Solana (SOL) shines as a powerful player in the blockchain world this August 30, 2025. This article explores SOL’s current market status and dives into an in-depth technical analysis using five key indicators, augmented by recent news influencing SOL’s trajectory. With robust ecosystem developments and a strong price forecast, Solana stands at a critical juncture, blending promising fundamentals with evolving market dynamics.

#1 Solana is trading at approximately $207.50 on August 30, 2025, showing steady growth compared to earlier volatility. Short-term price fluctuations hover around $200+, with technical analysis highlighting crucial resistance near $208.76 and potential rally points up to $239.99.

Solana is trading at approximately $207.50 on August 30, 2025, showing steady growth compared to earlier volatility. Short-term price fluctuations hover around $200+, with technical analysis highlighting crucial resistance near $208.76 and potential rally points up to $239.99.

Despite minor dips, the market continues to back SOL due to its rapid transaction speeds, low fees, and wide adoption in decentralized apps (dApps) and DeFi. Investors are watching for SOL to break key resistance levels as it seeks momentum to move higher.

Solana’s Market Status Today

Solana is trading at approximately $207.50 on August 30, 2025, showing steady growth compared to earlier volatility. Short-term price fluctuations hover around $200+, with technical analysis highlighting crucial resistance near $208.76 and potential rally points up to $239.99.

Solana is trading at approximately $207.50 on August 30, 2025, showing steady growth compared to earlier volatility. Short-term price fluctuations hover around $200+, with technical analysis highlighting crucial resistance near $208.76 and potential rally points up to $239.99. Despite minor dips, the market continues to back SOL due to its rapid transaction speeds, low fees, and wide adoption in decentralized apps (dApps) and DeFi. Investors are watching for SOL to break key resistance levels as it seeks momentum to move higher.

#2 Solana's presence in the blockchain ecosystem strengthens with several strategic developments. Institutional interest is growing following Solana’s partnerships geared towards boosting security, decentralized finance features, and Layer 2 scalability solutions. Innovations such as Proof of History combined with Staking keep it competitive for developers.

Solana's presence in the blockchain ecosystem strengthens with several strategic developments. Institutional interest is growing following Solana’s partnerships geared towards boosting security, decentralized finance features, and Layer 2 scalability solutions. Innovations such as Proof of History combined with Staking keep it competitive for developers.

Additionally, Solana's expanding NFT marketplace and gaming integration bring increasing user engagement. Recent funding rounds and ecosystem grants aim to boost developer activity, widening Solana’s appeal in Asia, Europe, and the US markets.

Recent News Bolstering Solana’s Strength

Solana's presence in the blockchain ecosystem strengthens with several strategic developments. Institutional interest is growing following Solana’s partnerships geared towards boosting security, decentralized finance features, and Layer 2 scalability solutions. Innovations such as Proof of History combined with Staking keep it competitive for developers.

Solana's presence in the blockchain ecosystem strengthens with several strategic developments. Institutional interest is growing following Solana’s partnerships geared towards boosting security, decentralized finance features, and Layer 2 scalability solutions. Innovations such as Proof of History combined with Staking keep it competitive for developers. Additionally, Solana's expanding NFT marketplace and gaming integration bring increasing user engagement. Recent funding rounds and ecosystem grants aim to boost developer activity, widening Solana’s appeal in Asia, Europe, and the US markets.

#3 Solana’s price action is assessed through these technical indicators on August 30, 2025:

Solana’s price action is assessed through these technical indicators on August 30, 2025:

