TRX, the native token of the Tron blockchain, is capturing investor interest in August 2025 as it demonstrates signs of price recovery and market strength. Combining recent news developments, technological progress, and key technical indicators, TRX is positioned for potential upward momentum. This analysis evaluates the latest price action, five critical market indicators, and the news shaping TRX’s outlook. Insights into market sentiment and technical signals offer a clear picture of where this coin might head in the near term.

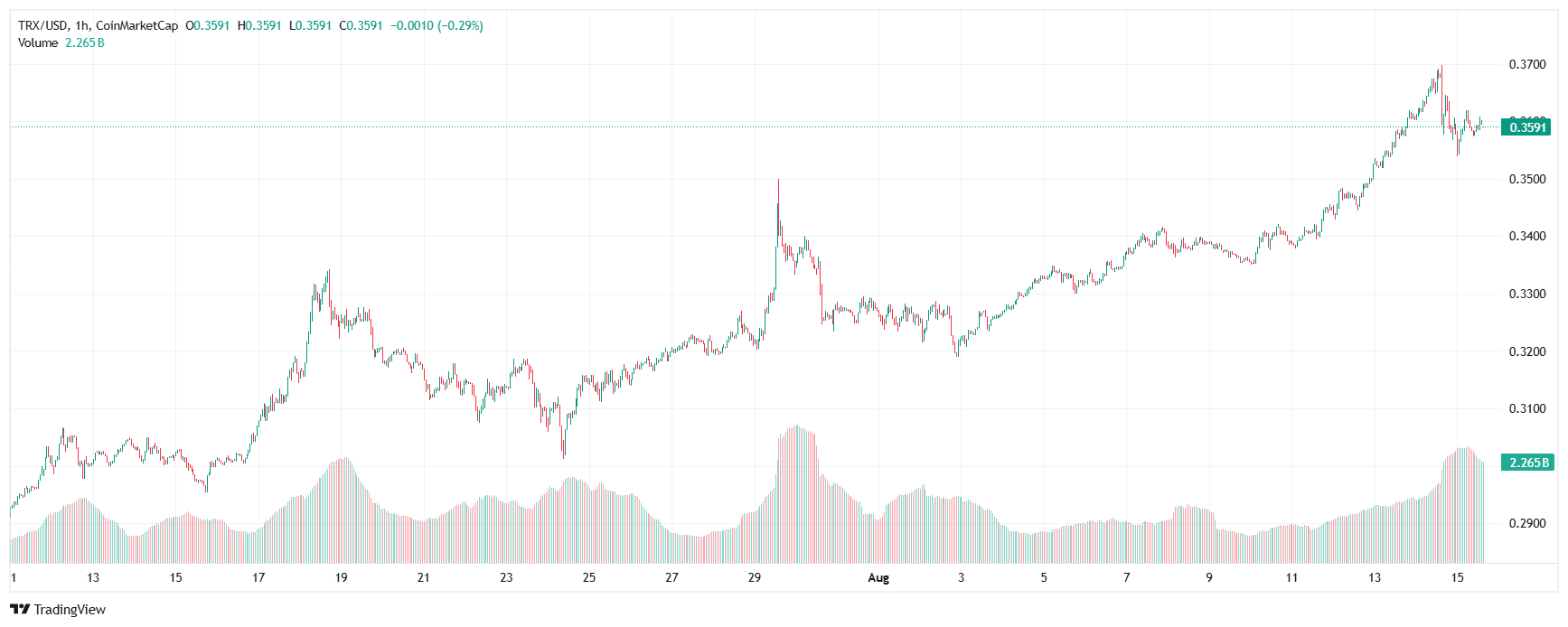

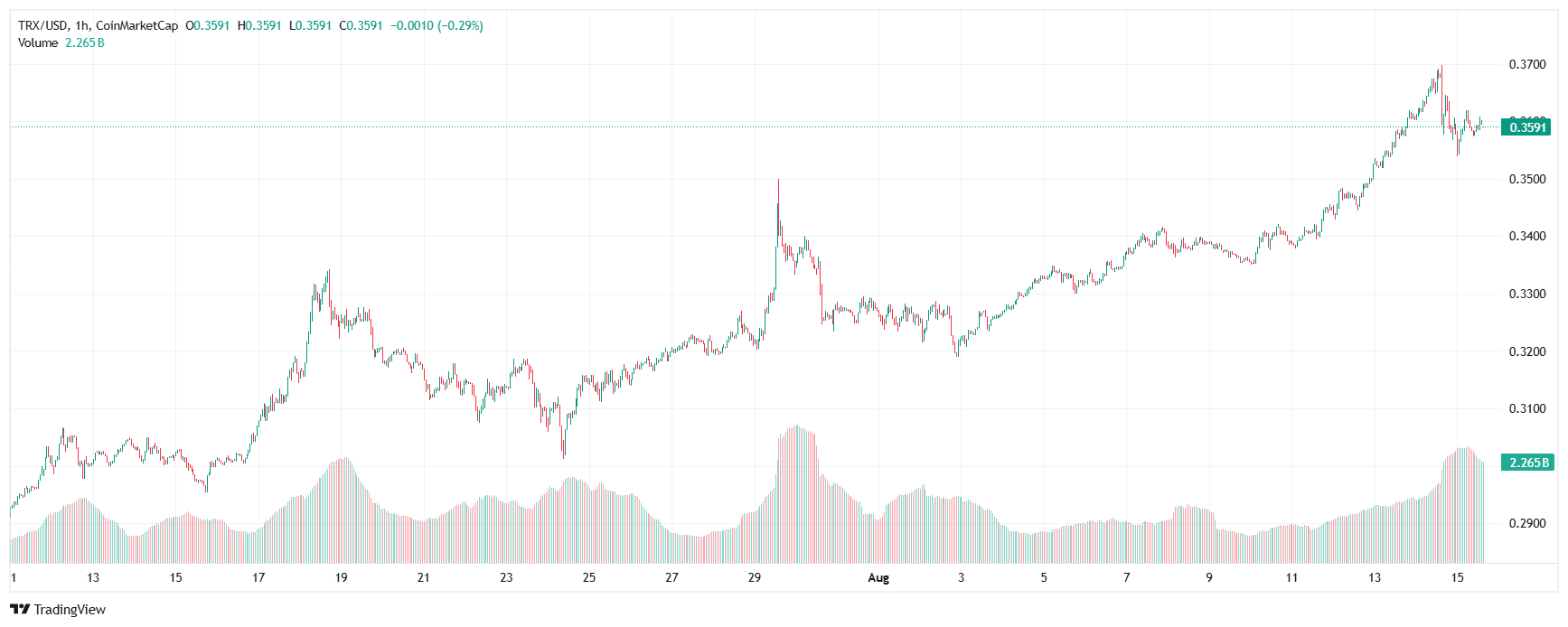

#1 TRX is trading steadily around $0.36 to $0.37 as of mid-August 2025, recovering from minor dips earlier this summer. Technical factors indicate cautious optimism with the Relative Strength Index (RSI) nearing 62, signifying moderate buying pressure without being overbought.

TRX is trading steadily around $0.36 to $0.37 as of mid-August 2025, recovering from minor dips earlier this summer. Technical factors indicate cautious optimism with the Relative Strength Index (RSI) nearing 62, signifying moderate buying pressure without being overbought.

The Moving Average Convergence Divergence (MACD) recently crossed bullishly, hinting at growing momentum.

The 50-day moving average is gradually climbing and approaching the 200-day moving average, setting the stage for a potential golden cross. Trading volume has increased significantly, highlighting renewed interest from retail and institutional traders.

TRX Current Market Overview

TRX is trading steadily around $0.36 to $0.37 as of mid-August 2025, recovering from minor dips earlier this summer. Technical factors indicate cautious optimism with the Relative Strength Index (RSI) nearing 62, signifying moderate buying pressure without being overbought.

