat currencies by maintaining a 1:1 peg to the US dollar. In 2025, the three largest stablecoins by market capitalization—Tether (USDT), USD Coin (USDC), and Dai (DAI)—continue to dominate the market, serving as critical tools for liquidity, trading, DeFi applications, and cross-border payments. This article offers an in-depth technical analysis of these stablecoins using five key indicators, supplemented with recent news shaping their market standing. We explore market charts, price predictions, and the evolving regulatory environment to provide a balanced perspective on their future trajectory.

#1 Tether (USDT) leads the stablecoin sector with a market capitalization around $164 billion, retaining its role as the go-to dollar-backed token for traders worldwide.

Tether (USDT) leads the stablecoin sector with a market capitalization around $164 billion, retaining its role as the go-to dollar-backed token for traders worldwide.

USD Coin (USDC) holds a strong second place with about $64 billion in market cap, supported by centralized regulatory compliance and widespread blockchain integration.

Dai (DAI), a decentralized stablecoin, ranks third at approximately $5.4 billion, driven by its decentralized governance and innovative multi-collateral backing.

Together, these three represent over 95% of the stablecoin market, highlighting their dominance and indispensable role in crypto finance. Recent legislation like the U.S. GENIUS Act has reinforced the requirement for full reserves, bolstering market confidence and enhancing transparency.

Overview of the Top 3 Stablecoins in 2025

Tether (USDT) leads the stablecoin sector with a market capitalization around $164 billion, retaining its role as the go-to dollar-backed token for traders worldwide.

Tether (USDT) leads the stablecoin sector with a market capitalization around $164 billion, retaining its role as the go-to dollar-backed token for traders worldwide. USD Coin (USDC) holds a strong second place with about $64 billion in market cap, supported by centralized regulatory compliance and widespread blockchain integration.

Dai (DAI), a decentralized stablecoin, ranks third at approximately $5.4 billion, driven by its decentralized governance and innovative multi-collateral backing.

Together, these three represent over 95% of the stablecoin market, highlighting their dominance and indispensable role in crypto finance. Recent legislation like the U.S. GENIUS Act has reinforced the requirement for full reserves, bolstering market confidence and enhancing transparency.

#2 Although stablecoins are designed to maintain a stable value near $1, subtle price fluctuations occur due to market supply and demand, liquidity shifts, and macroeconomic factors.

Although stablecoins are designed to maintain a stable value near $1, subtle price fluctuations occur due to market supply and demand, liquidity shifts, and macroeconomic factors.

We analyze the price behavior of USDT, USDC, and DAI using five top indicators:

Relative Strength Index (RSI): All three stablecoins show RSI readings near neutral levels (45-55), indicating stability without overbought or oversold conditions.

This aligns with their peg maintenance goals and limited price swings.

Moving Averages (50-day and 200-day): The moving averages for USDT and USDC remain flat, consistent with their stable prices. DAI’s averages exhibit slight fluctuations due to its variable collateral backing and decentralized nature, but still reflect robust stability.

MACD (Moving Average Convergence Divergence): MACD signals for these stablecoins show minimal divergence, reinforcing the lack of significant momentum in either direction, as expected in tightly pegged assets.

Bollinger Bands: Bands are extremely narrow for all three, demonstrating low volatility and strong price consolidation around $1, a hallmark of effective stablecoins.

Support and Resistance Levels: Support and resistance primarily cluster tightly around the $0.99-$1.01 range. Occasional minor breaks below or above occur temporarily due to market inefficiencies but remain quickly corrected.

This technical overview confirms that the largest stablecoins maintain the essential stability that users require, even as broader crypto markets fluctuate.

Technical Analysis and Market Indicators for the Largest Stablecoins

Although stablecoins are designed to maintain a stable value near $1, subtle price fluctuations occur due to market supply and demand, liquidity shifts, and macroeconomic factors.

