Ethereum (ETH), the titan of smart contracts and decentralized finance, is front and center in the crypto conversation as August 2025 unfolds. ETH has experienced a recent wave of powerful momentum, surging to multi-month highs—yet now faces a crucial test at key resistance near $4,000. Major events, including ETF inflows, new regulation, record-breaking network activity, and continued dominance in NFTs and DeFi, keep Ethereum at the heart of blockchain innovation. Technical signals hint at mounting volatility and indecision, fueling speculation about whether ETH’s next big move will be a bullish breakout or a sharp correction—making this summer a season to watch.

#1 This summer, ETH has seen a 54% jump, outpacing Bitcoin’s returns, thanks to 20 consecutive days of spot ETF inflows and support from the U.S. stablecoin bill (“Genius Act”), which designates Ethereum as the leading home for Tether and USDC.

This summer, ETH has seen a 54% jump, outpacing Bitcoin’s returns, thanks to 20 consecutive days of spot ETF inflows and support from the U.S. stablecoin bill (“Genius Act”), which designates Ethereum as the leading home for Tether and USDC.

Institutional buying has increased, as treasury management strategies add ETH to corporate reserves.

The combination of ETF demand, more stablecoin launches, and mainstream financial sector participation has catalyzed bullish sentiment and enhanced Ethereum’s role as a premier blockchain settlement layer.

Ethereum Surges on ETF Inflows and Stablecoin News

This summer, ETH has seen a 54% jump, outpacing Bitcoin’s returns, thanks to 20 consecutive days of spot ETF inflows and support from the U.S. stablecoin bill (“Genius Act”), which designates Ethereum as the leading home for Tether and USDC.

This summer, ETH has seen a 54% jump, outpacing Bitcoin’s returns, thanks to 20 consecutive days of spot ETF inflows and support from the U.S. stablecoin bill (“Genius Act”), which designates Ethereum as the leading home for Tether and USDC.Institutional buying has increased, as treasury management strategies add ETH to corporate reserves.

The combination of ETF demand, more stablecoin launches, and mainstream financial sector participation has catalyzed bullish sentiment and enhanced Ethereum’s role as a premier blockchain settlement layer.

#2 Ethereum’s network fundamentals are setting new highs, with $238 billion in July transaction volume and over 46 million transactions—the highest in years.

Ethereum’s network fundamentals are setting new highs, with $238 billion in July transaction volume and over 46 million transactions—the highest in years.

NFT and DeFi applications remain dominant, and Layer-2 tokens like Mantle and Optimism are leading gains, all supported by rapid volume growth on the Ethereum mainnet.

Developers are rolling out decentralized exchanges, gaming dApps, and tokenized real-world assets at a record pace, further anchoring ETH’s status in the blockchain ecosystem.

Network Activity Breaks Records as NFT and DeFi Thriving

Ethereum’s network fundamentals are setting new highs, with $238 billion in July transaction volume and over 46 million transactions—the highest in years.

Ethereum’s network fundamentals are setting new highs, with $238 billion in July transaction volume and over 46 million transactions—the highest in years. NFT and DeFi applications remain dominant, and Layer-2 tokens like Mantle and Optimism are leading gains, all supported by rapid volume growth on the Ethereum mainnet.

Developers are rolling out decentralized exchanges, gaming dApps, and tokenized real-world assets at a record pace, further anchoring ETH’s status in the blockchain ecosystem.