TRX is trading steadily around $0.36 to $0.37 as of mid-August 2025, recovering from minor dips earlier this summer. Technical factors indicate cautious optimism with the Relative Strength Index (RSI) nearing 62, signifying moderate buying pressure without being overbought.The Moving Average Convergence Divergence (MACD) recently crossed bullishly, hinting at growing momentum.

The 50-day moving average is gradually climbing and approaching the 200-day moving average, setting the stage for a potential golden cross. Trading volume has increased significantly, highlighting renewed interest from retail and institutional traders.

#2 RSI (Relative Strength Index): At 62, RSI signals an upward trend but stops short of overbuying, reflecting healthy demand.

RSI (Relative Strength Index): At 62, RSI signals an upward trend but stops short of overbuying, reflecting healthy demand.

MACD (Moving Average Convergence Divergence): Bullish crossover indicates buying momentum is strengthening.

Moving Averages (50-day and 200-day): The narrowing gap between these averages hints at a bullish breakout if the 50-day crosses above the 200-day.

Volume: Recent volume upticks confirm increased trader participation and support price gains.

Bollinger Bands: Bands are tightening around the price, suggesting consolidation and a possible forthcoming surge or correction.

Overall, these indicators favor a bullish outlook while cautioning that volatility remains a factor.

Top 5 Technical Indicators Analysis for TRX

RSI (Relative Strength Index): At 62, RSI signals an upward trend but stops short of overbuying, reflecting healthy demand.

RSI (Relative Strength Index): At 62, RSI signals an upward trend but stops short of overbuying, reflecting healthy demand.MACD (Moving Average Convergence Divergence): Bullish crossover indicates buying momentum is strengthening.

Moving Averages (50-day and 200-day): The narrowing gap between these averages hints at a bullish breakout if the 50-day crosses above the 200-day.

Volume: Recent volume upticks confirm increased trader participation and support price gains.