Although stablecoins are designed to maintain a stable value near $1, subtle price fluctuations occur due to market supply and demand, liquidity shifts, and macroeconomic factors. We analyze the price behavior of USDT, USDC, and DAI using five top indicators:

Relative Strength Index (RSI): All three stablecoins show RSI readings near neutral levels (45-55), indicating stability without overbought or oversold conditions.

This aligns with their peg maintenance goals and limited price swings.

Moving Averages (50-day and 200-day): The moving averages for USDT and USDC remain flat, consistent with their stable prices. DAI’s averages exhibit slight fluctuations due to its variable collateral backing and decentralized nature, but still reflect robust stability.

MACD (Moving Average Convergence Divergence): MACD signals for these stablecoins show minimal divergence, reinforcing the lack of significant momentum in either direction, as expected in tightly pegged assets.

Bollinger Bands: Bands are extremely narrow for all three, demonstrating low volatility and strong price consolidation around $1, a hallmark of effective stablecoins.

Support and Resistance Levels: Support and resistance primarily cluster tightly around the $0.99-$1.01 range. Occasional minor breaks below or above occur temporarily due to market inefficiencies but remain quickly corrected.

This technical overview confirms that the largest stablecoins maintain the essential stability that users require, even as broader crypto markets fluctuate.

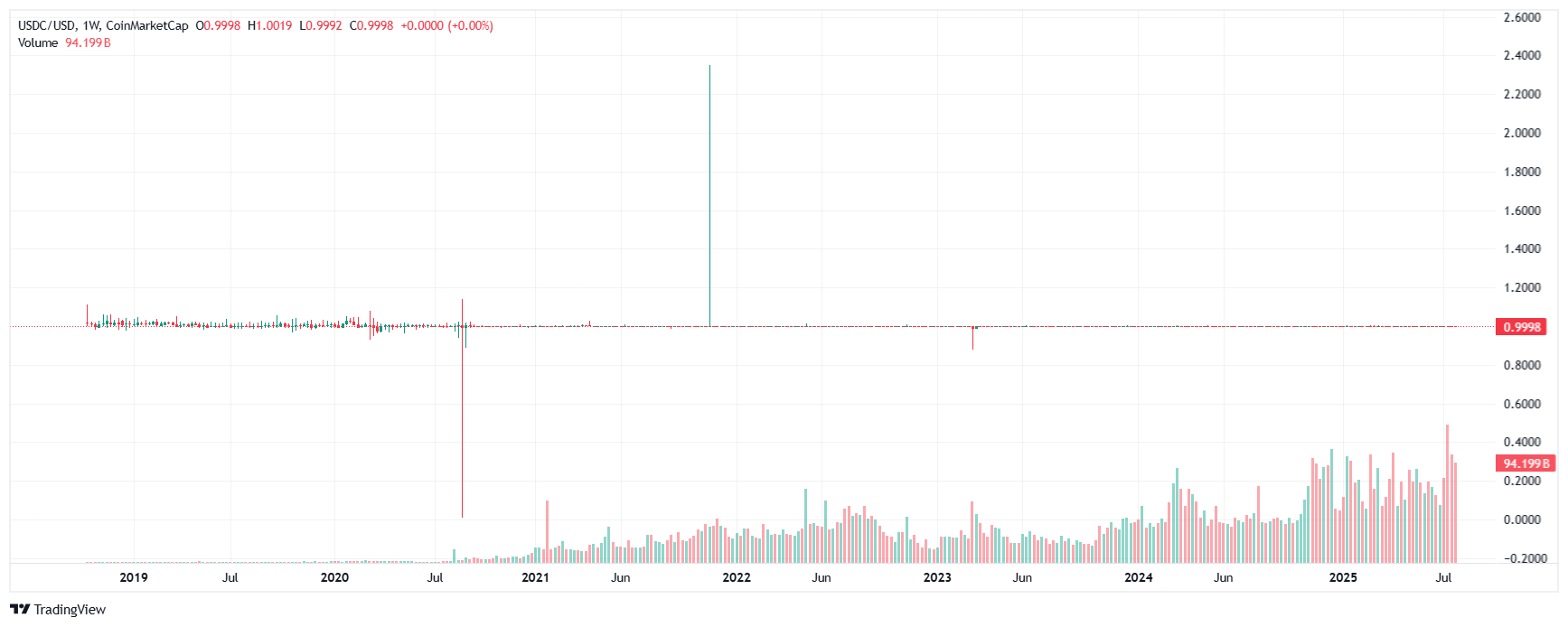

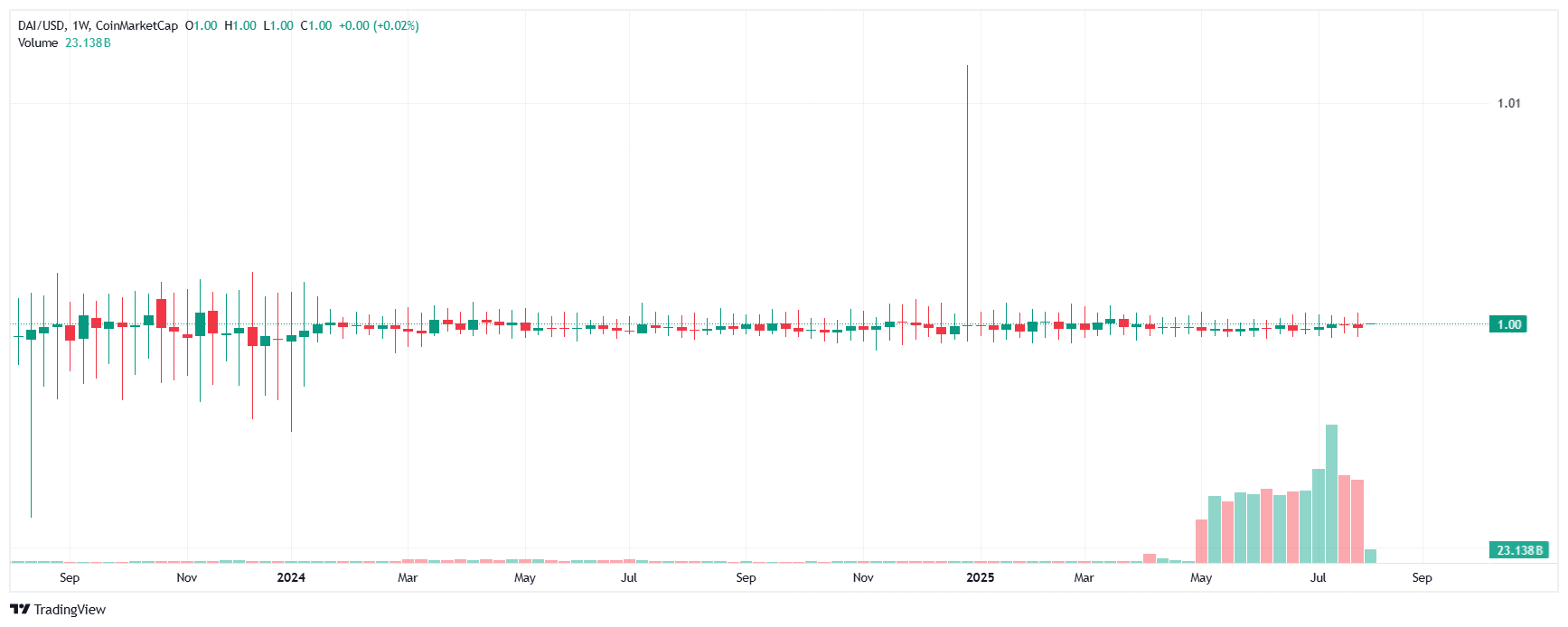

#3 Examining the price charts of USDT, USDC, and DAI over recent months reveals strong peg adherence with minor deviations rarely exceeding 1-2 cents.