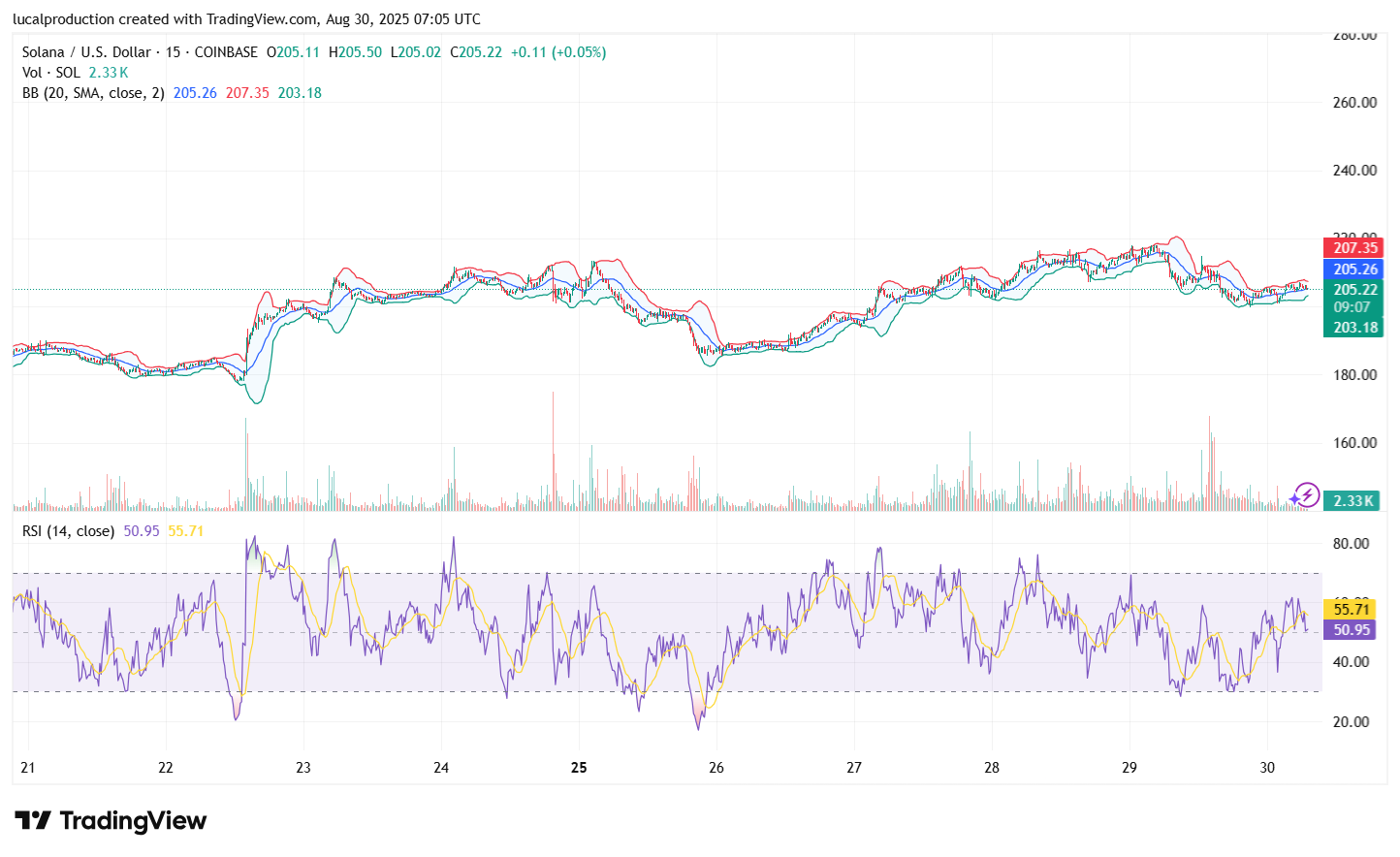

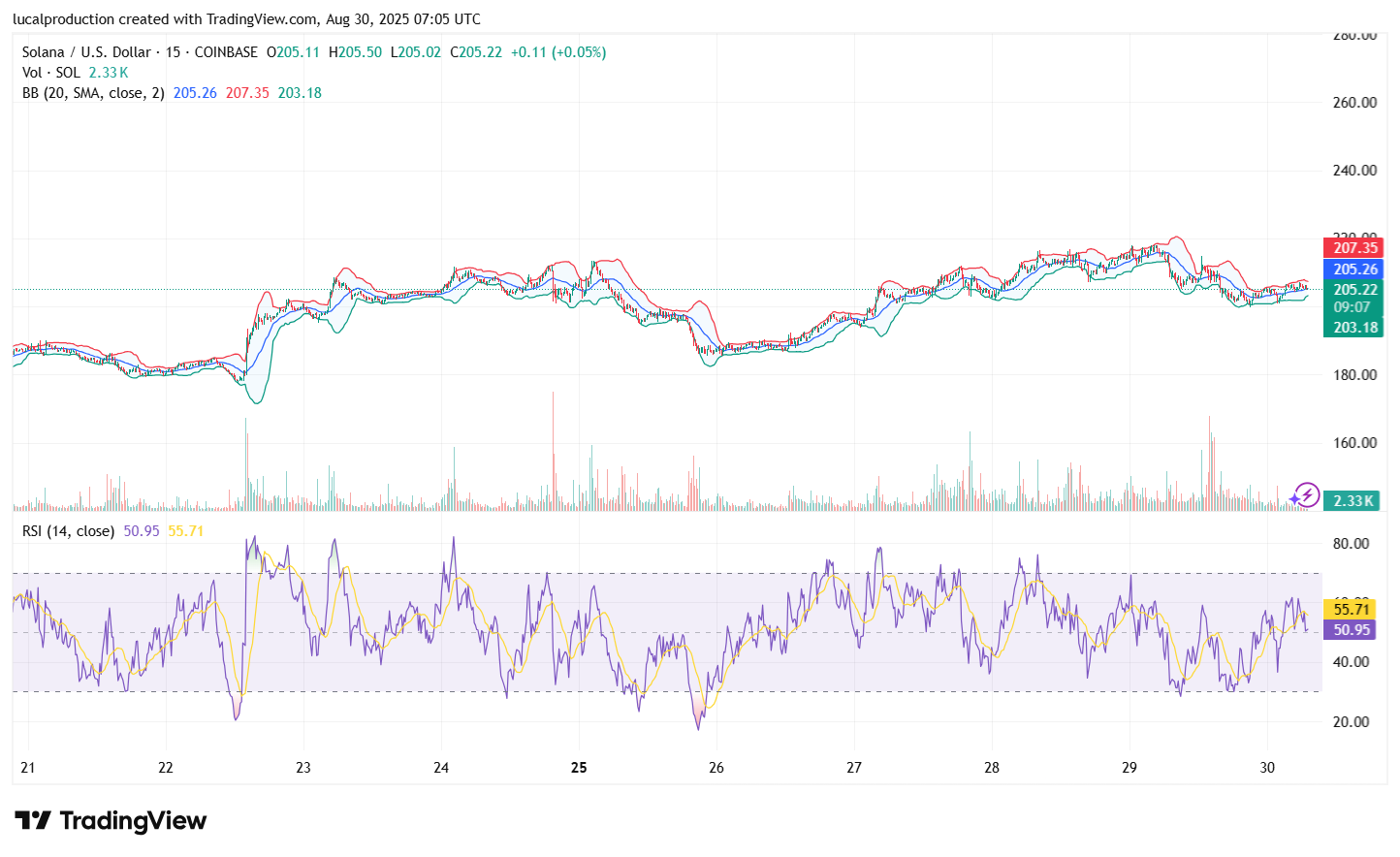

Relative Strength Index (RSI): At 57, the RSI shows moderately bullish momentum, signaling SOL is not yet overbought and may still rise.

Moving Average Convergence Divergence (MACD): The MACD line is above the signal, with positive histogram bars supporting a sustained upward trend.

Bollinger Bands: SOL trades near the upper Bollinger Band, suggesting growing bullish pressure but caution for potential short-term pullback.

50-Day Moving Average (MA): Sitting around $202, the 50-day MA acts as solid support, indicating strength in the medium term.

Volume Trends: Trading volume is strong and consistent, confirming active participation by traders and investors, reinforcing bullish signals.

Together, these metrics forecast a strong upward potential if SOL can maintain its support above $202 and break resistance around $208.76.