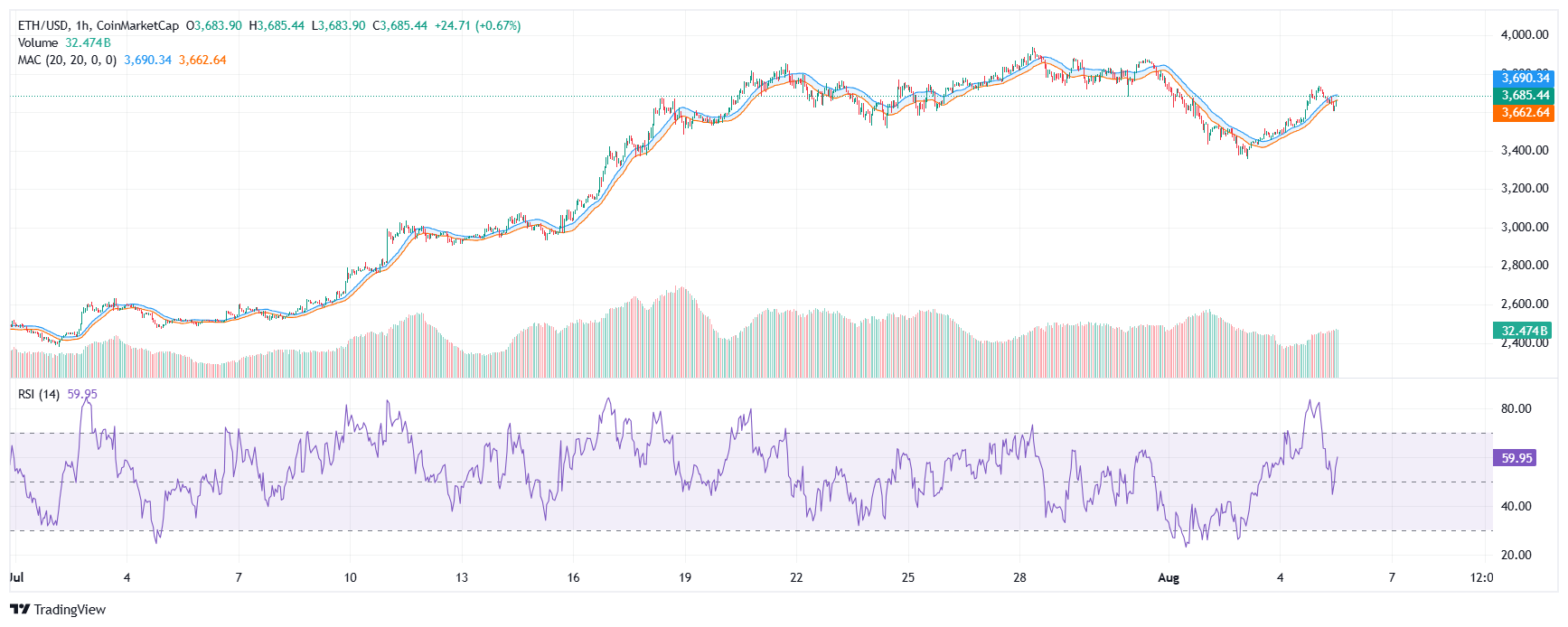

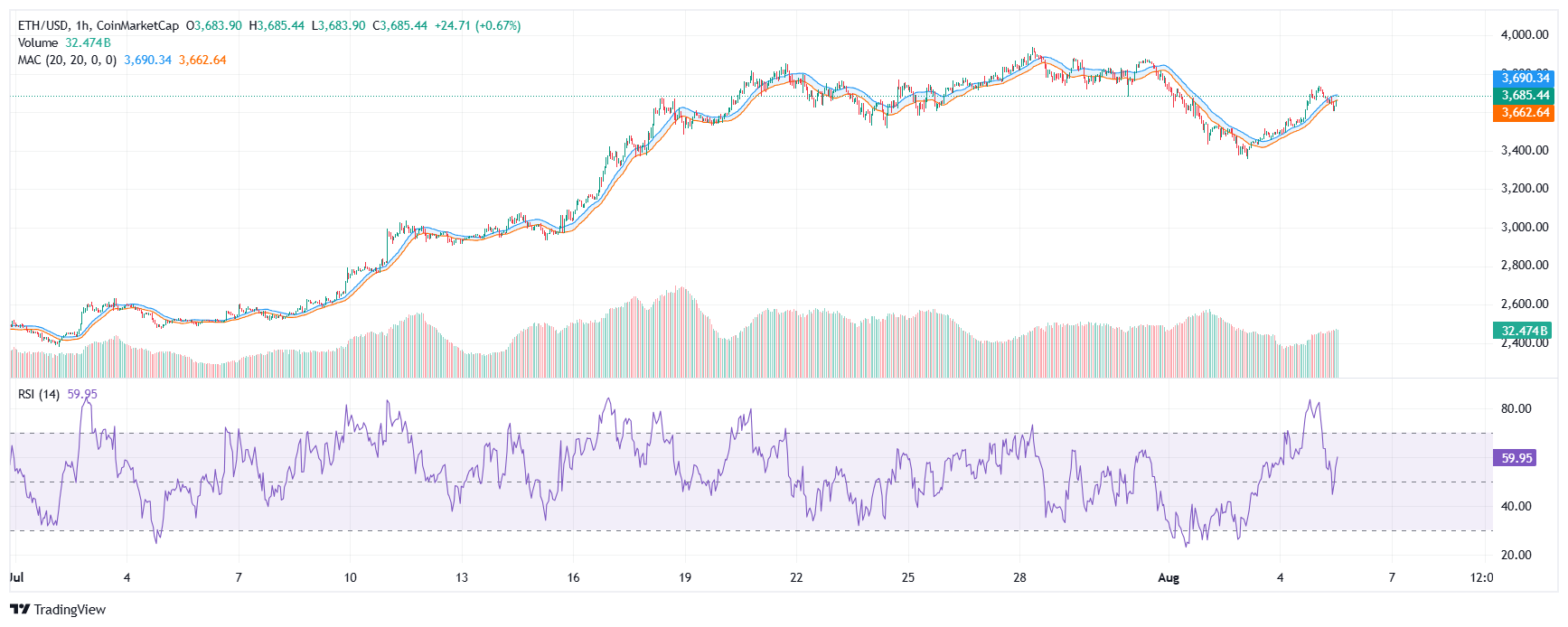

#3 After climbing as high as $3,939, Ethereum has pulled back to consolidate around $3,535–$3,700, briefly testing both weekly highs and the $3,400 support zone.

After climbing as high as $3,939, Ethereum has pulled back to consolidate around $3,535–$3,700, briefly testing both weekly highs and the $3,400 support zone.

Whale wallets have quietly increased their ETH holdings by 1.8%, signaling hushed accumulation ahead of what could be a sharp move. Record liquidation events cleared out excessive leverage, and analysts now debate whether the current structure sets up for a significant bullish reversal or a renewed downturn.

ETH Price Analysis: Tug of War at Resistance

After climbing as high as $3,939, Ethereum has pulled back to consolidate around $3,535–$3,700, briefly testing both weekly highs and the $3,400 support zone.

After climbing as high as $3,939, Ethereum has pulled back to consolidate around $3,535–$3,700, briefly testing both weekly highs and the $3,400 support zone. Whale wallets have quietly increased their ETH holdings by 1.8%, signaling hushed accumulation ahead of what could be a sharp move. Record liquidation events cleared out excessive leverage, and analysts now debate whether the current structure sets up for a significant bullish reversal or a renewed downturn.

#4 Ethereum’s daily trading volume spiked during the late July rally, then steadied, suggesting speculators are preparing for a decisive trend shift.

Ethereum’s daily trading volume spiked during the late July rally, then steadied, suggesting speculators are preparing for a decisive trend shift.

The MACD, flattening but set for a possible bullish crossover, hints at an imminent directional change—it flipped bullish on short timeframes but remains ambivalent on longer ranges.