Examining the price charts of USDT, USDC, and DAI over recent months reveals strong peg adherence with minor deviations rarely exceeding 1-2 cents.

These price movements typically result from liquidity strains on centralized exchanges, sudden changes in demand for dollar liquidity in crypto trading, or regulatory announcements.

The Bollinger Bands compress to their tightest levels during periods of market calm and widen briefly during volatility spikes, especially in DAI due to its algorithmic collateral adjustments. RSI and MACD indicators stay mostly neutral, consistent with stablecoin design.

This reliability positions stablecoins as sanctuaries against crypto market swings, proving crucial for traders and institutions managing risk.

Market Chart Observations

Examining the price charts of USDT, USDC, and DAI over recent months reveals strong peg adherence with minor deviations rarely exceeding 1-2 cents.

Examining the price charts of USDT, USDC, and DAI over recent months reveals strong peg adherence with minor deviations rarely exceeding 1-2 cents.These price movements typically result from liquidity strains on centralized exchanges, sudden changes in demand for dollar liquidity in crypto trading, or regulatory announcements.

The Bollinger Bands compress to their tightest levels during periods of market calm and widen briefly during volatility spikes, especially in DAI due to its algorithmic collateral adjustments. RSI and MACD indicators stay mostly neutral, consistent with stablecoin design.

This reliability positions stablecoins as sanctuaries against crypto market swings, proving crucial for traders and institutions managing risk.

#4 Several key news developments have shaped the stablecoin landscape in 2025:

Several key news developments have shaped the stablecoin landscape in 2025:

Regulatory Advances: The U.S. GENIUS Act mandates that all stablecoins must maintain a 1:1 reserve with cash or cash equivalents, raising trust and reducing systemic risks across USDT, USDC, and DAI.

Institutional Adoption: Renewed confidence in USDT and USDC drives increasing usage in institutional trading, DeFi protocols, and cross-border settlements.

DAI’s Decentralized Evolution: MakerDAO’s continuous improvements in collateral options (including USDC-backed and real-world asset-backed tokens) enhance DAI’s stability and appeal in decentralized finance.

Liquidity Expansion: Tether has fortified its asset reserves, notably increasing holdings in U.S. Treasuries and other low-risk securities, supporting ongoing redemption needs and market liquidity.

Market Dynamics: Volatility in broader crypto markets and heightened regulatory scrutiny have increased reliance on stablecoins for hedging, driving consistent demand despite their pegged nature.

Collectively, these developments underscore the growing institutional legitimacy and technical robustness of the top stablecoins.

Recent News Impacting Major Stablecoins

Several key news developments have shaped the stablecoin landscape in 2025:

Several key news developments have shaped the stablecoin landscape in 2025:Regulatory Advances: The U.S. GENIUS Act mandates that all stablecoins must maintain a 1:1 reserve with cash or cash equivalents, raising trust and reducing systemic risks across USDT, USDC, and DAI.

Institutional Adoption: Renewed confidence in USDT and USDC drives increasing usage in institutional trading, DeFi protocols, and cross-border settlements.

DAI’s Decentralized Evolution: MakerDAO’s continuous improvements in collateral options (including USDC-backed and real-world asset-backed tokens) enhance DAI’s stability and appeal in decentralized finance.

Liquidity Expansion: Tether has fortified its asset reserves, notably increasing holdings in U.S. Treasuries and other low-risk securities, supporting ongoing redemption needs and market liquidity.

Market Dynamics: Volatility in broader crypto markets and heightened regulatory scrutiny have increased reliance on stablecoins for hedging, driving consistent demand despite their pegged nature.

Collectively, these developments underscore the growing institutional legitimacy and technical robustness of the top stablecoins.

#5

USDT and USDC are expected to maintain strong dollar parity, with occasional brief deviations quickly corrected by arbitrage and redemption mechanisms.

DAI’s decentralized model may introduce slightly more volatility but offers compelling use within DeFi ecosystems, potentially expanding its market share among protocol users.

