Tron (TRX) is a key player in the blockchain space, known for its high throughput and focus on decentralized applications and entertainment. As of late August 2025, TRX shows a mix of technical signals and market movements, influenced by ongoing network upgrades and partnership developments. This article examines TRX’s current price action using five important indicators, alongside relevant news to provide a comprehensive view of its trajectory and future potential.

#1 On August 29, 2025, Tron trades near $0.345 with a mild intraday pullback of about 1%. Market capitalization holds strong above $32 billion, supported by consistent trading volumes around $760 million daily. Tron’s ecosystem growth continues with increased adoption in gaming, NFTs, and DeFi platforms running on its blockchain.

On August 29, 2025, Tron trades near $0.345 with a mild intraday pullback of about 1%. Market capitalization holds strong above $32 billion, supported by consistent trading volumes around $760 million daily. Tron’s ecosystem growth continues with increased adoption in gaming, NFTs, and DeFi platforms running on its blockchain.

Recent updates have enhanced transaction speeds and reduced fees, strengthening TRX’s appeal among developers and users alike. Despite market volatility and competition from Ethereum Layer 2 solutions, Tron remains a top-ranked cryptocurrency driven by active community engagement and strategic collaborations.

Tron’s Current Market Landscape

On August 29, 2025, Tron trades near $0.345 with a mild intraday pullback of about 1%. Market capitalization holds strong above $32 billion, supported by consistent trading volumes around $760 million daily. Tron’s ecosystem growth continues with increased adoption in gaming, NFTs, and DeFi platforms running on its blockchain.

On August 29, 2025, Tron trades near $0.345 with a mild intraday pullback of about 1%. Market capitalization holds strong above $32 billion, supported by consistent trading volumes around $760 million daily. Tron’s ecosystem growth continues with increased adoption in gaming, NFTs, and DeFi platforms running on its blockchain.Recent updates have enhanced transaction speeds and reduced fees, strengthening TRX’s appeal among developers and users alike. Despite market volatility and competition from Ethereum Layer 2 solutions, Tron remains a top-ranked cryptocurrency driven by active community engagement and strategic collaborations.

#2 Assessing Tron’s chart through the lens of five key technical indicators reveals a nuanced picture:

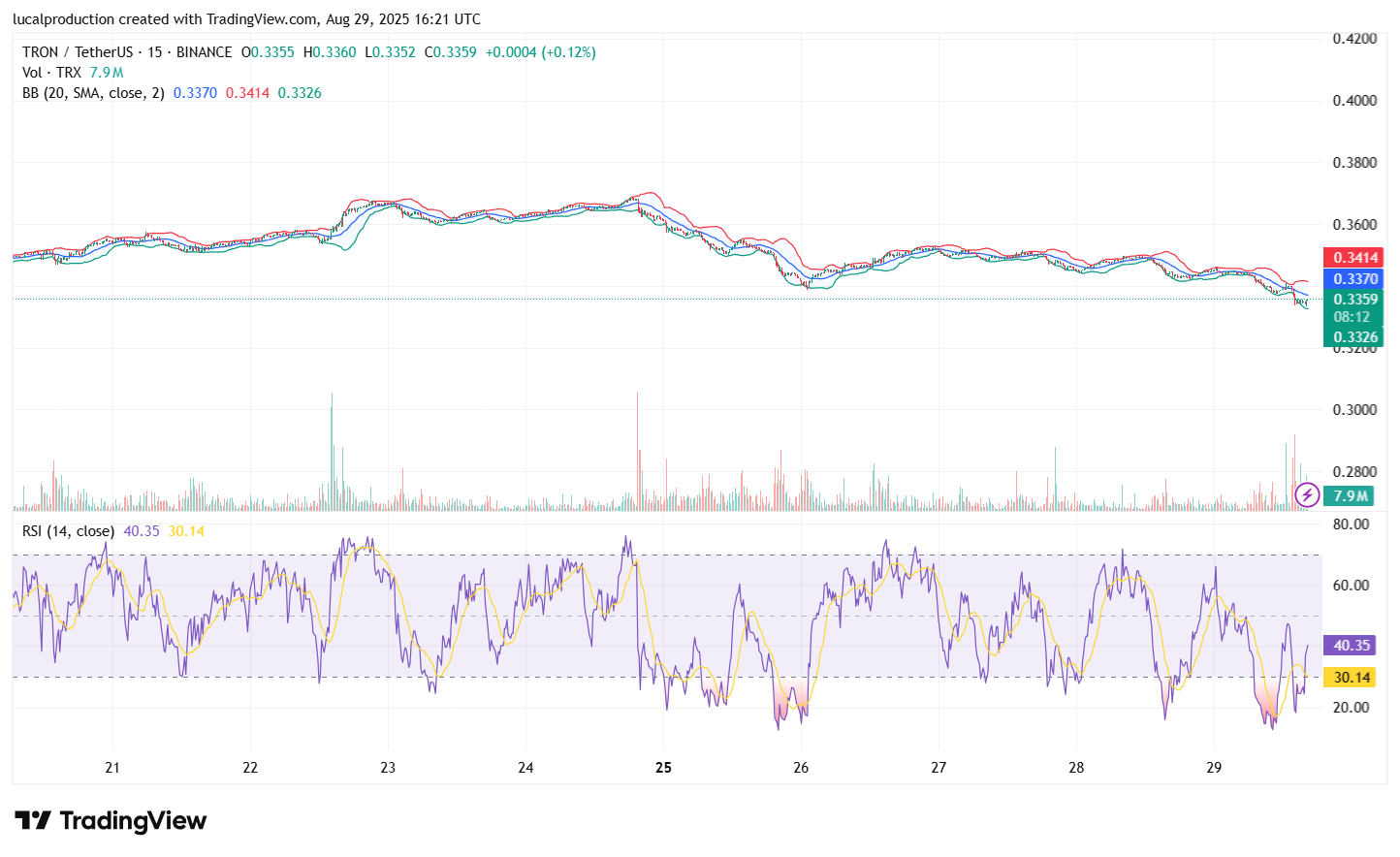

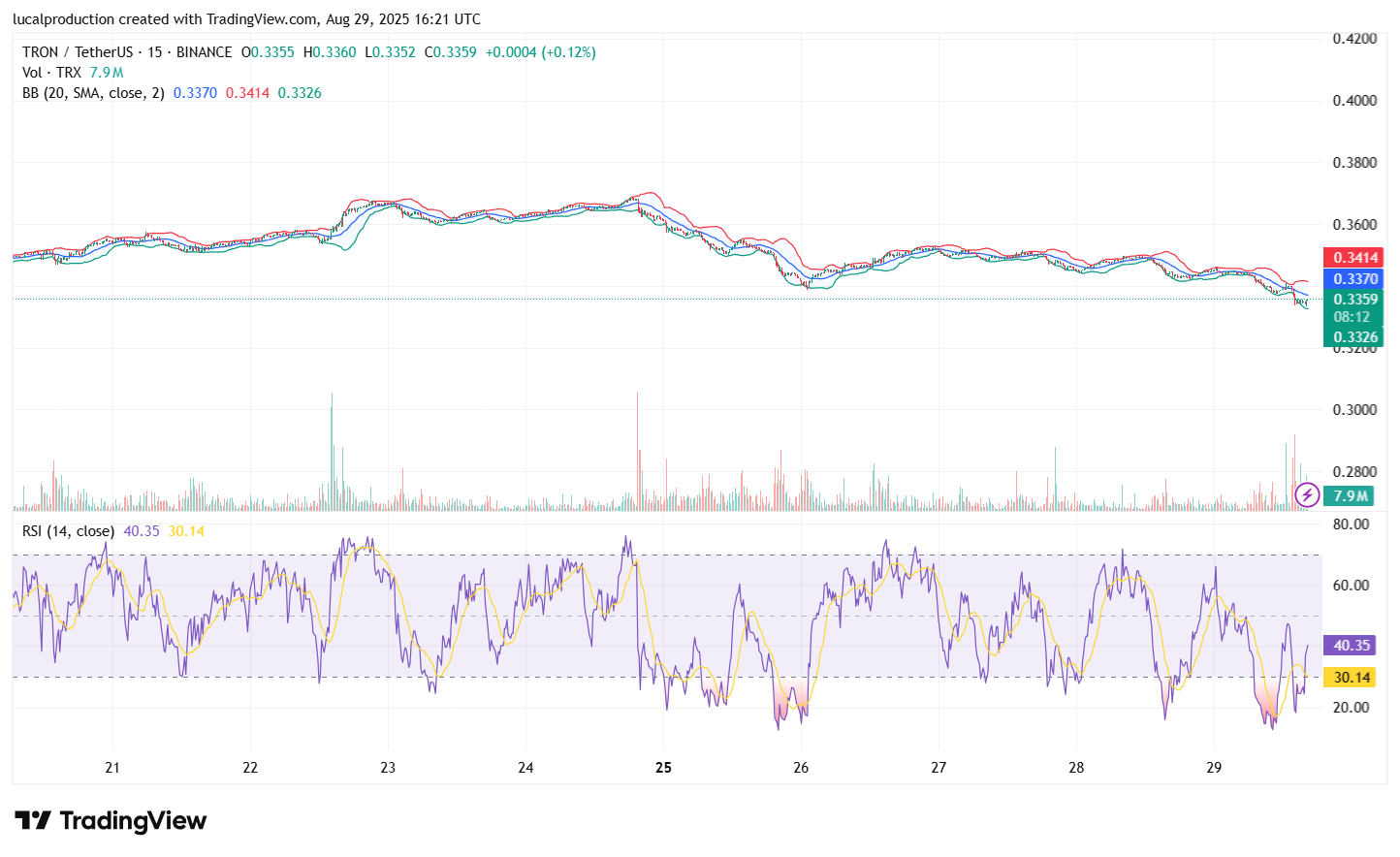

Assessing Tron’s chart through the lens of five key technical indicators reveals a nuanced picture:

RSI (Relative Strength Index): Positioned around 47, the RSI signals near-neutral momentum, suggesting neither overbought nor oversold conditions and room for directional movement.

MACD (Moving Average Convergence Divergence): The MACD is slightly bearish as the MACD line hovers under the signal line, hinting at potential short-term weakness but a possible turnaround if a bullish crossover occurs soon.

Moving Averages (50-day and 200-day): Tron’s price trades below the 50-day moving average (~$0.355) but above the 200-day moving average (~$0.320), reflecting a consolidation phase with critical resistance ahead.

Bollinger Bands: Price currently approaches the lower Bollinger Band, indicating possible oversold territory and setting the stage for a bounce towards the middle band around $0.355.

Volume: Trading volume shows stable activity but lacks the spike typically seen before a strong breakout, suggesting cautious sentiment among traders.

These indicators suggest Tron is in a consolidation phase with pressure near key support levels, awaiting either a volume-backed breakout or a further pullback.

Technical Chart Analysis Using Five Indicators

Assessing Tron’s chart through the lens of five key technical indicators reveals a nuanced picture:

Assessing Tron’s chart through the lens of five key technical indicators reveals a nuanced picture:RSI (Relative Strength Index): Positioned around 47, the RSI signals near-neutral momentum, suggesting neither overbought nor oversold conditions and room for directional movement.

MACD (Moving Average Convergence Divergence): The MACD is slightly bearish as the MACD line hovers under the signal line, hinting at potential short-term weakness but a possible turnaround if a bullish crossover occurs soon.

Moving Averages (50-day and 200-day): Tron’s price trades below the 50-day moving average (~$0.355) but above the 200-day moving average (~$0.320), reflecting a consolidation phase with critical resistance ahead.

Bollinger Bands: Price currently approaches the lower Bollinger Band, indicating possible oversold territory and setting the stage for a bounce towards the middle band around $0.355.

Volume: Trading volume shows stable activity but lacks the spike typically seen before a strong breakout, suggesting cautious sentiment among traders.

These indicators suggest Tron is in a consolidation phase with pressure near key support levels, awaiting either a volume-backed breakout or a further pullback.

#3 Tron’s momentum is fueled by strategic network upgrades and new ecosystem partnerships. The launch of advanced smart contract features and cross-chain bridges continues to attract DeFi projects and NFT platforms. Additionally, Tron’s governance ecosystem sees iterative improvements, empowering community participation in key network decisions.