The RSI sits near 63 on low time frames, mild bullish territory, yet could quickly turn if resistance at $4,000 remains stubbornly intact.

Volume Remains Robust, MACD and RSI Give Mixed Signals

Ethereum’s daily trading volume spiked during the late July rally, then steadied, suggesting speculators are preparing for a decisive trend shift.

Ethereum’s daily trading volume spiked during the late July rally, then steadied, suggesting speculators are preparing for a decisive trend shift. The MACD, flattening but set for a possible bullish crossover, hints at an imminent directional change—it flipped bullish on short timeframes but remains ambivalent on longer ranges.

The RSI sits near 63 on low time frames, mild bullish territory, yet could quickly turn if resistance at $4,000 remains stubbornly intact.

#5

Should bulls break out above $3,700–$4,000, new highs and a push to $4,234 or even $4,500 are possible; failure at these levels could result in a swift retest of the lower supports.

EMA Levels Map Out Critical Battle Lines

On the 4-hour and daily charts, ETH price reclaimed the 20/50 EMA levels but faces stiff resistance at the 100 EMA and the major psychological mark of $4,000. Major daily supports sit at $3,480 and $3,339 (the 200 EMA & multi-session demand).Should bulls break out above $3,700–$4,000, new highs and a push to $4,234 or even $4,500 are possible; failure at these levels could result in a swift retest of the lower supports.

#6

However, October and November outlooks call for possible corrections toward $2,800–$3,000 if ETH is unable to breach resistance and the broader market sours. Long-term forecasts remain highly bullish with $5,907 and even $7,194 targets for the 2025–2026 horizon, powered by upgrades, adoption, and global DeFi expansion.