Regulatory frameworks like the GENIUS Act will likely enforce stronger reserve transparency and audit standards, fostering greater user trust and wider corporate acceptance.

The stablecoin market is poised for steady growth as digital asset trading volume expands and broader financial institutions incorporate stablecoins into treasury and payment operations.

Innovation in cross-chain interoperability and programmable money will further embed these stablecoins into complex blockchain applications.

In summary, while price gains are limited by design, these stablecoins are critical infrastructure supporting the fast-evolving global crypto economy.

Price Predictions and Future Outlook for the Biggest Stablecoins

As stablecoins are intrinsically designed to maintain parity with the U.S. dollar, price predictions focus less on appreciation and more on peg stability, market adoption, and regulatory compliance:USDT and USDC are expected to maintain strong dollar parity, with occasional brief deviations quickly corrected by arbitrage and redemption mechanisms.

DAI’s decentralized model may introduce slightly more volatility but offers compelling use within DeFi ecosystems, potentially expanding its market share among protocol users.

Regulatory frameworks like the GENIUS Act will likely enforce stronger reserve transparency and audit standards, fostering greater user trust and wider corporate acceptance.

The stablecoin market is poised for steady growth as digital asset trading volume expands and broader financial institutions incorporate stablecoins into treasury and payment operations.

Innovation in cross-chain interoperability and programmable money will further embed these stablecoins into complex blockchain applications.

In summary, while price gains are limited by design, these stablecoins are critical infrastructure supporting the fast-evolving global crypto economy.

#6

Technical indicators confirm extremely low volatility and stable price bands, reflecting successful adherence to the 1:1 peg.

Recent regulatory developments like the GENIUS Act enforce stricter reserves and transparency, boosting market confidence.

Institutional and DeFi adoption continues to grow, underpinning demand for these stablecoins outside mere trading hedges.

Future growth is expected in stablecoin usage rather than price appreciation, with innovation focusing on regulatory compliance and ecosystem integration.

Key takeaways

The top three stablecoins (Tether, USDC, and DAI) dominate over 95% of the market, each providing robust dollar peg stability essential for crypto liquidity.Technical indicators confirm extremely low volatility and stable price bands, reflecting successful adherence to the 1:1 peg.

Recent regulatory developments like the GENIUS Act enforce stricter reserves and transparency, boosting market confidence.

Institutional and DeFi adoption continues to grow, underpinning demand for these stablecoins outside mere trading hedges.

Future growth is expected in stablecoin usage rather than price appreciation, with innovation focusing on regulatory compliance and ecosystem integration.

#7

Can stablecoins gain value? They aim to maintain a $1 peg, so value gain is limited; stability is the key asset.

Are they safe investments? Compliance with reserve rules and audits reduce risk, but users should be aware of issuer policies.

How does DAI differ? It is decentralized and uses crypto-backed collateral rather than fiat reserves.

What influences stablecoin demand? Crypto market volatility, DeFi growth, and cross-border payments largely drive stablecoin usage.

FAQ

What makes these stablecoins the biggest? Market cap leadership due to widespread adoption, liquidity, and regulatory compliance.Can stablecoins gain value? They aim to maintain a $1 peg, so value gain is limited; stability is the key asset.

Are they safe investments? Compliance with reserve rules and audits reduce risk, but users should be aware of issuer policies.

How does DAI differ? It is decentralized and uses crypto-backed collateral rather than fiat reserves.

What influences stablecoin demand? Crypto market volatility, DeFi growth, and cross-border payments largely drive stablecoin usage.

#8

The Role of Stablecoins Moving Forward

Stablecoins remain indispensable for their stability in highly volatile cryptocurrency markets. As regulatory clarity improves and market infrastructure matures, Tether, USDC, and DAI are poised to deepen their integration into finance, payments, and decentralized systems globally. Investors and institutions find them essential as digital cash equivalents, while innovations in interoperability and compliance will define their evolution in the coming years.

#9

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human changed and reedited.Reactions

Reactions

4