Technical Analysis Using Five Indicators

Solana’s price action is assessed through these technical indicators on August 30, 2025:

Solana’s price action is assessed through these technical indicators on August 30, 2025:Relative Strength Index (RSI): At 57, the RSI shows moderately bullish momentum, signaling SOL is not yet overbought and may still rise.

Moving Average Convergence Divergence (MACD): The MACD line is above the signal, with positive histogram bars supporting a sustained upward trend.

Bollinger Bands: SOL trades near the upper Bollinger Band, suggesting growing bullish pressure but caution for potential short-term pullback.

50-Day Moving Average (MA): Sitting around $202, the 50-day MA acts as solid support, indicating strength in the medium term.

Volume Trends: Trading volume is strong and consistent, confirming active participation by traders and investors, reinforcing bullish signals.

Together, these metrics forecast a strong upward potential if SOL can maintain its support above $202 and break resistance around $208.76.

#4

Medium-term targets hover around $214 by late September, reflective of steady appreciation supported by growing demand and ecosystem maturity. Risk management is crucial, as major resistance levels at $217 and beyond may face profit-taking pressure.

Long-term outlook enhances bullish sentiments, fueled by Solana’s role in DeFi, NFTs, and gaming sectors, indicating strong potential growth into 2026 and beyond.

Price Forecast and Trading Outlook

Analysts predict SOL could rally to $239.99 in the short term, with possible dips to about $221.53 acting as consolidation zones.Medium-term targets hover around $214 by late September, reflective of steady appreciation supported by growing demand and ecosystem maturity. Risk management is crucial, as major resistance levels at $217 and beyond may face profit-taking pressure.

Long-term outlook enhances bullish sentiments, fueled by Solana’s role in DeFi, NFTs, and gaming sectors, indicating strong potential growth into 2026 and beyond.

#5

Solana’s developer-friendly environment continues to attract new projects, bolstered by grants and incubators focused on scaling ecosystem growth. Moreover, the recent integration with cross-chain bridges facilitates interoperability across multiple blockchains, enhancing Solana’s relevance in a multi-chain reality.

Solana’s Expanding Ecosystem Influence

Solana transcends its role as a cryptocurrency, powering high-speed decentralized applications and enterprise solutions. Its innovative Proof of History consensus allows up to 65,000 transactions per second, appealing to DeFi protocols, gaming platforms, and NFT marketplaces.Solana’s developer-friendly environment continues to attract new projects, bolstered by grants and incubators focused on scaling ecosystem growth. Moreover, the recent integration with cross-chain bridges facilitates interoperability across multiple blockchains, enhancing Solana’s relevance in a multi-chain reality.

#6

Technical risks linked to network outages or bugs also prompt caution among holders. Competition from Ethereum Layer 2 solutions and well-funded rivals like Avalanche or Polygon adds pressure. Yet, Solana’s ongoing technical upgrades and ecosystem incentives aim to mitigate these risks, positioning SOL as a resilient and adaptive market contender.

Challenges and Market Risks

Solana’s growth is not without hurdles. Regulatory uncertainty, especially in the US, weighs on investor sentiment, potentially slowing adoption.Technical risks linked to network outages or bugs also prompt caution among holders. Competition from Ethereum Layer 2 solutions and well-funded rivals like Avalanche or Polygon adds pressure. Yet, Solana’s ongoing technical upgrades and ecosystem incentives aim to mitigate these risks, positioning SOL as a resilient and adaptive market contender.

#7

Recent ecosystem growth and partnerships fuel long-term confidence.

Key resistance levels ($208 and $217) will determine short-term price direction.

Volume and MACD support suggest potential for a sustained rally.

Regulatory and competition risks require careful monitoring by investors.

Key takeaways

Solana shows moderate bullish momentum with strong technical support near $202.Recent ecosystem growth and partnerships fuel long-term confidence.

Key resistance levels ($208 and $217) will determine short-term price direction.

Volume and MACD support suggest potential for a sustained rally.

Regulatory and competition risks require careful monitoring by investors.

#8