Bollinger Bands: Bands are tightening around the price, suggesting consolidation and a possible forthcoming surge or correction.

Overall, these indicators favor a bullish outlook while cautioning that volatility remains a factor.

#3 Recent news has played a significant role in TRX’s renewed vigor. The Tron Foundation announced partnerships with several Asian fintech firms to enhance decentralized finance (DeFi) capabilities on the network. Additionally, the launch of Tron Virtual Machine upgrades has improved transaction speed and cost efficiency, critical for mass adoption. Market chatter around expanding collaborations with gaming and NFT platforms gives TRX fresh appeal among younger investors. These developments align with Tron’s ambition to be a leading blockchain for entertainment and finance use cases.

Recent news has played a significant role in TRX’s renewed vigor. The Tron Foundation announced partnerships with several Asian fintech firms to enhance decentralized finance (DeFi) capabilities on the network. Additionally, the launch of Tron Virtual Machine upgrades has improved transaction speed and cost efficiency, critical for mass adoption. Market chatter around expanding collaborations with gaming and NFT platforms gives TRX fresh appeal among younger investors. These developments align with Tron’s ambition to be a leading blockchain for entertainment and finance use cases.

TRX News Highlights Fueling Market Confidence

Recent news has played a significant role in TRX’s renewed vigor. The Tron Foundation announced partnerships with several Asian fintech firms to enhance decentralized finance (DeFi) capabilities on the network. Additionally, the launch of Tron Virtual Machine upgrades has improved transaction speed and cost efficiency, critical for mass adoption. Market chatter around expanding collaborations with gaming and NFT platforms gives TRX fresh appeal among younger investors. These developments align with Tron’s ambition to be a leading blockchain for entertainment and finance use cases.

Recent news has played a significant role in TRX’s renewed vigor. The Tron Foundation announced partnerships with several Asian fintech firms to enhance decentralized finance (DeFi) capabilities on the network. Additionally, the launch of Tron Virtual Machine upgrades has improved transaction speed and cost efficiency, critical for mass adoption. Market chatter around expanding collaborations with gaming and NFT platforms gives TRX fresh appeal among younger investors. These developments align with Tron’s ambition to be a leading blockchain for entertainment and finance use cases.

#4

Moving into September, expectations widen with possible highs nearing $0.398, contingent on sustained positive momentum and broader market conditions. Machine learning models echo similar forecasts, projecting around a 6% to 10% gain over the next month.

However, some analysts warn of potential pullbacks typical in the mid-cycle phase of crypto markets, especially if macroeconomic headwinds intensify.

Market Predictions and Price Targets for TRX

Analysts’ price forecasts present cautious optimism for TRX through the end of 2025. August projections range from $0.366 to $0.383, consistent with a stable upward trend.Moving into September, expectations widen with possible highs nearing $0.398, contingent on sustained positive momentum and broader market conditions. Machine learning models echo similar forecasts, projecting around a 6% to 10% gain over the next month.

However, some analysts warn of potential pullbacks typical in the mid-cycle phase of crypto markets, especially if macroeconomic headwinds intensify.

#5

Competition is fierce, especially from blockchains focusing on DeFi and NFTs, where Tron strives to innovate. Price volatility remains a key risk as rapid shifts in market sentiment can trigger sharp moves. Monitoring macroeconomic factors like interest rates, inflation data, and geopolitical tensions is essential for assessing near-term risk to TRX’s trajectory.

Challenges and Risks Ahead for TRX

Despite promising signs, TRX faces headwinds that investors should monitor. Ongoing regulatory scrutiny of crypto markets could result in fresh constraints impacting liquidity and trading volume.Competition is fierce, especially from blockchains focusing on DeFi and NFTs, where Tron strives to innovate. Price volatility remains a key risk as rapid shifts in market sentiment can trigger sharp moves. Monitoring macroeconomic factors like interest rates, inflation data, and geopolitical tensions is essential for assessing near-term risk to TRX’s trajectory.

#6

Tron’s tech upgrades and strategic partnerships bolster its long-term potential.

Price forecasts for August-September 2025 range from $0.366 to $0.398 with cautious optimism.

Regulatory and market volatility remain risks to watch.

TRX is gaining traction in DeFi, gaming, and NFT sectors, feeding investor interest.

Key Takeaways

TRX’s technical indicators show bullish momentum and rising trading volume.Tron’s tech upgrades and strategic partnerships bolster its long-term potential.

Price forecasts for August-September 2025 range from $0.366 to $0.398 with cautious optimism.

Regulatory and market volatility remain risks to watch.

TRX is gaining traction in DeFi, gaming, and NFT sectors, feeding investor interest.

#7

Disclaimer

The information provided is NOT financial advice. I am not a financial adviser, accountant or the like.This information is purely from my own due diligence and an expression of my thoughts, my opinions based on my personal experiences and the help from technology information gathering tools to indicate the movement of the market, coin or any relevant information which is human changed and reedited.Reactions

Reactions

1