Forecasts: Bulls Eye $4,234, Bears Warn of Volatility

Consensus projections for August see ETH ranging from $3,528 to $4,234, with the potential for new highs if institutional flows return.However, October and November outlooks call for possible corrections toward $2,800–$3,000 if ETH is unable to breach resistance and the broader market sours. Long-term forecasts remain highly bullish with $5,907 and even $7,194 targets for the 2025–2026 horizon, powered by upgrades, adoption, and global DeFi expansion.

#7

While ETF inflows boost confidence, some risk remains as institutional players may reverse course quickly in a downturn.

Still, Ethereum’s unique standing in regulatory discussions and expanding treasury participation support its resilience and long-term growth outlook.

Regulation, ETFs, and Institutional Adoption Shape ETH’s Future

The US stablecoin bill, new ETF products, and regulatory clarity have all favored Ethereum, making it increasingly attractive to both traditional finance and crypto-native whales.While ETF inflows boost confidence, some risk remains as institutional players may reverse course quickly in a downturn.

Still, Ethereum’s unique standing in regulatory discussions and expanding treasury participation support its resilience and long-term growth outlook.

#8

Traders are closely monitoring whale moves, ETF inflows, and potential price breakouts or fails at key EMA levels. The interplay between bullish on-chain trends and essential technical resistance will determine whether Ethereum captures the next leg higher—or faces another correction.

What to Watch: The Road Ahead

ETH’s showdown with $4,000 resistance is the main story this August, with upcoming Layer 2 upgrades and the DeFi ecosystem’s health also in the spotlight.Traders are closely monitoring whale moves, ETF inflows, and potential price breakouts or fails at key EMA levels. The interplay between bullish on-chain trends and essential technical resistance will determine whether Ethereum captures the next leg higher—or faces another correction.

#9

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like. This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from various technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human approved and verified.

#10

https://www.tradingview.com/news/cryptonews:3540c92ee094b:0-live-crypto-news-today-latest-updates-for-august-05-2025-crypto-market-rebounds-as-layer-2-tokens-lead-surge-eth-briefly-breaks-above-3-700/

https://www.bitrue.com/blog/eth-price-prediction-aug5-aug11-will-it-break-4k

https://cryptorank.io/news/feed/4cef9-ethereum-eth-price-prediction-for-august-5-2025

https://bravenewcoin.com/insights/ethereum-eth-price-prediction-can-ethereum-hold-the-3400-level-as-analysts-hint-at-a-potential-bullish-reversal

https://www.binance.com/en/square/post/27714327529922

https://changelly.com/blog/ethereum-eth-price-predictions/

https://www.dailyforex.com/forex-technical-analysis/2025/07/ethusd-monthly-forecast-august-2025/232058

https://finance.yahoo.com/news/eth-price-prediction-where-ethereum-083024607.html

https://finance.yahoo.com/news/10-best-altcoins-buy-august-134604085.html

https://www.youtube.com/watch?v=JOepCkQcZj0

https://www.mitrade.com/au/insights/news/live-news/article-3-1010757-20250805

https://www.investing.com/crypto/ethereum/technical

Sources

https://www.betashares.com.au/insights/ethereum-builds-momentum/https://www.tradingview.com/news/cryptonews:3540c92ee094b:0-live-crypto-news-today-latest-updates-for-august-05-2025-crypto-market-rebounds-as-layer-2-tokens-lead-surge-eth-briefly-breaks-above-3-700/

https://www.bitrue.com/blog/eth-price-prediction-aug5-aug11-will-it-break-4k

https://cryptorank.io/news/feed/4cef9-ethereum-eth-price-prediction-for-august-5-2025

https://bravenewcoin.com/insights/ethereum-eth-price-prediction-can-ethereum-hold-the-3400-level-as-analysts-hint-at-a-potential-bullish-reversal

https://www.binance.com/en/square/post/27714327529922

https://changelly.com/blog/ethereum-eth-price-predictions/

https://www.dailyforex.com/forex-technical-analysis/2025/07/ethusd-monthly-forecast-august-2025/232058

https://finance.yahoo.com/news/eth-price-prediction-where-ethereum-083024607.html

https://finance.yahoo.com/news/10-best-altcoins-buy-august-134604085.html

https://www.youtube.com/watch?v=JOepCkQcZj0

https://www.mitrade.com/au/insights/news/live-news/article-3-1010757-20250805

https://www.investing.com/crypto/ethereum/technical