Tron’s momentum is fueled by strategic network upgrades and new ecosystem partnerships. The launch of advanced smart contract features and cross-chain bridges continues to attract DeFi projects and NFT platforms. Additionally, Tron’s governance ecosystem sees iterative improvements, empowering community participation in key network decisions.

Increased adoption in gaming through partnerships with popular franchises further underlines the platform’s relevance. On the market side, institutional interest in alternative blockchains supporting high transaction throughput keeps TRX in focus, even as the broader crypto market faces macroeconomic uncertainty and regulatory scrutiny.

Recent Developments and News Impacting Tron

Tron’s momentum is fueled by strategic network upgrades and new ecosystem partnerships. The launch of advanced smart contract features and cross-chain bridges continues to attract DeFi projects and NFT platforms. Additionally, Tron’s governance ecosystem sees iterative improvements, empowering community participation in key network decisions.

Tron’s momentum is fueled by strategic network upgrades and new ecosystem partnerships. The launch of advanced smart contract features and cross-chain bridges continues to attract DeFi projects and NFT platforms. Additionally, Tron’s governance ecosystem sees iterative improvements, empowering community participation in key network decisions. Increased adoption in gaming through partnerships with popular franchises further underlines the platform’s relevance. On the market side, institutional interest in alternative blockchains supporting high transaction throughput keeps TRX in focus, even as the broader crypto market faces macroeconomic uncertainty and regulatory scrutiny.

#4

Analysts remain cautiously optimistic, citing Tron’s technical setup and ecosystem progress as solid foundations for renewed price appreciation. Long-term outlooks extend bullish, envisioning prices reaching $0.5 or higher by 2026 if adoption accelerates and innovations continue. Traders should monitor volume trends and RSI shifts for confirming signals of any breakout or breakdown.

Price Forecast and Market Outlook

Market forecasts project Tron’s price drifting between $0.33 and $0.37 over the coming weeks with potential to rise above $0.37 if volume and momentum build. Resistance near $0.36 to $0.38 is crucial for a sustained upward trend, while support at $0.32 to $0.33 acts as a safeguard against declines.Analysts remain cautiously optimistic, citing Tron’s technical setup and ecosystem progress as solid foundations for renewed price appreciation. Long-term outlooks extend bullish, envisioning prices reaching $0.5 or higher by 2026 if adoption accelerates and innovations continue. Traders should monitor volume trends and RSI shifts for confirming signals of any breakout or breakdown.

#5

Meanwhile, support at $0.32 provides an important floor to maintain. Keeping an eye on trading volume spikes and MACD crossovers will prove critical in discerning Tron’s next significant price moves. As upgrade rollouts and DApp expansions continue, Tron’s relevance in the broader blockchain ecosystem strengthens, making it a cryptocurrency to watch closely in late 2025.

What to Watch Moving Forward

Tron is navigating a period of consolidation with technical signs hinting at a possible near-term reversal. Key resistance levels near $0.36 must be convincingly surpassed for bullish momentum to solidify.Meanwhile, support at $0.32 provides an important floor to maintain. Keeping an eye on trading volume spikes and MACD crossovers will prove critical in discerning Tron’s next significant price moves. As upgrade rollouts and DApp expansions continue, Tron’s relevance in the broader blockchain ecosystem strengthens, making it a cryptocurrency to watch closely in late 2025.

#6

Five major technical indicators show consolidation with potential for directional breakout.

Network upgrades and new partnerships expand Tron’s ecosystem and appeal.

Price likely to oscillate between $0.33 and $0.37 in the short term, with $0.36–$0.38 resistance crucial for gains.

Monitoring volume and momentum indicators will signal the next market move.

Key takeaways

Tron trades near $0.345, supported by stable volume and market cap over $32 billion.Five major technical indicators show consolidation with potential for directional breakout.

Network upgrades and new partnerships expand Tron’s ecosystem and appeal.

Price likely to oscillate between $0.33 and $0.37 in the short term, with $0.36–$0.38 resistance crucial for gains.

Monitoring volume and momentum indicators will signal the next market move.

#7